Duplicate1099 Aflac Com Form

What is the Duplicate1099 Aflac Com

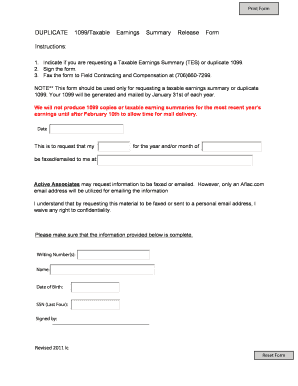

The Duplicate1099 Aflac Com is a tax form used to report various types of income received from Aflac, a provider of supplemental insurance. This form is essential for individuals who have received payments that may be taxable, ensuring compliance with IRS regulations. The Duplicate1099 serves as a duplicate of the original 1099 form issued by Aflac, allowing recipients to maintain accurate records for tax filing purposes.

How to use the Duplicate1099 Aflac Com

Using the Duplicate1099 Aflac Com involves several straightforward steps. First, ensure that you have received the form from Aflac, which outlines the income received during the tax year. Next, review the information for accuracy, including your name, Social Security number, and the reported income amount. If any discrepancies are found, contact Aflac for corrections. Finally, use the information provided on the Duplicate1099 to accurately complete your tax return, reporting the income as required by the IRS.

Steps to complete the Duplicate1099 Aflac Com

Completing the Duplicate1099 Aflac Com requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including your original 1099 form and any other relevant financial records.

- Verify your personal information on the form, ensuring it matches your tax records.

- Check the income amounts reported; these should reflect all payments received from Aflac.

- Consult IRS guidelines to determine how to report this income on your tax return.

- File your tax return by the appropriate deadline, including the information from the Duplicate1099 Aflac Com.

Legal use of the Duplicate1099 Aflac Com

The legal use of the Duplicate1099 Aflac Com is crucial for tax compliance. This form must be accurately filled out and submitted to the IRS to avoid potential penalties. It serves as official documentation of income received, which is necessary for both the taxpayer and the IRS. Ensuring that the information is correct and submitted on time is vital in maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Duplicate1099 Aflac Com align with standard tax filing dates. Typically, the IRS requires that all 1099 forms be submitted by January thirty-first of the year following the tax year in question. Taxpayers should also be aware of the general tax filing deadline, which is usually April fifteenth. Staying informed about these dates helps ensure timely submission and compliance.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Duplicate1099 Aflac Com can result in significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to file altogether. These penalties can vary depending on how late the form is submitted and whether the errors are corrected promptly. Understanding these consequences highlights the importance of accurate and timely filing.

Quick guide on how to complete duplicate1099 aflac com

Complete Duplicate1099 Aflac Com seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Duplicate1099 Aflac Com on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to modify and eSign Duplicate1099 Aflac Com with minimal effort

- Obtain Duplicate1099 Aflac Com and click on Get Form to commence.

- Use the tools provided to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Duplicate1099 Aflac Com while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the duplicate1099 aflac com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Aflac 1099 form, and why is it important?

An Aflac 1099 form is a tax document that reports income received from Aflac insurance payments. It’s important for tax reporting purposes, as it helps individuals and businesses accurately report additional income earned through Aflac. Ensuring you have this form helps maintain compliance with IRS regulations.

-

How does airSlate SignNow facilitate the signing of Aflac 1099 forms?

airSlate SignNow simplifies the process of signing Aflac 1099 forms by providing an intuitive platform for electronic signatures. Users can send, sign, and manage their documents securely and efficiently. This streamlines tax form handling, ensuring you get your Aflac 1099 completed promptly.

-

What pricing options does airSlate SignNow offer for eSigning Aflac 1099 forms?

airSlate SignNow offers various pricing plans tailored to meet different business needs, making it cost-effective for eSigning Aflac 1099 forms. Whether you are a small business or a large enterprise, you can find a plan that fits your budget. Each plan offers a robust set of features to enhance document management.

-

Can I integrate airSlate SignNow with other applications for Aflac 1099 processing?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing the efficiency of Aflac 1099 processing. Integrations with popular tools like Google Drive and Dropbox allow for easy document management. This functionality enables you to streamline workflows while handling tax forms effectively.

-

What features does airSlate SignNow provide for managing Aflac 1099 forms?

airSlate SignNow offers features such as customizable templates, automated reminders, and audit trails for Aflac 1099 forms management. These features help ensure that your documents are completed accurately and on time. Moreover, the platform's user-friendly interface makes it easy for anyone to navigate and use.

-

How secure is airSlate SignNow for sending Aflac 1099 forms?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like Aflac 1099 forms. The platform employs advanced encryption and compliance with industry standards, ensuring your data is protected. You can confidently send and manage your Aflac 1099 documents without worrying about security bsignNowes.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning Aflac 1099 forms?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with eSigning processes. The intuitive interface guides users through each step, making it easy to send and sign Aflac 1099 forms. Support resources are also available to assist if questions arise during the process.

Get more for Duplicate1099 Aflac Com

Find out other Duplicate1099 Aflac Com

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free