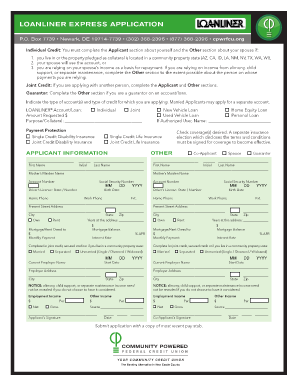

Loanliner Application Form

What is the Loanliner Application

The Loanliner application is a crucial document used in the lending process, particularly for businesses seeking financing. It serves as a formal request for a loan, outlining the borrower's financial information and the purpose of the funds. This application is essential for lenders to assess the creditworthiness of potential borrowers. By providing detailed information, including income, expenses, and collateral, the Loanliner application helps streamline the decision-making process for loan approval.

How to Use the Loanliner Application

Using the Loanliner application involves several straightforward steps. First, gather all necessary financial documents, such as tax returns, bank statements, and proof of income. Next, fill out the application form accurately, ensuring that all information is complete and truthful. Many lenders now offer digital platforms for submitting the Loanliner application, making it easier to complete and send securely. After submission, it is advisable to follow up with the lender to confirm receipt and inquire about the timeline for approval.

Steps to Complete the Loanliner Application

Completing the Loanliner application can be broken down into a few essential steps:

- Gather required documentation, including financial statements and identification.

- Fill out the application form with accurate and detailed information.

- Review the application for any errors or missing information.

- Submit the application through the lender's preferred method, whether online or by mail.

- Follow up with the lender to check on the status of your application.

Legal Use of the Loanliner Application

The Loanliner application is legally binding once it is signed and submitted, provided that it meets certain criteria set forth by relevant laws. For the application to be considered valid, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are recognized as legally enforceable, similar to their paper counterparts. It is important for applicants to understand their rights and obligations under these laws when submitting their Loanliner application.

Key Elements of the Loanliner Application

Several key elements are essential to include in the Loanliner application to ensure its effectiveness:

- Personal Information: Name, address, contact details, and Social Security number.

- Financial Information: Income sources, monthly expenses, and existing debts.

- Loan Details: Amount requested, purpose of the loan, and repayment terms.

- Collateral Information: Any assets offered as security for the loan.

Eligibility Criteria

Eligibility for the Loanliner application generally depends on several factors, including credit history, income level, and the purpose of the loan. Lenders typically assess the applicant's credit score to determine their ability to repay the loan. Additionally, some lenders may have specific requirements based on the type of loan being requested, such as business loans or personal loans. Understanding these criteria can help applicants prepare a stronger application and increase their chances of approval.

Quick guide on how to complete loanliner application

Effortlessly Prepare Loanliner Application on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Loanliner Application across any platform using airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

How to Edit and Electronically Sign Loanliner Application with Ease

- Locate Loanliner Application and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and electronically sign Loanliner Application, ensuring smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loanliner application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is loanliner and how does it work with airSlate SignNow?

Loanliner is a powerful tool that helps streamline the loan management process. With airSlate SignNow, loanliner integrates seamlessly to enable users to easily send, sign, and manage loan documents electronically. This enhances efficiency and simplifies the entire lending experience.

-

What features does loanliner offer in conjunction with airSlate SignNow?

The loanliner tool comes equipped with features such as document templates, automated workflows, and real-time tracking. When paired with airSlate SignNow, it allows users to eSign documents effortlessly while ensuring compliance and security. These features contribute to a more efficient loan processing operation.

-

How can loanliner benefit my business?

Using loanliner with airSlate SignNow can signNowly enhance your business's productivity by reducing paperwork and speeding up the loan approval process. It offers a centralized platform for managing documents, which can lead to improved customer satisfaction and quicker turnaround times. This ultimately supports better financial outcomes.

-

What are the pricing options for using loanliner with airSlate SignNow?

Pricing for loanliner when integrated with airSlate SignNow is competitive and scales according to the size and needs of your business. Various plans are available, allowing companies to select the most suitable options for their user base. Seeking a demo can help assess the pricing benefits tailored for your specific requirements.

-

Does loanliner support integrations with other software?

Yes, loanliner offers robust integration capabilities with various software platforms and services. When used with airSlate SignNow, it complements your existing tools, enhancing document management and signature processes. This interoperability ensures a smoother workflow and improved data exchange across applications.

-

Is loanliner secure for handling sensitive information?

Absolutely, loanliner prioritizes security and ensures all sensitive information is protected. With the robust security measures in place at airSlate SignNow, including encryption and authentication, users can confidently manage their loan documents. This commitment to security helps maintain compliance with regulations and protects client data.

-

Can I customize loanliner features to suit my business needs?

Yes, loanliner is designed to be customizable, offering features that can be tailored to fit your specific business processes. When integrated with airSlate SignNow, businesses can modify workflows, document templates, and signer roles to best align with their operational requirements. This flexibility supports better user adoption and process efficiency.

Get more for Loanliner Application

- Teddy bear template form

- Deped medical form 86

- Police verification certificate uttarakhand form

- Labour maternity form

- Tr 500 info instructions to defendant for remote form

- Oah 1 subpoena duces tecum template form

- Adr 105 information regarding rights after attorney client fee arbitration alternative dispute resolution

- Govinforeturn for e file options form

Find out other Loanliner Application

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer