TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS 2019-2026

What is the Tourist Development Tax Return?

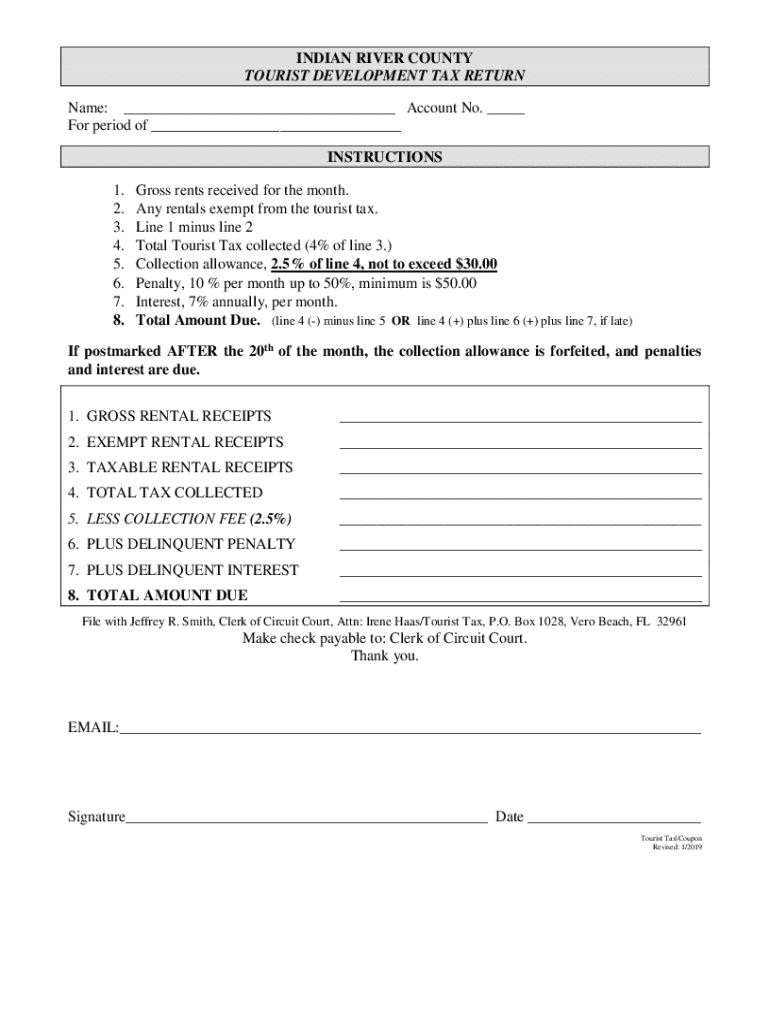

The Tourist Development Tax Return is a form used by businesses in the United States to report and remit taxes collected from tourists. This tax is typically levied on accommodations such as hotels, motels, and vacation rentals. The funds generated from this tax are often used to promote tourism and improve local infrastructure. Understanding this form is essential for compliance and ensuring that the correct amount is reported and paid to the appropriate tax authority.

Steps to Complete the Tourist Development Tax Return

Completing the Tourist Development Tax Return involves several key steps:

- Gather necessary information, including total rental income and the amount of tax collected from guests.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the applicable tax rate for your location.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines for the Tourist Development Tax Return. Most jurisdictions require the return to be filed monthly, quarterly, or annually, depending on the amount of tax collected. Missing these deadlines can result in late fees or penalties. Check with your local tax authority for specific dates and requirements to ensure timely compliance.

Required Documents for Submission

When filing the Tourist Development Tax Return, certain documents may be required to support your submission. These documents can include:

- Proof of tax collection, such as receipts or invoices from guests.

- Financial statements that detail total rental income.

- Any previous tax returns filed for reference.

Having these documents ready can streamline the filing process and help avoid discrepancies.

Penalties for Non-Compliance

Failure to comply with the requirements of the Tourist Development Tax Return can lead to significant penalties. Common penalties include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action from tax authorities for persistent non-compliance.

It is important to understand these risks and ensure timely and accurate filing to avoid complications.

Who Issues the Tourist Development Tax Return?

The Tourist Development Tax Return is typically issued by local or state tax authorities. Each jurisdiction may have its own specific form and guidelines, so it is essential to obtain the correct version based on your location. Checking with your local tax office can provide clarity on the exact requirements and processes involved.

Quick guide on how to complete tourist development tax return instructions

Effortlessly Prepare TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Modify and eSign TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS with Ease

- Obtain TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tourist development tax return instructions

Create this form in 5 minutes!

How to create an eSignature for the tourist development tax return instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

The TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS provide detailed guidelines on how to accurately complete and submit your tax return related to tourist development. These instructions help ensure compliance with local regulations and maximize your potential tax benefits.

-

How can airSlate SignNow assist with TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

airSlate SignNow simplifies the process of managing your TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS by allowing you to easily eSign and send documents securely. Our platform streamlines the workflow, making it easier to gather necessary signatures and submit your returns on time.

-

Are there any costs associated with using airSlate SignNow for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

Yes, while airSlate SignNow offers a cost-effective solution for managing your TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS, pricing may vary based on the features you choose. We provide various plans to fit different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage to help you manage your TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS efficiently. These tools enhance productivity and ensure that your documents are always accessible and organized.

-

Can I integrate airSlate SignNow with other software for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to enhance your workflow for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS. This integration capability ensures that you can connect with your existing tools for a more streamlined experience.

-

What are the benefits of using airSlate SignNow for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

Using airSlate SignNow for your TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to focus on your business while we handle the complexities of document management.

-

Is airSlate SignNow user-friendly for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS. Our intuitive interface ensures that you can quickly learn how to manage your documents without extensive training.

Get more for TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS

- Dependent please use black ink grossmont college financial aid office form

- Wwwthebalancecomcan you buy a money orderbuying a money order with a credit card the balance form

- Our team radiant heart after care for pets form

- When families and doctors disagree on do not resuscitatewhen families and doctors disagree on do not resuscitatewhen families form

- Application form for pet bathing

- Application for in state tuition old dominion university form

- Course withdrawal form morehouse college

- Centerville pet rescue located in lancaster pa form

Find out other TOURIST DEVELOPMENT TAX RETURN INSTRUCTIONS

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe