Personal Estimated Tax Form

What is the Personal Estimated Tax Form

The Personal Estimated Tax Form is a crucial document for individuals who expect to owe tax of one thousand dollars or more when filing their annual tax return. This form allows taxpayers to estimate their tax liability and make quarterly payments to the Internal Revenue Service (IRS) throughout the year. It is primarily used by self-employed individuals, freelancers, and those with significant income not subject to withholding. By filing this form, taxpayers can avoid penalties and interest that may arise from underpayment of taxes.

Steps to complete the Personal Estimated Tax Form

Completing the Personal Estimated Tax Form involves several key steps to ensure accuracy and compliance with IRS guidelines. Begin by gathering all necessary financial information, including income sources, deductions, and credits. Next, calculate your expected annual income and determine your estimated tax liability using the IRS tax tables or tax software. Once you have this information, fill out the form, ensuring that all figures are accurate. Finally, review the completed form for any errors before submitting it to the IRS by the specified deadlines.

How to use the Personal Estimated Tax Form

The Personal Estimated Tax Form serves as a tool for taxpayers to report their estimated tax payments to the IRS. It can be used to calculate the amount owed for each quarter based on projected income. Taxpayers should submit the form along with their estimated payments to ensure proper credit is applied to their account. It is important to keep a copy of the submitted form for personal records and to track payments made throughout the year.

Filing Deadlines / Important Dates

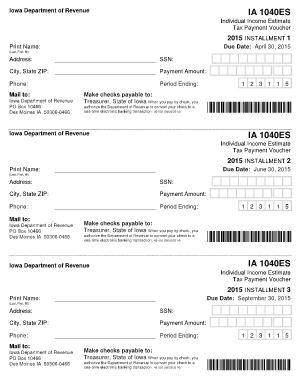

Timely submission of the Personal Estimated Tax Form is essential to avoid penalties. The IRS requires estimated tax payments to be made quarterly, with deadlines typically falling on April 15, June 15, September 15, and January 15 of the following year. Taxpayers should mark these dates on their calendar to ensure they meet their obligations. If a deadline falls on a weekend or holiday, the due date is extended to the next business day.

Legal use of the Personal Estimated Tax Form

The Personal Estimated Tax Form is legally binding when completed and submitted according to IRS regulations. To ensure its validity, taxpayers must provide accurate information and adhere to the deadlines set by the IRS. Electronic submission of the form is accepted, provided it complies with the eSignature laws and regulations, ensuring that the form is recognized as a legitimate document. This legal framework helps protect both the taxpayer and the IRS in the event of disputes.

Key elements of the Personal Estimated Tax Form

Several key elements must be included in the Personal Estimated Tax Form for it to be complete and accurate. These elements typically include the taxpayer's name, Social Security number, estimated income, deductions, and credits. Additionally, the form requires the calculation of the estimated tax liability and the amount of tax already paid or withheld. Ensuring all these elements are correctly filled out is vital for the form's acceptance by the IRS.

Quick guide on how to complete personal estimated tax form

Effortlessly Prepare Personal Estimated Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Personal Estimated Tax Form on any device with the airSlate SignNow apps available for Android or iOS, and simplify your documentation processes today.

The easiest way to modify and electronically sign Personal Estimated Tax Form with ease

- Obtain Personal Estimated Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Produce your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Personal Estimated Tax Form to ensure excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal estimated tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Personal Estimated Tax Form and how does it work?

A Personal Estimated Tax Form is a document that individuals use to estimate their tax liability for the year. This form helps taxpayers determine how much they should pay quarterly to avoid penalties. airSlate SignNow simplifies the process by allowing you to eSign and send your Personal Estimated Tax Form securely online.

-

How can airSlate SignNow help me prepare my Personal Estimated Tax Form?

With airSlate SignNow, you can easily upload your Personal Estimated Tax Form and fill it out electronically. Our platform offers intuitive tools that make it simple to enter your information accurately. Plus, you can eSign and share the completed form seamlessly with your tax advisor or directly with the IRS.

-

Is there a cost associated with using airSlate SignNow for my Personal Estimated Tax Form?

airSlate SignNow offers various pricing plans tailored to meet different needs, including a free trial for new users. Depending on your usage, you can choose a plan that best fits your budget while accessing all features necessary for managing your Personal Estimated Tax Form efficiently. Make sure to check our pricing page for detailed information.

-

Are there any features in airSlate SignNow specifically designed for tax forms?

Yes, airSlate SignNow provides features that are specifically beneficial for completing tax forms like the Personal Estimated Tax Form. These features include easy document sharing, real-time tracking of your signature requests, and secure cloud storage for your documents. This ensures you have everything you need in one convenient location.

-

Can I save my Personal Estimated Tax Form in airSlate SignNow for future reference?

Absolutely! airSlate SignNow allows you to save your Personal Estimated Tax Form and any other documents directly in your account. You can access them anytime, making it easy to refer back to past submissions or prepare for future tax seasons.

-

What integrations does airSlate SignNow offer that can assist with tax forms?

airSlate SignNow integrates seamlessly with various accounting and productivity tools, enhancing your workflow efficiency as you manage your Personal Estimated Tax Form. You can connect it to platforms like QuickBooks, Google Drive, and Microsoft Office, allowing for easy document management and collaboration.

-

How does airSlate SignNow ensure the security of my Personal Estimated Tax Form?

The security of your Personal Estimated Tax Form is a top priority for airSlate SignNow. Our platform uses advanced encryption protocols and secure data storage practices to protect your personal information. You can trust that your documents are safe and accessible only to authorized users.

Get more for Personal Estimated Tax Form

Find out other Personal Estimated Tax Form

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now