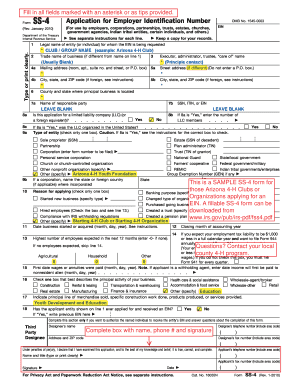

Ss4 Form Example

What is the SS4 Form Example

The SS4 form, officially known as the Application for Employer Identification Number (EIN), is a crucial document used by businesses and organizations in the United States to apply for an Employer Identification Number. This number is essential for tax reporting and identification purposes. The SS4 form example serves as a template to guide applicants in completing the form accurately, ensuring all necessary information is provided to the IRS.

Steps to Complete the SS4 Form Example

Completing the SS4 form requires careful attention to detail. Here are the steps to fill out the form correctly:

- Provide the legal name of the entity applying for the EIN.

- Include any trade name or DBA (Doing Business As) if applicable.

- Specify the entity type, such as corporation, partnership, or sole proprietorship.

- Enter the reason for applying for an EIN, such as starting a new business or hiring employees.

- Fill in the address where the business is located.

- List the name and Social Security Number (SSN) of the responsible party.

- Review the form for accuracy before submission.

Legal Use of the SS4 Form Example

The SS4 form is legally binding when completed accurately and submitted to the IRS. It is important to ensure that all information is truthful and complies with IRS regulations. Misrepresentation or errors can lead to delays in obtaining the EIN or potential penalties. Using a reliable electronic signature tool can enhance the legal validity of the submitted form, ensuring compliance with eSignature regulations.

IRS Guidelines

The IRS has set specific guidelines for completing and submitting the SS4 form. It is essential to follow these guidelines to avoid issues. Applicants should ensure that they are using the most current version of the form and adhere to the instructions provided by the IRS. This includes understanding the eligibility criteria for obtaining an EIN and the necessary documentation required for submission.

Form Submission Methods

The SS4 form can be submitted to the IRS through various methods. Applicants can choose to file online, which is the fastest method, or submit the form by mail or fax. When filing online, users can receive their EIN immediately upon completion. For mail submissions, it may take several weeks to process. Choosing the right submission method can impact the speed of receiving the EIN.

Required Documents

When completing the SS4 form, certain documents may be required to support the application. These can include the entity's formation documents, such as articles of incorporation or partnership agreements, and identification for the responsible party, such as a Social Security card or driver's license. Having these documents ready can streamline the application process and ensure compliance with IRS requirements.

Quick guide on how to complete ss4 form example 5432191

Prepare Ss4 Form Example effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly without delays. Handle Ss4 Form Example on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Ss4 Form Example without any hassle

- Find Ss4 Form Example and click on Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Edit and eSign Ss4 Form Example and ensure effective communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ss4 form example 5432191

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ss4 form example?

An ss4 form example is a sample of the IRS form used to apply for an Employer Identification Number (EIN). It helps businesses understand the required information and format when filling out their own forms. Using an ss4 form example can streamline your application process and ensure accuracy.

-

How does airSlate SignNow help with ss4 form examples?

AirSlate SignNow provides templates and tools to assist users in eSigning and sending documents, including ss4 form examples. This means you can easily fill, sign, and share your ss4 forms without the hassle of printing or scanning. Our platform enhances your document workflow by making it more efficient.

-

Is there a cost associated with using airSlate SignNow for ss4 form examples?

AirSlate SignNow offers various pricing plans that cater to different business needs. The cost can vary depending on the number of users and features you require, but our solutions remain cost-effective compared to traditional methods. You can start with a free trial to explore how we can assist with your ss4 form example needs.

-

What features does airSlate SignNow provide for handling ss4 forms?

AirSlate SignNow includes features such as customizable templates, electronic signatures, and seamless integration with other software. These features help you manage ss4 form examples efficiently and ensure that your documents are secure and compliant. The user-friendly interface allows for quick navigation and document processing.

-

Can I integrate airSlate SignNow with other applications when using ss4 form examples?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow when handling ss4 form examples. You can connect with popular tools such as Google Drive, Salesforce, and Dropbox. This integration helps facilitate document management and streamlines your business operations.

-

What benefits does airSlate SignNow offer businesses preparing ss4 form examples?

Using airSlate SignNow for ss4 form examples saves time and resources by simplifying the document signing process. Our platform is designed to improve efficiency with easy collaboration and document tracking. Additionally, electronic signatures increase security and compliance, giving you peace of mind.

-

How secure is airSlate SignNow when handling ss4 form examples?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure servers to protect your ss4 form examples and sensitive data. We also comply with industry regulations, ensuring that your documents remain confidential and safe from unauthorized access.

Get more for Ss4 Form Example

Find out other Ss4 Form Example

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document