Rt 7 Form

What is the Rt 7

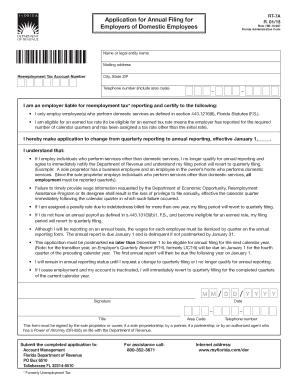

The Rt 7 is a form issued by the Florida Department of Revenue, primarily used for reporting and remitting sales and use tax. This form is essential for businesses operating in Florida to ensure compliance with state tax regulations. The Rt 7 form captures various details regarding taxable sales, exemptions, and the amount of tax collected, which is crucial for accurate tax reporting and payment.

How to use the Rt 7

To effectively use the Rt 7 form, businesses must first gather all pertinent sales data for the reporting period. This includes total sales, taxable sales, and any exemptions claimed. Once the information is compiled, it can be entered into the appropriate sections of the form. The completed Rt 7 must then be submitted to the Florida Department of Revenue, either electronically or via mail, depending on the preferred submission method.

Steps to complete the Rt 7

Completing the Rt 7 involves several key steps:

- Gather all sales records for the reporting period.

- Determine the total taxable sales and any exemptions.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for accuracy.

- Submit the form to the Florida Department of Revenue by the deadline.

Legal use of the Rt 7

The Rt 7 form is legally binding when filled out correctly and submitted on time. It is essential for businesses to adhere to the guidelines set forth by the Florida Department of Revenue to avoid penalties. The form must reflect accurate sales data, as discrepancies can lead to audits or fines. Using a reliable eSignature tool can enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the Rt 7 form are typically set by the Florida Department of Revenue and may vary based on the reporting period. Generally, businesses must submit the form monthly or quarterly, depending on their sales volume. It is crucial to keep track of these deadlines to avoid late fees or penalties associated with non-compliance.

Required Documents

When preparing to complete the Rt 7, businesses should have the following documents on hand:

- Sales records for the reporting period.

- Documentation of any tax-exempt sales.

- Previous Rt 7 forms for reference.

- Any correspondence from the Florida Department of Revenue related to tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Rt 7 form can be submitted through various methods to accommodate different business needs. Options include:

- Online submission via the Florida Department of Revenue's e-Services portal.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local Department of Revenue offices.

Quick guide on how to complete rt 7 6848507

Complete Rt 7 effortlessly on any gadget

Web-based document management has gained traction among companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, enabling you to obtain the right template and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Rt 7 on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to alter and eSign Rt 7 without stress

- Obtain Rt 7 and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, laborious document searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Rt 7 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rt 7 6848507

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form rt 7 and how can airSlate SignNow help with it?

Form rt 7 is a document needed for specific business transactions. airSlate SignNow simplifies the process by allowing you to eSign and send this form quickly and securely, ensuring a smooth transaction.

-

What are the pricing options for using airSlate SignNow for form rt 7?

airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides features tailored for managing documents like form rt 7 efficiently, ensuring you get the best value for eSigning and document management.

-

Can form rt 7 be customized using airSlate SignNow?

Yes, you can easily customize form rt 7 with airSlate SignNow's user-friendly interface. This allows you to add your company branding and specific fields, making the form tailored to your business requirements.

-

What features does airSlate SignNow provide for managing form rt 7?

airSlate SignNow offers a range of features for handling form rt 7, including templates, automated workflows, and mobile accessibility. These tools streamline the eSigning process, making it more efficient for your team.

-

How does airSlate SignNow ensure the security of form rt 7?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods and complies with industry standards to protect your form rt 7 and other sensitive documents against unauthorized access.

-

Can I integrate airSlate SignNow with other applications for form rt 7?

Absolutely! airSlate SignNow supports integration with various applications, enhancing your workflow for form rt 7. You can connect with CRM systems, cloud storage, and more, making document management seamless.

-

Is there a mobile app for signing form rt 7?

Yes, airSlate SignNow provides a mobile app that allows users to eSign form rt 7 on-the-go. Whether you are in the office or out in the field, you can manage your documents conveniently from your mobile device.

Get more for Rt 7

- Lowveld college of agriculture online application 2023 form

- Identifying cadences worksheet form

- Newcastle dysarthria assessment tool form

- Avid grade check form

- Cbm writing prompts pdf form

- Fillable form f

- Fillable online cjis 8102s sex offender registration form

- The family court of the state of delaware in and f form

Find out other Rt 7

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document