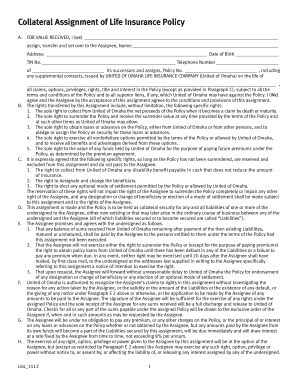

Collateral Assignment of Life Insurance Policy Mutual of Omaha Form

What is the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

The collateral assignment of a life insurance policy with Mutual of Omaha is a legal arrangement where the policyholder designates a lender or other party as the collateral assignee. This means that the assignee has a claim to the policy's benefits in the event of the policyholder's death, typically to secure a loan or other financial obligation. This assignment allows the policyholder to use the life insurance policy as collateral while retaining ownership and the right to make changes to the policy, such as changing beneficiaries or adjusting coverage amounts.

Key Elements of the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

Several key elements define the collateral assignment of a life insurance policy with Mutual of Omaha:

- Policyholder Information: The name and contact details of the individual who owns the policy.

- Assignee Information: The name and contact details of the individual or institution receiving the assignment.

- Policy Details: Specific information about the life insurance policy, including the policy number and coverage amount.

- Terms of Assignment: Clear stipulations regarding the rights of the assignee and any conditions that must be met for the assignment to be valid.

- Signatures: The signatures of both the policyholder and the assignee, along with the date of signing, are essential for legal validity.

Steps to Complete the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

Completing the collateral assignment of a life insurance policy with Mutual of Omaha involves several steps:

- Gather Information: Collect all necessary details about the policy and the assignee.

- Obtain the Form: Access the collateral assignment form from Mutual of Omaha or through a trusted source.

- Fill Out the Form: Carefully complete the form with accurate information, ensuring all required fields are filled.

- Review the Terms: Understand the implications of the assignment, including the rights of the assignee.

- Sign the Document: Both the policyholder and assignee must sign the form to validate the assignment.

- Submit the Form: Send the completed form to Mutual of Omaha for processing, either electronically or via mail.

Legal Use of the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

The collateral assignment of a life insurance policy is legally recognized in the United States, provided it meets specific criteria. The document must be signed by both parties, and the terms must be clear and unambiguous. Additionally, the assignment must comply with relevant state laws and the policies of Mutual of Omaha. It is advisable for policyholders to consult with a legal professional to ensure that the assignment is executed correctly and that their rights are protected.

How to Use the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

Using the collateral assignment of a life insurance policy involves several practical applications:

- Securing Loans: Policyholders can use the policy as collateral to secure personal or business loans.

- Financial Planning: This assignment can be part of a broader financial strategy, ensuring that obligations are met in the event of the policyholder's death.

- Estate Planning: It can also play a role in estate planning, helping to manage debts and obligations that may arise after death.

How to Obtain the Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

To obtain the collateral assignment of a life insurance policy, policyholders can follow these steps:

- Contact Mutual of Omaha: Reach out to customer service or your insurance agent to request the collateral assignment form.

- Access Online Resources: Visit the Mutual of Omaha website for downloadable forms and additional information.

- Consult with a Financial Advisor: Consider discussing your intentions with a financial advisor to ensure the assignment aligns with your overall financial strategy.

Quick guide on how to complete collateral assignment of life insurance policy mutual of omaha

Prepare Collateral Assignment Of Life Insurance Policy Mutual Of Omaha effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Collateral Assignment Of Life Insurance Policy Mutual Of Omaha on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign Collateral Assignment Of Life Insurance Policy Mutual Of Omaha without stress

- Locate Collateral Assignment Of Life Insurance Policy Mutual Of Omaha and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Collateral Assignment Of Life Insurance Policy Mutual Of Omaha and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collateral assignment of life insurance policy mutual of omaha

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha?

A Collateral Assignment Of Life Insurance Policy Mutual Of Omaha is a legal agreement that allows a borrower to use their life insurance policy as collateral for a loan. This arrangement ensures that the lender has secured interests in the policy until the debt is satisfied. It’s essential for anyone considering using their life insurance for this purpose to understand the implications and benefits.

-

How does a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha benefit policyholders?

The primary benefit of a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha is that it provides policyholders access to funds without having to surrender their policy. This can be crucial in times of financial need while maintaining the life insurance protection for beneficiaries. Additionally, it can often lead to more favorable loan terms due to the reduced risk for lenders.

-

What are the steps to set up a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha?

To set up a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha, you will first need to complete the assignment form provided by Mutual Of Omaha. After that, you will need to have the form signNowd and submitted to the insurance company. It’s advisable to consult with a legal or financial advisor to ensure the process aligns with your financial goals.

-

Are there any fees associated with a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha?

Typically, Mutual Of Omaha does not charge any fees for establishing a Collateral Assignment Of Life Insurance Policy. However, there may be administrative fees or costs associated with legal advice, notary services, or potential loan origination fees from the lender. It's important to discuss these with both your insurer and lender.

-

Can I revoke a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha?

Yes, you can revoke a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha, but it usually requires the consent of the lender. The revocation process often involves completing a formal written document and ensuring all parties involved are notified. It’s essential to understand any financial ramifications before proceeding with the revocation.

-

What happens to the policy benefits in a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha?

In a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha, the death benefit is paid out to the beneficiary after the insured’s death. However, if there are any outstanding loans against the policy, the lender will be paid first from the policy’s proceeds. This means it’s crucial to manage any loans carefully to protect your beneficiaries.

-

Is a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha flexible?

Yes, a Collateral Assignment Of Life Insurance Policy Mutual Of Omaha offers flexibility as it allows the policyholder to borrow funds as needed while still retaining ownership of the policy. This flexibility can be beneficial in managing unexpected expenses or investment opportunities. However, borrowers should always consider their repayment capacity to avoid losing their life insurance coverage.

Get more for Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

- Waiver release liability agreement 497427150 form

- Release liability minor form

- Liability bike form

- Waiver and release from liability for minor child for bicycling form

- Waiver and release from liability for adult for four wheeling form

- Waiver release child form

- Waiver release liability form 497427156

- Waiver and release from liability for minor child for amusement park form

Find out other Collateral Assignment Of Life Insurance Policy Mutual Of Omaha

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free