Form N 172

What is the Form N 172

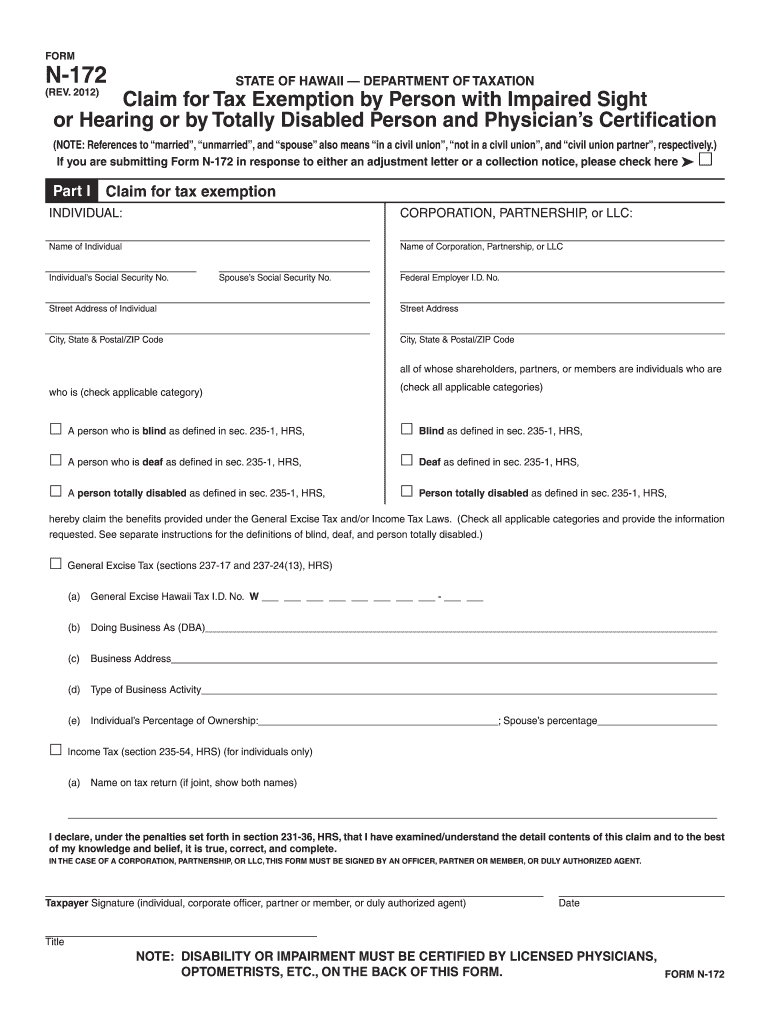

The Form N 172 is a specific document used in various administrative processes, particularly in the state of Hawaii. This form is often required for reporting certain types of information to government agencies. It is essential for individuals and businesses to understand its purpose and implications, as proper completion can ensure compliance with state regulations.

How to use the Form N 172

Using the Form N 172 involves several key steps to ensure accurate submission. First, identify the specific requirements for the form based on your situation. Next, gather all necessary information and documentation needed to complete the form. Carefully fill out each section, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submission.

Steps to complete the Form N 172

Completing the Form N 172 requires a systematic approach. Follow these steps:

- Read the instructions carefully to understand what information is required.

- Collect all relevant documents, such as identification and supporting evidence.

- Fill out the form, ensuring that each section is completed accurately.

- Double-check your entries for any mistakes or omissions.

- Sign and date the form where required.

Legal use of the Form N 172

The Form N 172 holds legal significance, especially in compliance with state regulations. For the form to be considered valid, it must be filled out correctly and submitted within the designated time frame. Digital signatures are acceptable, provided they meet the legal standards set by the state. Understanding the legal implications of this form can help prevent issues related to non-compliance.

Key elements of the Form N 172

Several key elements are critical when dealing with the Form N 172. These include:

- Identification information: Ensure that personal or business identifiers are accurate.

- Purpose of the form: Clearly state the reason for submitting the form.

- Signature: A valid signature is necessary for the form to be legally binding.

- Date: Include the date of completion to establish a timeline for submission.

Form Submission Methods (Online / Mail / In-Person)

The Form N 172 can be submitted through various methods, depending on the requirements set by the relevant authority. Options typically include:

- Online submission through designated government portals.

- Mailing the completed form to the appropriate office.

- In-person submission at local government offices.

Quick guide on how to complete form n 172 fillable

Complete Form N 172 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and safely archive it online. airSlate SignNow equips you with all the resources required to craft, modify, and eSign your documents quickly without delays. Handle Form N 172 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form N 172 effortlessly

- Locate Form N 172 and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with a few clicks from any device you choose. Modify and eSign Form N 172 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do a make a fillable PDF file required to be saved under a different name so it doesn't' override the original form?

Either make a copy of the file before filling it in so the original is always preserved or add a button to SAVE AS.There is (as far as I know) no simple way to stop it writing over the original if the user presses SAVE.Possibly you could write some Javascript (attached to a button) that would do a Save As and then close the PDF without saving - but that still wouldn’t stop the user from simply pressing File > Save.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the form n 172 fillable

How to create an eSignature for the Form N 172 Fillable online

How to make an electronic signature for the Form N 172 Fillable in Chrome

How to make an eSignature for putting it on the Form N 172 Fillable in Gmail

How to make an eSignature for the Form N 172 Fillable right from your smartphone

How to create an eSignature for the Form N 172 Fillable on iOS

How to generate an eSignature for the Form N 172 Fillable on Android

People also ask

-

What is Form N 172 and how does it work with airSlate SignNow?

Form N 172 is a document used for various business purposes, and airSlate SignNow offers a seamless way to create, send, and eSign this form. With airSlate SignNow, you can easily upload Form N 172, customize it for your needs, and send it to recipients for electronic signatures, streamlining your workflow.

-

Can I customize Form N 172 using airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form N 172 to fit your specific requirements. You can add fields for signatures, dates, and other necessary information, making the form more functional and tailored to your business needs.

-

What are the pricing plans for using airSlate SignNow with Form N 172?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs, including the ability to manage Form N 172. You can choose a plan that fits your budget and enjoy features like unlimited templates and eSigning capabilities.

-

Does airSlate SignNow provide templates for Form N 172?

Yes, airSlate SignNow provides templates for Form N 172, allowing you to start quickly without having to create the form from scratch. This feature not only saves time but also ensures that your form meets legal and compliance standards.

-

What are the benefits of using airSlate SignNow for Form N 172?

Using airSlate SignNow for Form N 172 offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. By digitizing the signing process, you can improve efficiency and ensure that your documents are signed and returned promptly.

-

Is airSlate SignNow compatible with other software for Form N 172?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Form N 172 alongside your existing tools. This integration helps streamline your processes and improves overall productivity.

-

How secure is airSlate SignNow when handling Form N 172?

airSlate SignNow prioritizes the security of your documents, including Form N 172. The platform uses advanced encryption methods and complies with industry standards to ensure that your data remains safe and confidential throughout the signing process.

Get more for Form N 172

Find out other Form N 172

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure