P46 Form

What is the P46 Form

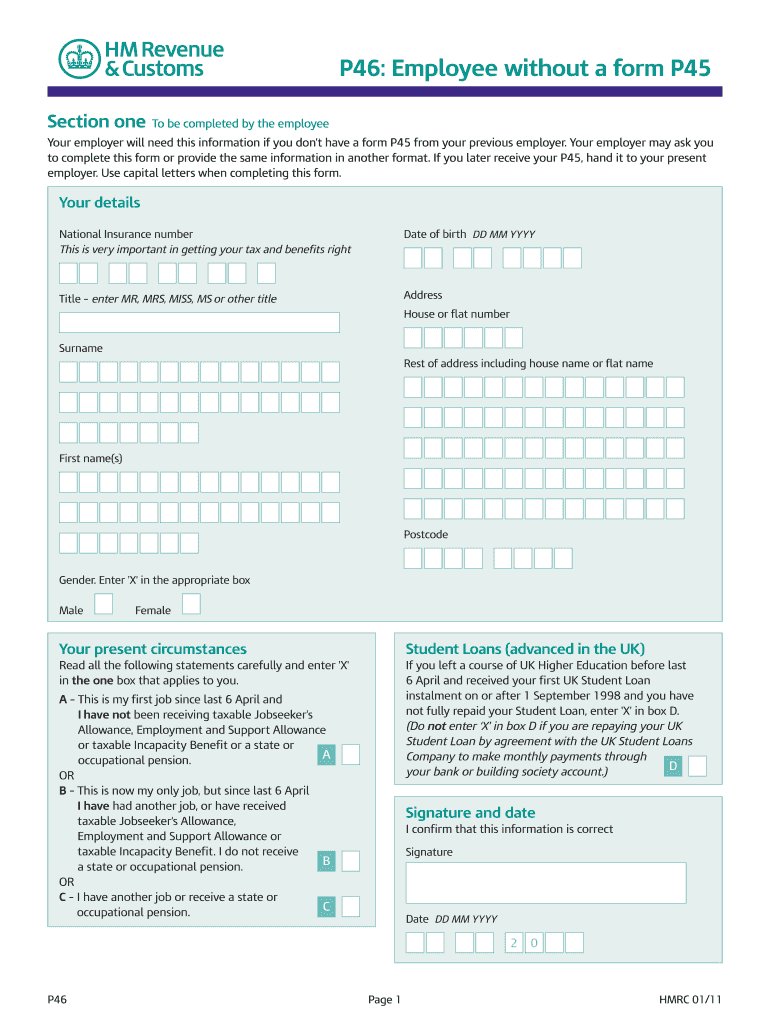

The P46 form, also known as the new starter form, is a document used in the United Kingdom for tax purposes. It is primarily utilized by employers to gather essential information about new employees. This includes details such as the employee's name, address, and National Insurance number. The information collected helps employers determine the correct tax code and ensure that the employee is taxed appropriately from their first paycheck.

How to use the P46 Form

Using the P46 form is straightforward. Employers should provide the form to new employees upon their start date. Employees must fill out the required fields accurately to avoid any tax issues. Once completed, the employer submits the form to HM Revenue and Customs (HMRC) to update the employee's tax records. This process ensures that the employee's tax code is set correctly, which is crucial for accurate payroll processing.

Steps to complete the P46 Form

Completing the P46 form involves several key steps:

- Gather necessary information, including personal details and National Insurance number.

- Fill out the form accurately, ensuring all sections are completed.

- Review the information for any errors or omissions.

- Submit the completed form to your employer.

Employers should then ensure that the form is sent to HMRC promptly to avoid any delays in processing the employee's tax information.

Legal use of the P46 Form

The P46 form is legally recognized as a valid document for tax purposes in the UK. When filled out and submitted correctly, it serves as an official record for both the employer and HMRC. Compliance with the guidelines set forth by HMRC ensures that the form is accepted, and the information is processed without issue. It is important for both employers and employees to understand the legal implications of the information provided on the form.

Key elements of the P46 Form

Several key elements must be included in the P46 form to ensure its validity:

- Employee's Full Name: The legal name of the new starter.

- Address: Current residential address of the employee.

- National Insurance Number: Essential for tax identification.

- Previous Employment Details: Information about the employee's last employer, if applicable.

Including all required information helps streamline the tax code assignment process.

Form Submission Methods

The P46 form can be submitted through various methods. Employers typically send the completed forms to HMRC electronically or via postal mail. Electronic submission is often preferred for its speed and efficiency, allowing for quicker updates to the employee's tax records. Employers should ensure that they follow the appropriate submission method as per HMRC guidelines to maintain compliance.

Quick guide on how to complete p46 form word document

Complete P46 Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage P46 Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to edit and eSign P46 Form effortlessly

- Find P46 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether that’s by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign P46 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Does a method exist in WordPress to pass data that a user fills out on a form to pre-populate a word or PDF document?

There is a method.First: Go to google and search how to create a PDF or Word document from HTML using PHP or Javascript.Results from my search below.search text -> php/javascript create word documenthttps://www.google.com/search?nu...search text -> php/javascript create pdfhttps://www.google.com/search?nu...Second: Code it.

-

Which type of document do we need to fill out the KVPY application form or entrance form?

The students applying for KVPY Application Form need to upload the following documents:Scanned Image of Photograph and SignatureCaste Certificate for SC/ST StudentsMedical Certificate in case of PWD candidates

-

How do you turn a Word document into a fillable form?

one of the oldest questions concerning Word of all time…Word has a feature where you can insert form fields into the document then protect the document for forms and then users cannot change the document except inside the forms.For a detailed how-to I would simply do a Google search for “form fields in Microsoft Word”Good luck with it (though it is not really very difficult to implment),Brian

-

Which documents are required to fill out the AIT Pune admission form?

There are number of documents that are required. You will get an idea about them by visiting the official website of AIT, and going through the notice they have given out for students who are aspiring to take admission in AIT.

-

What documents are required to fill out the form of the JEE Main and Advanced?

High school marksheet , if you are dropper then required in 12th marksheet and 2 photo and adhar card and your scanned signatureImporyant point is requirement in current photos

Create this form in 5 minutes!

How to create an eSignature for the p46 form word document

How to create an eSignature for your P46 Form Word Document in the online mode

How to generate an electronic signature for your P46 Form Word Document in Google Chrome

How to make an eSignature for signing the P46 Form Word Document in Gmail

How to create an eSignature for the P46 Form Word Document straight from your mobile device

How to make an electronic signature for the P46 Form Word Document on iOS devices

How to create an eSignature for the P46 Form Word Document on Android

People also ask

-

What is the p46 form print and why is it important?

The p46 form print is a document used by employers in the UK to collect information about new employees. This form is essential as it helps ensure that the correct tax code is applied, preventing overpayment or underpayment of taxes. Understanding its significance can streamline the onboarding process for new hires.

-

How can I easily obtain a p46 form print using airSlate SignNow?

With airSlate SignNow, obtaining a p46 form print is seamless. You can access customizable templates, fill in the necessary details, and send the form for eSigning directly. This not only saves time but also enhances compliance and accuracy.

-

Does airSlate SignNow charge for the p46 form print functionality?

Yes, airSlate SignNow offers various pricing plans that include features for p46 form print and eSigning. Depending on your business needs, you can choose a plan that fits your budget and provides the necessary functionalities to manage your documents efficiently.

-

What features can enhance my experience with p46 form print on airSlate SignNow?

airSlate SignNow provides a range of features to improve your p46 form print experience. With options for template creation, electronic signatures, and real-time tracking, you can easily manage the entire signing process. Additionally, advanced security settings ensure that your documents are safeguarded.

-

Can I integrate airSlate SignNow with other applications for p46 form print?

Indeed! airSlate SignNow offers robust integrations with various applications, enhancing your workflow. Whether you use CRM systems, payroll software, or other document management tools, you can seamlessly integrate and automate the p46 form print process to increase efficiency.

-

What are the benefits of using airSlate SignNow for p46 form print?

Using airSlate SignNow for p46 form print offers numerous benefits. It streamlines the process of sending and signing documents, reduces turnaround time, and enhances accuracy with automated features. This leads to improved productivity and ensures compliance with tax regulations.

-

Is the p46 form print process secure with airSlate SignNow?

Yes, the p46 form print process is highly secure with airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your documents. This ensures that sensitive employee information is kept safe and confidential throughout the signing process.

Get more for P46 Form

Find out other P46 Form

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer