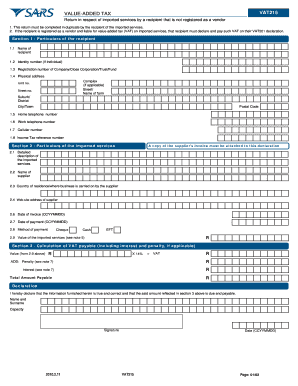

Vat215 2010

What is the VAT 201 form?

The VAT 201 form is a tax document used in the United States for reporting and paying value-added tax (VAT) obligations. This form is essential for businesses that engage in taxable sales or services, allowing them to declare their VAT liabilities accurately. It serves as a formal declaration to the tax authorities, ensuring compliance with federal and state tax regulations. Understanding the VAT 201 form is crucial for maintaining proper tax records and fulfilling legal obligations.

Steps to complete the VAT 201 form

Completing the VAT 201 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including sales records and previous VAT filings.

- Enter your business information, including your name, address, and tax identification number.

- Calculate total sales and the applicable VAT for the reporting period.

- Fill in any exemptions or deductions that may apply to your business.

- Review all entries for accuracy before submission.

- Sign and date the form to certify its accuracy.

Legal use of the VAT 201 form

The VAT 201 form must be used in accordance with the legal requirements set forth by the Internal Revenue Service (IRS) and state tax authorities. To ensure its legal validity, businesses must adhere to the following:

- Complete the form accurately and truthfully.

- Submit the form by the designated filing deadlines to avoid penalties.

- Maintain copies of submitted forms and supporting documentation for record-keeping purposes.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the VAT 201 form is essential for compliance. Typically, the deadlines are set quarterly or annually, depending on the business's tax reporting frequency. Businesses should mark these dates on their calendars to ensure timely submissions and avoid late fees. Additionally, it is advisable to check for any updates or changes to deadlines that may occur due to regulatory changes.

Required Documents

To accurately complete the VAT 201 form, certain documents are required. These typically include:

- Sales invoices and receipts that detail taxable sales.

- Previous VAT filings for reference.

- Documentation of any exemptions claimed.

- Bank statements that reflect VAT payments made.

Who Issues the Form

The VAT 201 form is issued by the Internal Revenue Service (IRS) and may also be available through state tax agencies. It is crucial for businesses to use the correct version of the form that corresponds to their specific tax obligations. Keeping abreast of any updates to the form or its requirements ensures compliance and accuracy in tax reporting.

Quick guide on how to complete vat215

Complete Vat215 effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Vat215 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign Vat215 with ease

- Find Vat215 and then click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, either by email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Vat215 and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat215

Create this form in 5 minutes!

How to create an eSignature for the vat215

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT 201 form?

The VAT 201 form is a declaration document that businesses use to report their value-added tax. It's essential for compliance with tax regulations, and the accurate completion of the VAT 201 form can help avoid penalties. Understanding how to fill it out correctly is crucial for any business dealing with VAT.

-

How can airSlate SignNow help with the VAT 201 form?

airSlate SignNow streamlines the process of completing and eSigning the VAT 201 form. With our user-friendly platform, you can easily fill out and send the form for eSignature, ensuring a quick and compliant submission. This helps to save time and reduces the frustration often associated with managing tax documents.

-

Is airSlate SignNow cost-effective for managing the VAT 201 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the VAT 201 form and other documents. Our pricing plans are designed to fit various business sizes and budgets, providing excellent value for features that enhance efficiency and compliance. You can choose the plan that best suits your needs without breaking the bank.

-

What features does airSlate SignNow provide for the VAT 201 form?

AirSlate SignNow offers several features that simplify the handling of the VAT 201 form, including eSignature capabilities, document templates, and secure cloud storage. These features help ensure your VAT 201 form is completed accurately and securely. Additionally, users can track document status in real-time for better management.

-

Can I integrate airSlate SignNow with other applications for the VAT 201 form?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage the VAT 201 form alongside your existing workflows. You can connect with accounting software, CRM tools, and cloud storage services to streamline document management. This integration capability enhances your overall efficiency when handling tax-related documents.

-

How secure is my data when using airSlate SignNow for the VAT 201 form?

AirSlate SignNow prioritizes the security of your data, including information on the VAT 201 form. We implement bank-level encryption and secure cloud storage to protect all sensitive documents. This commitment to security ensures your data remains confidential and secure throughout the signing process.

-

Can I track the status of my VAT 201 form with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your VAT 201 form and receive notifications when the document is viewed or signed. This feature gives you peace of mind and allows you to manage your paperwork efficiently. You'll always be updated on the progress of your VAT 201 form.

Get more for Vat215

- Bed bug addendum pdf form

- Ap land registration form 32a pdf

- Optometrist employment contract form

- Payment form

- Cards against humanity instructions form

- Pc1 form 62484309

- Mathster graph paper generator form

- Jv 692 notification to sheriff of juvenile delinquency felony adjudication welfare ampamp institutions code section 827 2 form

Find out other Vat215

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien