Type of Existing Loan to Be Assumed Use a Separate Addendum for Each Loan to Be Assumed 2017-2026

Understanding the Type of Existing Loan to Be Assumed

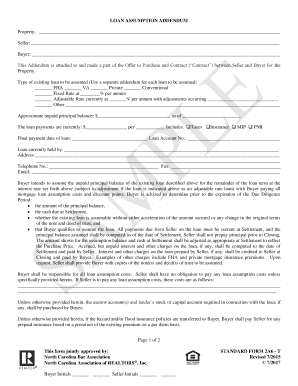

The type of existing loan to be assumed refers to the specific loan agreements that a buyer may take over from the seller during a property transaction. This process allows the buyer to inherit the seller's mortgage terms, which can sometimes be beneficial if the original loan has favorable interest rates or conditions. It is crucial to identify the exact loans that are eligible for assumption and to understand the implications of taking over these financial obligations.

Steps to Complete the Loan Assumption Process

Completing the assumption of a loan involves several key steps. Initially, the buyer should review the existing loan documents to ensure they meet the lender's requirements for assumption. Next, the buyer must submit a formal request to the lender, which may include providing personal financial information to demonstrate creditworthiness. Once approved, the buyer will need to sign an addendum that outlines the terms of the assumed loan. Each loan being assumed should have a separate addendum to ensure clarity and legal compliance.

Key Elements of the Loan Assumption Addendum

A loan assumption addendum typically includes essential information such as the names of the parties involved, the loan amount, interest rate, and payment terms. It should also specify any conditions that must be met for the assumption to be valid. This document serves as a legal record of the transfer of responsibility for the loan from the seller to the buyer, ensuring that all parties are aware of their obligations under the new arrangement.

Legal Considerations for Loan Assumptions

When assuming a loan, it is important to consider the legal implications. Not all loans are assumable, and lenders may have specific criteria that must be met. Additionally, the buyer should be aware of any potential liabilities associated with the loan, including penalties for late payments or defaults. Consulting with a legal professional can provide clarity on these issues and help ensure that the assumption process adheres to all applicable laws and regulations.

Examples of Loan Assumption Scenarios

Common scenarios for loan assumptions include situations where a buyer is purchasing a home with a favorable fixed-rate mortgage or when a seller is relocating and wishes to transfer their existing mortgage to a buyer. For instance, if a seller has a low-interest rate mortgage, a buyer may find it advantageous to assume that loan rather than secure a new loan at a higher rate. Each scenario may have unique considerations that should be evaluated before proceeding.

State-Specific Rules for Loan Assumptions

Loan assumption processes can vary by state, with different regulations governing the transfer of mortgage obligations. Buyers and sellers should familiarize themselves with their state's laws regarding loan assumptions, including any required disclosures or documentation. Understanding these state-specific rules can prevent potential legal complications and ensure a smoother transaction.

Required Documents for Loan Assumption

To facilitate a loan assumption, several documents are typically required. These may include the original loan agreement, a completed assumption application, and financial statements from the buyer. Additionally, the lender may request proof of income, credit reports, and other documentation to assess the buyer's eligibility. Gathering these documents in advance can help streamline the assumption process.

Create this form in 5 minutes or less

Find and fill out the correct type of existing loan to be assumed use a separate addendum for each loan to be assumed

Create this form in 5 minutes!

How to create an eSignature for the type of existing loan to be assumed use a separate addendum for each loan to be assumed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for assuming a loan using airSlate SignNow?

To assume a loan, you need to identify the Type Of Existing Loan To Be Assumed. Use a Separate Addendum For Each Loan To Be Assumed to ensure clarity and compliance. Our platform simplifies this process by allowing you to create and manage addendums efficiently.

-

How does airSlate SignNow handle multiple loans in a single transaction?

When dealing with multiple loans, it's crucial to specify the Type Of Existing Loan To Be Assumed. Use a Separate Addendum For Each Loan To Be Assumed to keep your documents organized. This feature helps streamline the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides access to features that support the Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed. You can choose a plan based on your volume of transactions and required features.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various software solutions. This allows you to manage the Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed alongside your existing tools. Our integrations enhance workflow efficiency and document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust document management features, including templates and eSignature capabilities. When dealing with the Type Of Existing Loan To Be Assumed, you can Use A Separate Addendum For Each Loan To Be Assumed to ensure all necessary information is captured. This streamlines the documentation process.

-

Is airSlate SignNow secure for handling sensitive loan documents?

Absolutely, airSlate SignNow prioritizes security and compliance. We implement advanced security measures to protect your documents, especially when dealing with the Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed. Your data is safe with us.

-

How can airSlate SignNow benefit my business?

airSlate SignNow empowers businesses by providing a cost-effective solution for document management and eSigning. By using our platform, you can efficiently handle the Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed, saving time and reducing paperwork.

Get more for Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed

Find out other Type Of Existing Loan To Be Assumed Use A Separate Addendum For Each Loan To Be Assumed

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF