Ides Withholding Change Form

What is the Ides Withholding Change Form

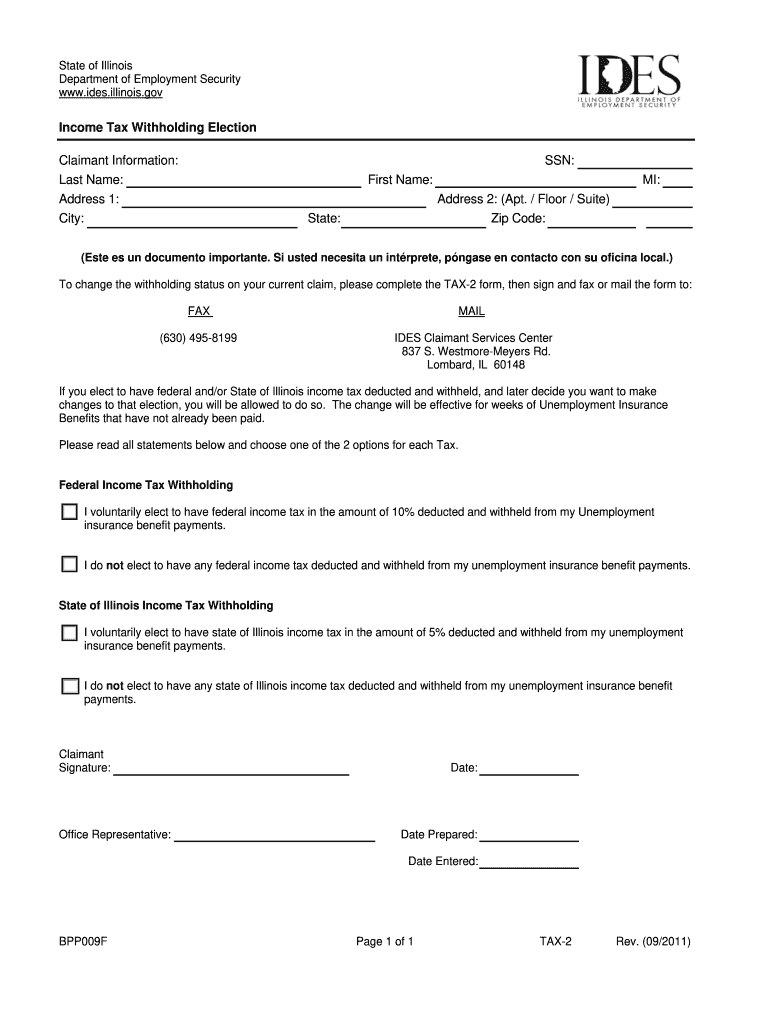

The Ides Withholding Change Form is a document used by employees to modify their state income tax withholding amounts in the United States. This form is essential for individuals who wish to adjust their tax withholdings based on changes in their financial situation, such as a change in marital status, number of dependents, or income level. By submitting this form, employees can ensure that the correct amount of state taxes is withheld from their paychecks, helping to avoid underpayment or overpayment of taxes.

How to use the Ides Withholding Change Form

Using the Ides Withholding Change Form involves a straightforward process. First, obtain the form from your employer or the state’s tax authority website. Next, fill out the required sections, including your personal information and the specific changes you wish to make regarding your withholding. After completing the form, submit it to your employer’s payroll department. It is advisable to keep a copy for your records to ensure that your changes are accurately reflected in future paychecks.

Steps to complete the Ides Withholding Change Form

Completing the Ides Withholding Change Form requires careful attention to detail. Follow these steps:

- Obtain the form from your employer or the state tax authority.

- Provide your full name, address, and Social Security number in the designated areas.

- Indicate your current withholding status and the changes you wish to make.

- Review the form for accuracy before signing it.

- Submit the completed form to your employer’s payroll department.

Legal use of the Ides Withholding Change Form

The legal use of the Ides Withholding Change Form ensures compliance with state tax regulations. It is important to understand that submitting this form is a formal request to alter your tax withholding, and it must be completed accurately to avoid potential penalties. Employers are required to process these changes in accordance with state laws, making it crucial for employees to provide truthful information on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Ides Withholding Change Form can vary based on state regulations. Typically, employees should submit the form at least one pay period before the desired changes take effect to ensure proper withholding adjustments. It is important to check with your employer or state tax authority for specific deadlines to avoid any discrepancies in your tax withholdings.

Form Submission Methods (Online / Mail / In-Person)

The Ides Withholding Change Form can be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online: Some employers may allow electronic submission through their payroll systems.

- Mail: You can send the completed form via postal mail to your employer's payroll department.

- In-Person: Submitting the form directly to your employer's HR or payroll office is also an option.

Quick guide on how to complete ides withholding change form

Complete Ides Withholding Change Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Ides Withholding Change Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Ides Withholding Change Form effortlessly

- Obtain Ides Withholding Change Form and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ides Withholding Change Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ides withholding change form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ides Withholding Change Form?

The Ides Withholding Change Form is a critical document used by employees to update their withholding allowances for state income tax. With airSlate SignNow, you can easily fill out and eSign this form online, ensuring your information is accurate and submitted quickly.

-

How does airSlate SignNow simplify the process of filling out the Ides Withholding Change Form?

airSlate SignNow streamlines the process by allowing users to electronically complete the Ides Withholding Change Form from any device. Our platform saves time and reduces errors by guiding users through each step of form completion.

-

What are the costs associated with using airSlate SignNow for the Ides Withholding Change Form?

airSlate SignNow offers a cost-effective solution for managing documents like the Ides Withholding Change Form. We have flexible pricing plans to suit businesses of all sizes, ensuring that you get the best value for your eSigning needs.

-

Are there any special features that help with the Ides Withholding Change Form in airSlate SignNow?

Yes, airSlate SignNow provides features like templates and customizable fields specifically for the Ides Withholding Change Form. These tools enhance efficiency, making it easy to reuse forms and quickly gather the necessary signatures.

-

Can I integrate airSlate SignNow with other software for handling the Ides Withholding Change Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including HR and payroll systems. This ensures you can manage the Ides Withholding Change Form within your existing workflows, enhancing productivity.

-

What benefits does airSlate SignNow provide for managing the Ides Withholding Change Form?

Using airSlate SignNow to manage the Ides Withholding Change Form offers numerous benefits, including faster processing times and improved accuracy. Additionally, the secure electronic storage of signed documents ensures compliance and easy access.

-

Is it secure to use airSlate SignNow for the Ides Withholding Change Form?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your sensitive information while completing the Ides Withholding Change Form.

Get more for Ides Withholding Change Form

- Community service completion form 15842768

- Missed punches form

- K cns 010 form

- Professional development feedback form for teachers

- Cetusa travel release form

- Permitting and inspections department 389 congress form

- Five county credit union direct deposit change request form

- Articles of dissolution of a voluntary cloudfront net form

Find out other Ides Withholding Change Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF