Ri 1040v Form

What is the Ri 1040v Form

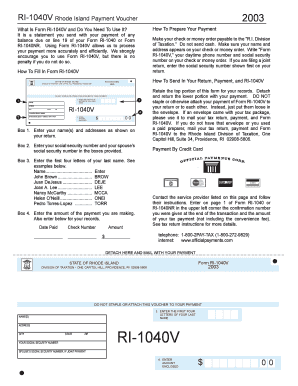

The Ri 1040v form is a payment voucher used by taxpayers in Rhode Island to accompany their state income tax returns. This form is essential for individuals who owe taxes and wish to submit their payments electronically or via mail. The Ri 1040v ensures that the payment is correctly attributed to the taxpayer's account, facilitating a smoother processing of their tax return. Understanding the purpose of this form is crucial for maintaining compliance with state tax regulations.

Steps to complete the Ri 1040v Form

Completing the Ri 1040v form requires careful attention to detail. Here are the steps to guide you through the process:

- Begin by entering your name and address at the top of the form.

- Provide your Social Security number to ensure proper identification.

- Indicate the amount of tax you are submitting with the voucher.

- Review the payment methods available, ensuring you choose one that suits your needs.

- Sign and date the form to validate your submission.

Each step is integral to ensuring that your payment is processed correctly and on time.

How to obtain the Ri 1040v Form

Taxpayers can obtain the Ri 1040v form through several convenient methods. The form is available for download from the Rhode Island Division of Taxation's official website. Additionally, physical copies can be requested by contacting the local tax office. It is advisable to ensure you have the most current version of the form to avoid any issues during submission.

Legal use of the Ri 1040v Form

The Ri 1040v form is legally binding when filled out and submitted according to state regulations. To ensure its legal standing, it must be completed accurately, with all required information provided. Submitting this form electronically or via mail is acceptable, provided that the payment is made in accordance with the deadlines set by the Rhode Island Division of Taxation. Compliance with these guidelines helps avoid penalties and ensures that your tax obligations are met.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Ri 1040v form is essential for taxpayers. Typically, the deadline for submitting the form coincides with the due date for the Rhode Island state income tax return, which is usually April fifteenth. However, it is advisable to check for any updates or changes to these dates each tax year to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the Ri 1040v form. It can be submitted online through the Rhode Island Division of Taxation’s e-filing system, which offers a secure and efficient way to handle payments. Alternatively, taxpayers may choose to mail the form along with their payment or submit it in person at designated tax offices. Each method provides a reliable way to ensure that payments are processed in a timely manner.

Quick guide on how to complete ri 1040v form

Complete Ri 1040v Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Ri 1040v Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Ri 1040v Form with ease

- Obtain Ri 1040v Form and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method to deliver your form, via email, SMS, or an invite link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ri 1040v Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1040v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1040V form?

The RI 1040V is a tax payment voucher used by Rhode Island residents when filing their state income tax returns. It helps taxpayers pay any balance due when submitting their RI 1040 forms. Understanding this form is crucial for timely and accurate tax payments.

-

How can airSlate SignNow help with the RI 1040V?

airSlate SignNow simplifies the process of signing and submitting the RI 1040V electronically. With our user-friendly platform, you can quickly eSign the form and send it directly to tax authorities, ensuring a hassle-free filing process. This saves time and reduces the chances of errors.

-

What features does airSlate SignNow offer for managing the RI 1040V?

airSlate SignNow provides robust features to manage the RI 1040V effectively, including templates, cloud storage, and automated reminders. You can easily customize the form and track document status, enhancing the overall filing experience. This ensures your tax submissions are organized and accessible.

-

Is airSlate SignNow a cost-effective choice for handling the RI 1040V?

Yes, airSlate SignNow offers a cost-effective solution for managing the RI 1040V and other documents. Our pricing plans are tailored to suit individuals and businesses of all sizes, providing competitive rates without sacrificing quality. This affordability makes tax filing more accessible.

-

Can I integrate airSlate SignNow with other tools for managing my RI 1040V?

Absolutely! airSlate SignNow integrates seamlessly with popular platforms like Google Drive and Dropbox, making it easy to manage your RI 1040V within your existing workflow. This integration helps streamline your document management process and allows for easy access to your files.

-

What are the benefits of using airSlate SignNow for the RI 1040V?

By using airSlate SignNow for the RI 1040V, taxpayers can enjoy benefits such as enhanced efficiency, reduced paperwork, and secure electronic signatures. Our platform ensures your data is protected while allowing for quick and easy document processing. This makes tax time less stressful and more manageable.

-

Is it safe to eSign the RI 1040V with airSlate SignNow?

Yes, it is safe to eSign the RI 1040V with airSlate SignNow. We prioritize security with encryption and comply with industry standards to protect your sensitive information. You can file your tax documents confidently, knowing your data is secure.

Get more for Ri 1040v Form

- Ucsc w 9 form

- Mwallet amendment application form prabhu bank

- Form br city of akron

- Annex b form

- Illinois medical cannabis pilot program physician written form

- Sams club bakery order form

- Instructions for schedule bcdh 100s e form rs login

- Form 592 resident and nonresident withholding statement form 592 resident and nonresident withholding statement

Find out other Ri 1040v Form

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself