Ss4 Form

What is the SS-4 Form

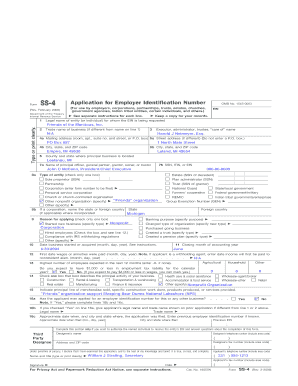

The SS-4 form is an application used by businesses and organizations to apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is essential for tax administration and is required for various business activities, such as hiring employees, opening a business bank account, and filing tax returns. The SS-4 form can be completed online, by mail, or by fax, making it accessible for various business types, including corporations, partnerships, and sole proprietorships.

Steps to Complete the SS-4 Form

Completing the SS-4 form involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary information: Collect details about your business, such as its legal structure, address, and the reason for applying for an EIN.

- Fill out the form: Provide accurate information in each section of the SS-4 form. Be sure to double-check for any errors.

- Submit the form: Choose your preferred submission method—online through the IRS website, by mail, or by fax.

- Receive your EIN: After processing, the IRS will issue your EIN, which you can use for various business purposes.

Legal Use of the SS-4 Form

The SS-4 form is legally binding and must be filled out with accurate information. Misrepresenting details on the form can lead to penalties, including fines or delays in receiving your EIN. It is essential to comply with IRS regulations when using the SS-4 form to ensure that your business is properly registered and recognized for tax purposes.

How to Obtain the SS-4 Form

The SS-4 form can be obtained through multiple channels. It is available directly on the IRS website, where you can fill it out online. Alternatively, you can download a PDF version to complete and submit by mail or fax. Many tax preparation software programs also include the SS-4 form, allowing for easy access and completion within their platforms.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the SS-4 form. It is important to follow these guidelines closely to avoid any issues. The form must be filled out in English, and all information should be accurate and complete. The IRS recommends that applicants review their entries carefully before submission to ensure compliance with all requirements.

Filing Deadlines / Important Dates

While the SS-4 form does not have a strict filing deadline, it is advisable to apply for an EIN as soon as you establish your business. Certain business activities, such as hiring employees or opening a bank account, may require an EIN, so timely submission of the SS-4 form is crucial. Additionally, be aware of any specific deadlines related to your business type or tax obligations to ensure compliance.

Quick guide on how to complete ss4 form

Effortlessly Prepare Ss4 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ss4 Form on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related workflow today.

How to Edit and eSign Ss4 Form with Ease

- Obtain Ss4 Form and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ss4 Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ss4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ss4 example and how is it used in airSlate SignNow?

An ss4 example refers to a sample form used for applying for an Employer Identification Number (EIN). In airSlate SignNow, this example can be filled out electronically, making the submission process seamless and efficient.

-

How much does airSlate SignNow cost for using ss4 examples?

airSlate SignNow offers various pricing plans that are affordable, enabling businesses to efficiently use ss4 examples. Pricing typically fluctuates based on the features you require, so it's best to check the official site for the latest pricing details.

-

What features does airSlate SignNow provide for working with ss4 examples?

airSlate SignNow provides a range of features tailored for handling ss4 examples, including eSignature capabilities, document templates, and real-time collaboration. These features ensure that the process is not only streamlined but also secure.

-

What are the benefits of using airSlate SignNow for ss4 examples?

Using airSlate SignNow for ss4 examples simplifies the document signing process and reduces the time taken to complete forms. Additionally, it enhances accuracy by minimizing human error and provides a legally binding signature.

-

Can airSlate SignNow integrate with other applications when handling ss4 examples?

Yes, airSlate SignNow can seamlessly integrate with various applications such as CRMs, cloud storage, and project management tools to enhance your efficiency when managing ss4 examples. This integration facilitates better workflow and document management.

-

Is airSlate SignNow user-friendly for newcomers utilizing ss4 examples?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for newcomers to navigate when handling ss4 examples. The platform provides helpful resources and support to ensure a smooth onboarding experience.

-

How secure is airSlate SignNow when dealing with ss4 examples?

Security is a top priority at airSlate SignNow. When dealing with ss4 examples, the platform employs advanced encryption and security protocols to protect your sensitive information, ensuring peace of mind.

Get more for Ss4 Form

- Qtc medical evaluation protocol form

- Cico daily report form garrard kyschools

- Disbursement form template

- Cancer treatment drugs market research china market research report form

- Grain stability calculation form excel 448634973

- Arkansas divorce packet pdf form

- Form 433 f sp rev 2 collection information statement spanish version

- Form433 b oic sp rev 4 collection information statement for businesses spanish version

Find out other Ss4 Form

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document