F625 109 000 Form

What is the F625 109 000

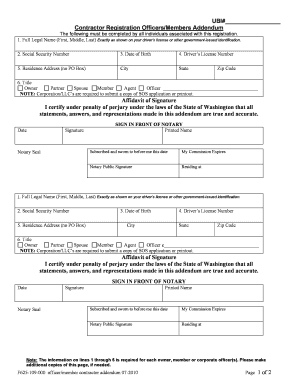

The F625 109 000 is a specific form used in the state of Washington, primarily for tax purposes. It is essential for individuals and businesses to accurately report certain financial information to the state. This form plays a crucial role in ensuring compliance with state tax laws and regulations. Understanding its purpose and requirements is vital for anyone who needs to file it.

Steps to complete the F625 109 000

Completing the F625 109 000 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents that pertain to the reporting period. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. Double-check your entries to avoid mistakes, as errors can lead to delays or penalties. Once completed, sign and date the form before submission.

Legal use of the F625 109 000

The F625 109 000 is legally binding when filled out correctly and submitted to the appropriate state authorities. To ensure its legal validity, it must comply with Washington state laws regarding tax reporting. This includes providing accurate information and adhering to deadlines. Utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring that it meets all necessary electronic signature regulations.

How to obtain the F625 109 000

Obtaining the F625 109 000 form is a straightforward process. It can typically be downloaded from the Washington state tax authority's official website. Additionally, physical copies may be available at local tax offices or government buildings. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the F625 109 000 are critical for compliance. Typically, forms must be submitted by specific dates set by the Washington state tax authority. It is advisable to check the official website or consult with a tax professional for the most accurate and up-to-date information regarding deadlines. Missing these dates can result in penalties or interest charges.

Examples of using the F625 109 000

There are various scenarios in which the F625 109 000 may be utilized. For instance, a small business owner may need to report income and expenses related to their operations. Similarly, individuals who have received certain types of income, such as rental income, may also be required to complete this form. Understanding specific use cases can help ensure proper filing and compliance.

Quick guide on how to complete f625 109 000 5717113

Complete F625 109 000 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without issues. Manage F625 109 000 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign F625 109 000 effortlessly

- Obtain F625 109 000 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign F625 109 000 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f625 109 000 5717113

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f625 109 000 form used for?

The f625 109 000 form is utilized for specific tax reporting purposes, particularly its relevance in various financial transactions. Understanding its function is crucial for businesses to ensure compliance and accurate reporting. Using airSlate SignNow can streamline the process of obtaining signatures on this form, making it simpler for users.

-

How does airSlate SignNow handle f625 109 000 document security?

Security is a top priority for airSlate SignNow when managing documents like the f625 109 000 form. Our platform employs encryption and features such as two-factor authentication to guard sensitive information. This ensures your documents are protected from unauthorized access.

-

Can I customize my f625 109 000 documents using airSlate SignNow?

Yes, airSlate SignNow allows users to customize their f625 109 000 documents easily. Our user-friendly interface lets you add fields, adjust layouts, and make the document reflect your brand identity. This customization can enhance user engagement and streamline the signing process.

-

What are the pricing options for using airSlate SignNow for the f625 109 000?

AirSlate SignNow offers flexible pricing plans to suit various business needs, including options for users handling the f625 109 000 form. These plans range from basic to advanced features, ensuring that you only pay for what you need. You can also take advantage of a free trial to explore the platform.

-

Does airSlate SignNow integrate with other applications for handling the f625 109 000?

Indeed, airSlate SignNow integrates seamlessly with a variety of applications, making it easy to manage the f625 109 000 form alongside your existing tools. Popular integrations include CRM platforms, cloud storage services, and productivity apps, which enhance workflow efficiency and make document handling more straightforward.

-

How quickly can I get started with airSlate SignNow for the f625 109 000?

Getting started with airSlate SignNow is incredibly quick and easy. Once you sign up, you'll have immediate access to features that allow you to create, send, and eSign the f625 109 000 form within minutes. Our intuitive setup process ensures that you can dive into eSigning right away.

-

What support resources are available for users of airSlate SignNow when managing the f625 109 000?

AirSlate SignNow provides comprehensive support resources for users dealing with the f625 109 000 form. This includes access to a knowledge base, tutorial videos, and customer support representatives to assist with any questions or challenges. Our aim is to ensure a smooth experience for all users.

Get more for F625 109 000

- Ignited mind lab past papers form

- Nys tax exempt form st 119

- Area and perimeter in the coordinate plane problems worksheet answers pdf form

- Blue cross blue shield centennial form

- Kiwa logbook form

- Soonerride mileage reimbursement form 419471496

- Do the mlo license endorsement requirements apply to form

- California real estate broker license endorsement mortgage nationwidelicensingsystem form

Find out other F625 109 000

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free