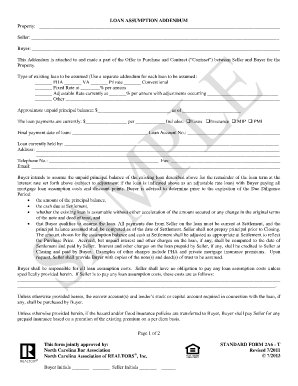

Loan Assumption Addendum 2013

What is the Loan Assumption Addendum

The loan assumption addendum is a legal document that allows a borrower to transfer their mortgage obligations to another party. This addendum is often used in real estate transactions when a property is sold, enabling the new buyer to take over the existing loan terms without needing to secure a new mortgage. It is essential for both buyers and sellers to understand the implications of this document, as it can affect their financial responsibilities and the terms of the loan.

How to use the Loan Assumption Addendum

Using the loan assumption addendum involves several key steps. First, both the current borrower and the new borrower must agree to the terms outlined in the addendum. This includes understanding the existing loan terms and any fees associated with the assumption process. Next, the addendum must be completed with accurate information about both parties and the loan details. Finally, both parties should sign the document, ideally in the presence of a notary, to ensure its legal validity.

Steps to complete the Loan Assumption Addendum

Completing the loan assumption addendum requires attention to detail. Here are the steps to follow:

- Gather necessary information, including the original loan documents, property details, and personal identification.

- Fill out the addendum with the required information, ensuring accuracy in names, addresses, and loan terms.

- Review the addendum with all parties involved to confirm understanding and agreement.

- Sign the document, ensuring that all signatures are dated and witnessed if required.

- Submit the completed addendum to the lender for approval, following any specific submission guidelines they may have.

Key elements of the Loan Assumption Addendum

Several key elements must be included in the loan assumption addendum to ensure it is comprehensive and legally binding. These elements typically include:

- The names and contact information of both the current borrower and the new borrower.

- A detailed description of the loan being assumed, including the loan number and original terms.

- Any conditions or stipulations that must be met for the assumption to be valid.

- Signatures of both parties, along with the date of signing.

- A statement indicating that the lender has approved the assumption, if applicable.

Legal use of the Loan Assumption Addendum

The legal use of the loan assumption addendum is governed by state and federal laws that dictate the terms under which a mortgage can be assumed. It is crucial for both parties to understand that the addendum must comply with these regulations to be enforceable. This includes ensuring that the lender is notified and that any necessary approvals are obtained. Failure to follow legal protocols can result in penalties or the invalidation of the addendum.

Digital vs. Paper Version

In today’s digital age, the loan assumption addendum can be completed in both digital and paper formats. The digital version offers advantages such as easier sharing, quicker completion, and enhanced security features. However, some parties may prefer a paper version for its traditional feel or the ability to physically sign documents. Regardless of the format chosen, it is essential to ensure that the document meets all legal requirements and is stored securely.

Quick guide on how to complete loan assumption addendum

Complete Loan Assumption Addendum easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, edit, and eSign your documents quickly without delays. Manage Loan Assumption Addendum on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Loan Assumption Addendum effortlessly

- Find Loan Assumption Addendum and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Loan Assumption Addendum and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan assumption addendum

Create this form in 5 minutes!

How to create an eSignature for the loan assumption addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan assumption addendum?

A loan assumption addendum is a legal document that modifies the original loan agreement, allowing one party to take over the existing loan terms from another. This document is essential in real estate transactions when a buyer wants to assume an existing mortgage. Using airSlate SignNow can simplify the process of creating and signing a loan assumption addendum.

-

How does airSlate SignNow help with loan assumption addendums?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your loan assumption addendum efficiently. This electronic signature solution ensures that both parties can review and sign the document quickly, streamlining the whole process. With airSlate SignNow, you can manage your documents from anywhere, making it a great choice for busy professionals.

-

What are the benefits of using a loan assumption addendum?

The primary benefits of using a loan assumption addendum include transferring mortgage obligations smoothly and potentially saving money on closing costs. This document can also be beneficial for buyers looking to secure favorable loan terms that were locked in by the current owner. Additionally, a well-executed loan assumption addendum fosters transparency in the transaction.

-

Is there a cost associated with creating a loan assumption addendum using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning documents, the pricing structure may vary depending on your subscription plan. We provide various pricing options to cater to different business needs. It’s advisable to visit our pricing page for detailed information on creating a loan assumption addendum.

-

Can I use airSlate SignNow for multiple loan assumption addendums?

Absolutely! airSlate SignNow allows you to create and manage multiple loan assumption addendums seamlessly. Whether you need to handle a single transaction or multiple agreements, our platform can accommodate your requirements. This flexibility ensures you have the tools needed for any real estate transaction.

-

Are electronic signatures on loan assumption addendums legally binding?

Yes, electronic signatures on loan assumption addendums are legally binding in most jurisdictions, as long as they comply with the applicable laws, such as the ESIGN Act and UETA. airSlate SignNow follows strict compliance measures to ensure that your eSigns are valid and secure. This allows you to proceed confidently with your loan assumption addendum.

-

What integrations does airSlate SignNow offer for managing loan assumption addendums?

airSlate SignNow integrates seamlessly with popular business tools like Google Drive, Dropbox, and various CRM systems. This connectivity facilitates easy access to your documents, including loan assumption addendums, ensuring you can manage all your files in one place. Our integrations help streamline your workflow and improve efficiency.

Get more for Loan Assumption Addendum

- Qdoba donation request form

- Jcpb form

- 4th grade released eog form

- Rf111 form

- Rick warren class 101 pdf form

- Good practice communication skills in english for the medical practitioner pdf form

- Please list all know allergies that your child may have gracepoint form

- Fr eler frdermanahmen des bundeslandes sachsen anhalt form

Find out other Loan Assumption Addendum

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement