Ct Form Os 114 Sut

What is the Ct Form Os 114 Sut

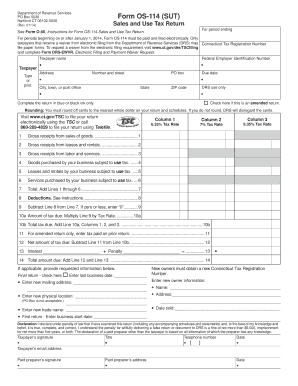

The Ct Form OS 114 SUT is a specific document used in Connecticut for the purpose of reporting and remitting sales and use taxes. This form is essential for businesses that engage in retail sales, providing a structured way to calculate the tax owed to the state. It helps ensure compliance with state tax regulations and facilitates the accurate collection of taxes from consumers.

How to use the Ct Form Os 114 Sut

To effectively use the Ct Form OS 114 SUT, businesses must first gather all necessary sales data for the reporting period. This includes total sales, exempt sales, and any applicable deductions. Once the data is compiled, businesses can fill out the form by entering the required information in the designated fields. It is important to review the completed form for accuracy before submission to avoid any potential penalties.

Steps to complete the Ct Form Os 114 Sut

Completing the Ct Form OS 114 SUT involves several key steps:

- Gather sales records for the reporting period.

- Calculate total sales and any exempt sales.

- Determine the total sales tax collected.

- Fill out the form with the calculated figures.

- Review the form for accuracy.

- Submit the form by the designated deadline.

Legal use of the Ct Form Os 114 Sut

The Ct Form OS 114 SUT is legally binding when completed accurately and submitted in accordance with state regulations. It serves as an official record of sales and tax remittance, which can be referenced by the Connecticut Department of Revenue Services. Proper use of this form helps businesses maintain compliance with tax laws and avoid potential audits or penalties.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the Ct Form OS 114 SUT to ensure timely submission. Typically, the form is due quarterly, with specific dates set by the Connecticut Department of Revenue Services. Missing these deadlines can result in late fees or penalties, making it crucial for businesses to stay informed of their obligations.

Form Submission Methods (Online / Mail / In-Person)

The Ct Form OS 114 SUT can be submitted through various methods. Businesses have the option to file online via the Connecticut Department of Revenue Services website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate state office or submitted in person. Each method has its own advantages, and businesses should choose the one that best fits their operational needs.

Key elements of the Ct Form Os 114 Sut

Several key elements must be included when completing the Ct Form OS 114 SUT. These include:

- Total sales for the reporting period.

- Exempt sales and deductions.

- Total sales tax collected.

- Business identification information.

- Signature of the authorized representative.

Quick guide on how to complete ct form os 114 sut

Complete Ct Form Os 114 Sut effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Ct Form Os 114 Sut on any device using the airSlate SignNow apps for Android or iOS and simplify any document-centric process today.

How to modify and eSign Ct Form Os 114 Sut effortlessly

- Locate Ct Form Os 114 Sut and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct Form Os 114 Sut and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct form os 114 sut

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct form os 114 sut?

The ct form os 114 sut is a standardized document used for filing various requests with state authorities. This form is essential for businesses and individuals who need to maintain compliance with state regulations. Understanding how to fill out the ct form os 114 sut correctly can save you time and ensure your submissions are accepted.

-

How can airSlate SignNow help with the ct form os 114 sut?

airSlate SignNow simplifies the process of completing and submitting the ct form os 114 sut. With its intuitive interface, you can easily input your information, eSign the document, and send it quickly to the relevant state office. This helps eliminate delays and ensures your submissions are processed faster.

-

Is there a cost associated with using airSlate SignNow for the ct form os 114 sut?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when using features for the ct form os 114 sut. With a cost-effective solution, you can choose a plan that best suits your usage, providing access to essential tools for eSigning and document management. You'll find that the investment can lead to signNow time and resource savings.

-

What features does airSlate SignNow provide for the ct form os 114 sut?

airSlate SignNow includes features such as eSignature, document templates, and real-time tracking which streamline the handling of the ct form os 114 sut. These tools enhance your workflow, making it easier to collaborate with others while ensuring documents are completed accurately and efficiently. You also have the ability to integrate with other applications seamlessly.

-

Can I integrate airSlate SignNow with other software for the ct form os 114 sut?

Absolutely! airSlate SignNow allows for easy integration with a variety of popular business applications. This means you can use the capabilities for the ct form os 114 sut alongside your existing tools, such as CRM or project management software, to create a more efficient workflow.

-

What are the benefits of using airSlate SignNow for business documents like the ct form os 114 sut?

Using airSlate SignNow for the ct form os 114 sut streamlines your document management process, saving both time and money. The electronic signing feature eliminates printing, scanning, and mailing, making it an eco-friendly choice. Additionally, your documents remain secure and easily accessible, enhancing overall productivity.

-

How does eSigning the ct form os 114 sut work with airSlate SignNow?

eSigning the ct form os 114 sut with airSlate SignNow is a straightforward process. Simply upload your document, add the necessary fields, and invite signers to eSign. The eSigning feature is legally binding and complies with all regulations, ensuring that your submitted forms are valid and secure.

Get more for Ct Form Os 114 Sut

- Lambunao scandal form

- Form 34 rto gujarat

- 8 ball pool vip points hack form

- Ritz carlton hotel in usa document and i d card form

- California meal break waiver form pdf 12073681

- Eraeft enrollment form aetna

- Wells fargo certification of trustee form

- Tc 69c notice of change for a tax account cloudfront net form

Find out other Ct Form Os 114 Sut

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast