Record in Respect of Imported Services by a Recipient that is Not Registered as a Vendor 2020-2026

Understanding the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

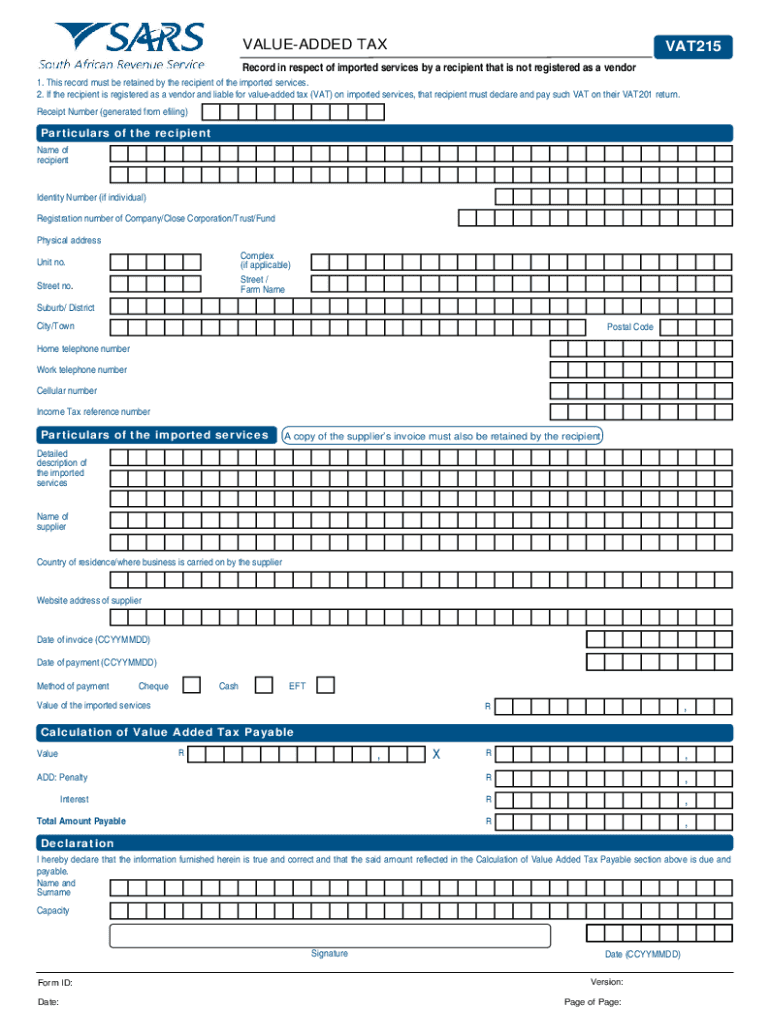

The Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor is a crucial document for businesses that engage in importing services but do not hold vendor registration. This record helps ensure compliance with tax regulations by documenting the imported services received. It is particularly relevant for businesses that may be subject to use tax or other tax obligations related to services acquired from foreign entities. Understanding the purpose and requirements of this record is essential for accurate tax reporting and avoidance of penalties.

Steps to Complete the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

Completing the Record In Respect Of Imported Services involves several important steps:

- Gather all relevant information regarding the imported services, including the nature of the services, the provider's details, and the transaction amounts.

- Ensure that you have the correct format for the record, which may include specific fields for service descriptions, dates, and amounts paid.

- Fill out the record accurately, ensuring that all information is complete and correct to avoid discrepancies.

- Review the completed record for any errors or omissions before submission.

- Submit the record according to the guidelines provided by your state or local tax authority.

Legal Use of the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

The legal use of the Record In Respect Of Imported Services is primarily to fulfill tax obligations. Businesses that import services without being registered as vendors must maintain this record to demonstrate compliance with tax laws. It serves as evidence during audits or inquiries by tax authorities, helping to substantiate claims regarding the services received and any applicable tax liabilities. Proper use of this record can mitigate risks associated with non-compliance, including penalties and interest charges.

Key Elements of the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

Key elements of the Record In Respect Of Imported Services include:

- Service Description: A detailed account of the services imported, including the type and scope.

- Provider Information: Name and contact details of the service provider.

- Transaction Amount: The total cost incurred for the imported services.

- Date of Service: When the services were rendered.

- Recipient Information: Details of the recipient, including business name and address.

Examples of Using the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

Examples of situations where this record is applicable include:

- A U.S.-based company hiring a foreign consultant for project management services.

- A business utilizing online marketing services from an overseas provider.

- A firm importing software development services from an international tech company.

In each case, maintaining a record of these transactions is essential for tax compliance and reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Record In Respect Of Imported Services can vary by state and local jurisdiction. It is important to stay informed about specific deadlines to ensure timely submission. Typically, records should be filed along with other tax returns, and any applicable deadlines should be noted in your tax calendar to avoid late fees or penalties. Consult your local tax authority for the most accurate and relevant deadlines.

Create this form in 5 minutes or less

Find and fill out the correct record in respect of imported services by a recipient that is not registered as a vendor

Create this form in 5 minutes!

How to create an eSignature for the record in respect of imported services by a recipient that is not registered as a vendor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor?

To Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor, you need to gather all relevant documentation related to the imported services. Then, utilize airSlate SignNow to eSign and store these documents securely, ensuring compliance with local regulations.

-

How does airSlate SignNow help with compliance for Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor?

airSlate SignNow provides templates and workflows that ensure you capture all necessary information for compliance. By using our platform, you can easily manage and document the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor, reducing the risk of errors.

-

What features does airSlate SignNow offer for managing imported services documentation?

Our platform offers features like customizable templates, automated workflows, and secure eSigning. These tools are essential for efficiently managing the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor, streamlining your documentation process.

-

Is there a cost associated with using airSlate SignNow for Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost will depend on the features you require for managing the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor, but we provide a cost-effective solution for all users.

-

Can I integrate airSlate SignNow with other software for better management of imported services?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor. This integration allows for a more streamlined workflow and better data management.

-

What are the benefits of using airSlate SignNow for Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By simplifying the process to Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor, you can focus more on your core business activities.

-

How secure is the information when using airSlate SignNow for imported services documentation?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your data, ensuring that your Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor is safe from unauthorized access.

Get more for Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

Find out other Record In Respect Of Imported Services By A Recipient That Is Not Registered As A Vendor

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer