Or W 4 Form

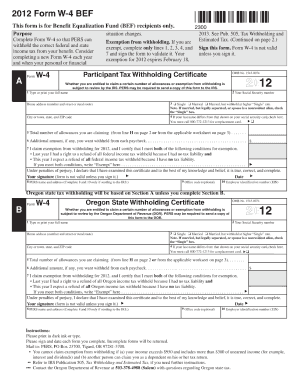

What is the Oregon W-4?

The Oregon W-4 is a state-specific form used by employees to determine the amount of state income tax withholding from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld based on individual circumstances, such as marital status and number of allowances claimed. The Oregon W-4 allows employees to adjust their withholding to better match their tax liability, which can help prevent owing taxes at the end of the year or receiving a large refund.

Steps to Complete the Oregon W-4

Completing the Oregon W-4 involves several straightforward steps:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate and enter the number of allowances you are claiming. This number can affect your withholding amount.

- Additional Withholding: If you wish to have an additional amount withheld from your paycheck, specify that amount in the designated section.

- Signature: Sign and date the form to validate your information.

After completing the form, submit it to your employer to ensure the correct withholding begins with your next paycheck.

Legal Use of the Oregon W-4

The Oregon W-4 is legally binding when filled out correctly and submitted to an employer. It complies with state tax laws and regulations, ensuring that both employees and employers adhere to the appropriate withholding requirements. To be considered valid, the form must be completed in full, signed, and submitted on time. Employers are required to keep these forms on file for their records and to ensure accurate payroll processing.

Examples of Using the Oregon W-4

Here are some examples illustrating how the Oregon W-4 can be utilized:

- New Job: When starting a new job, an employee fills out the Oregon W-4 to establish their tax withholding preferences based on their personal situation.

- Life Changes: After getting married or having a child, an employee may need to update their Oregon W-4 to reflect changes in their filing status or number of allowances.

- Tax Planning: An employee who expects to owe taxes may choose to claim fewer allowances or request additional withholding to avoid a tax bill at the end of the year.

State-Specific Rules for the Oregon W-4

Oregon has specific rules regarding the completion and submission of the W-4 form. Employees must follow these guidelines:

- Employees must submit a new Oregon W-4 whenever they experience a significant life event that affects their tax situation.

- Employers are required to withhold state income tax based on the information provided on the Oregon W-4.

- Failure to provide a completed Oregon W-4 may result in the employer withholding taxes at the highest rate.

IRS Guidelines

While the Oregon W-4 is specific to state tax withholding, it is essential to understand that it must align with federal guidelines. The IRS provides instructions on how to fill out the federal W-4, which can impact state withholding. Employees should ensure that their state and federal forms are consistent to avoid discrepancies in withholding amounts.

Quick guide on how to complete or w 4

Finish Or W 4 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Or W 4 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-heavy task today.

How to modify and eSign Or W 4 with ease

- Obtain Or W 4 and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Or W 4 while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 4 form 2024 printable used for?

The W 4 form 2024 printable is used by employees to inform their employers about how much tax to withhold from their paycheck. Accurately completing this form is crucial for ensuring that you do not overpay or underpay your taxes throughout the year.

-

How can I obtain the W 4 form 2024 printable?

You can easily obtain the W 4 form 2024 printable from the IRS website or through platforms like airSlate SignNow. Simply visit the appropriate section, download the form, and you'll be ready to fill it out accurately.

-

Is airSlate SignNow compatible with the W 4 form 2024 printable?

Yes, airSlate SignNow supports the W 4 form 2024 printable, allowing users to upload, sign, and manage this document digitally. Our platform streamlines the process, making it easy to handle all your tax documents securely.

-

What features does airSlate SignNow offer for the W 4 form 2024 printable?

AirSlate SignNow offers robust features for the W 4 form 2024 printable, including electronic signatures, cloud storage, and collaboration tools. These features help businesses manage their tax forms efficiently while ensuring security and compliance.

-

How much does it cost to use airSlate SignNow for W 4 form 2024 printable services?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective compared to traditional methods. Our plans are designed to suit different business needs, providing excellent value for managing documents like the W 4 form 2024 printable.

-

Can I integrate airSlate SignNow with other applications for the W 4 form 2024 printable?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Salesforce. This integration allows you to manage the W 4 form 2024 printable alongside other essential documents in one convenient location.

-

Are there benefits to using airSlate SignNow for the W 4 form 2024 printable?

Utilizing airSlate SignNow for the W 4 form 2024 printable provides numerous benefits, including time savings, increased productivity, and enhanced accuracy. The platform's user-friendly interface makes it easy to complete and send documents securely and efficiently.

Get more for Or W 4

Find out other Or W 4

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure