Illinois Reciprocal States Form

What is the Illinois Reciprocal States

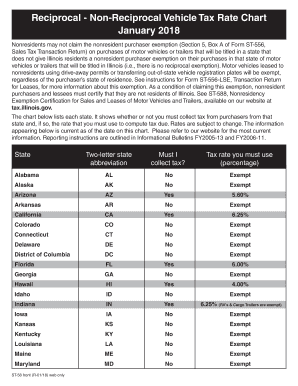

The Illinois reciprocal states refer to a group of states that have agreements with Illinois regarding the taxation of income earned by residents working in another state. These agreements allow residents to avoid double taxation on income, meaning they only pay state income tax in their home state of Illinois. The reciprocal states include Indiana, Iowa, Kentucky, Michigan, and Wisconsin, among others. Understanding these agreements is crucial for Illinois residents to ensure compliance with tax obligations and to maximize their tax benefits.

How to use the Illinois Reciprocal States

To utilize the benefits of the Illinois reciprocal states, residents must complete the appropriate forms, typically the ST-58, which serves as a declaration of the reciprocal agreement. This form allows employees to exempt their wages from withholding in the state where they work, provided they live in Illinois. It is essential to submit this form to the employer before the first paycheck is issued to ensure proper tax withholding. Employers are responsible for verifying the residency of their employees and maintaining records of the ST-58 forms.

Steps to complete the Illinois Reciprocal States

Completing the process for the Illinois reciprocal states involves several steps:

- Determine your eligibility based on your residency in Illinois and employment in a reciprocal state.

- Obtain the ST-58 form from the Illinois Department of Revenue.

- Fill out the form accurately, providing necessary personal information and details about your employer.

- Submit the completed ST-58 form to your employer.

- Keep a copy of the form for your records and ensure your employer processes it correctly.

Legal use of the Illinois Reciprocal States

The legal framework governing the Illinois reciprocal states is designed to prevent double taxation on income earned by Illinois residents. By utilizing the ST-58 form, taxpayers can legally exempt their income from withholding in the state where they work. It is important to understand that this exemption applies only to state income taxes and does not affect other taxes, such as local taxes or federal taxes. Compliance with these regulations is essential to avoid penalties and ensure that tax obligations are met appropriately.

Key elements of the Illinois Reciprocal States

Several key elements define the Illinois reciprocal states agreements:

- Reciprocal Agreements: These are formal arrangements between Illinois and other states that outline tax treatment for residents working across state lines.

- Form ST-58: This form is critical for claiming the exemption from withholding for Illinois residents working in reciprocal states.

- Residency Verification: Employers must verify the residency of employees to ensure compliance with the reciprocal agreements.

- Tax Benefits: Residents can benefit from reduced tax liability by avoiding double taxation on income earned in another state.

Examples of using the Illinois Reciprocal States

Consider a scenario where an Illinois resident works in Indiana. By submitting the ST-58 form to their Indiana employer, they can ensure that their wages are not subjected to Indiana state income tax, thus only paying taxes in Illinois. Another example involves a resident working in Wisconsin; by following the same process, they can similarly avoid double taxation. These examples illustrate the practical application of the Illinois reciprocal states and the importance of proper documentation.

Quick guide on how to complete illinois reciprocal states

Effortlessly Prepare Illinois Reciprocal States on Any Device

The management of online documents has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage Illinois Reciprocal States on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Illinois Reciprocal States with Ease

- Obtain Illinois Reciprocal States and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive content using the features that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Illinois Reciprocal States to ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois reciprocal states

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Illinois reciprocal states PDF' and how does it relate to eSigning?

The 'Illinois reciprocal states PDF' refers to the list of states that recognize the validity of Illinois signatures for legal documents. Understanding this is crucial when using airSlate SignNow for eSigning, as it ensures your signed documents are recognized in these states. This resource can help streamline your documentation process across state lines.

-

How does airSlate SignNow support users dealing with the Illinois reciprocal states PDF?

airSlate SignNow provides users with easy-to-use templates and tools that accommodate the unique requirements of the Illinois reciprocal states PDF. This means you can prepare and send documents for eSignature in compliance with state laws. Our platform ensures that your documents are valid and enforceable in these jurisdictions.

-

What are the pricing options for airSlate SignNow when considering the Illinois reciprocal states PDF?

airSlate SignNow offers flexible pricing plans to suit various business needs, regardless of the Illinois reciprocal states PDF considerations. Our plans are designed to deliver signNow value, ensuring that you get the right features for eSigning documents. You can choose from monthly or annual subscriptions that fit your budget.

-

What features does airSlate SignNow offer to enhance the eSigning process for the Illinois reciprocal states PDF?

airSlate SignNow includes robust features like customizable templates, real-time tracking, and API integrations that enhance the eSigning process of documents related to the Illinois reciprocal states PDF. These tools help streamline workflows, ensuring that your processes are both efficient and legally compliant. Additionally, users can benefit from advanced security measures to protect their data.

-

What are the benefits of using airSlate SignNow for documents involving the Illinois reciprocal states PDF?

Using airSlate SignNow for documents tied to the Illinois reciprocal states PDF simplifies the signing process and helps maintain compliance with interstate laws. It allows businesses to move quickly while ensuring their signatures are legally enforceable. The platform also saves time and reduces paperwork, enhancing overall productivity.

-

Can I integrate airSlate SignNow with other applications when working with the Illinois reciprocal states PDF?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easier to manage documents related to the Illinois reciprocal states PDF. Whether you're using CRM tools or document management systems, our platform can connect with them to facilitate a smoother workflow. Integration ensures that you can send and sign documents efficiently without switching between apps.

-

Is there customer support available for questions regarding the Illinois reciprocal states PDF?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with questions about the Illinois reciprocal states PDF and any other concerns. Our support team is equipped to guide you through the eSigning process and help troubleshoot any issues, ensuring you have a smooth experience.

Get more for Illinois Reciprocal States

Find out other Illinois Reciprocal States

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter