Form 433 F SP Rev 2 Collection Information Statement Spanish Version 2019

What is the Form 433 F SP Rev 2 Collection Information Statement Spanish Version

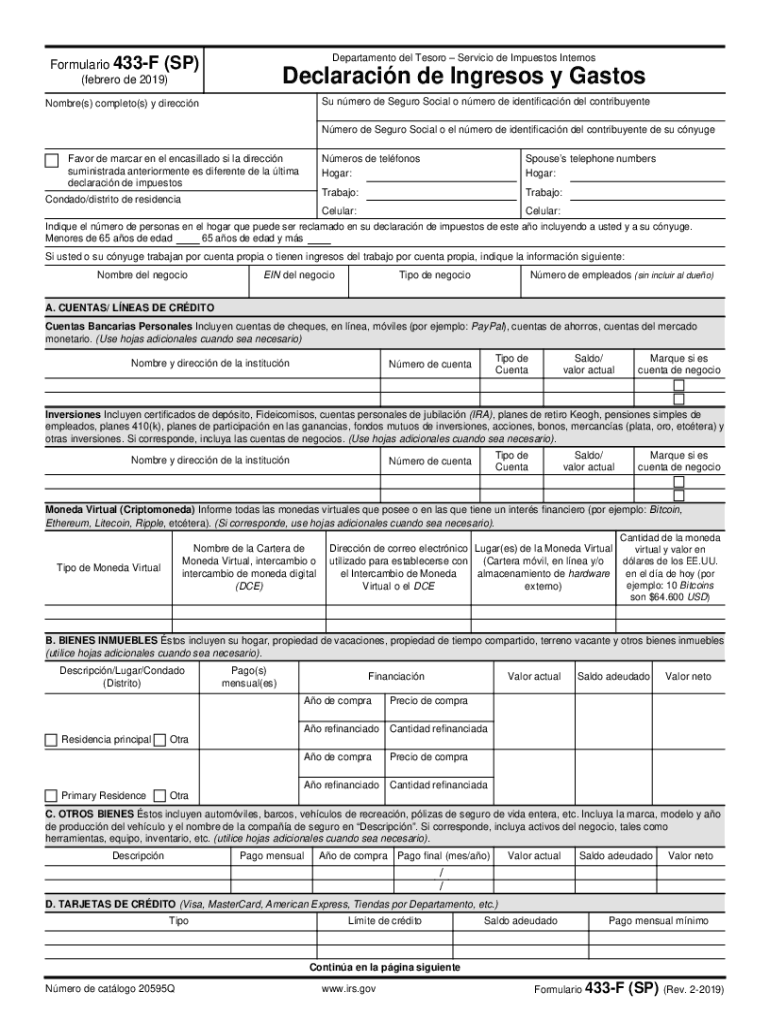

The Form 433 F SP Rev 2 Collection Information Statement Spanish Version is a document used by the Internal Revenue Service (IRS) to gather financial information from taxpayers who owe federal taxes. This form is specifically designed for Spanish-speaking individuals and provides a comprehensive overview of a taxpayer's financial situation. It includes details about income, expenses, assets, and liabilities, allowing the IRS to assess the taxpayer's ability to pay their tax debts. This form is crucial for individuals seeking to negotiate payment plans or settle their tax liabilities with the IRS.

How to use the Form 433 F SP Rev 2 Collection Information Statement Spanish Version

Using the Form 433 F SP Rev 2 involves several key steps. First, taxpayers must gather all necessary financial information, including income statements, bank statements, and details about any assets or debts. Next, the form must be filled out accurately, ensuring that all sections are completed to provide a clear picture of the taxpayer's financial status. Once completed, the form should be submitted to the IRS, either online or by mail, depending on the specific instructions provided by the IRS. It is important to keep a copy of the submitted form for personal records.

Steps to complete the Form 433 F SP Rev 2 Collection Information Statement Spanish Version

Completing the Form 433 F SP Rev 2 involves several important steps:

- Gather financial documents: Collect all relevant documents, such as pay stubs, bank statements, and records of assets and liabilities.

- Fill out the form: Carefully complete each section of the form, providing accurate and detailed information about your financial situation.

- Review the form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Send the completed form to the IRS as instructed, either electronically or via mail.

Key elements of the Form 433 F SP Rev 2 Collection Information Statement Spanish Version

The Form 433 F SP Rev 2 includes several key elements that are essential for accurately reporting financial information. These elements include:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Income Details: Monthly income from all sources, including wages, self-employment, and other income.

- Expense Information: Monthly living expenses, including housing, utilities, food, and transportation costs.

- Asset Information: A detailed list of assets, such as bank accounts, real estate, and vehicles.

- Liabilities: A summary of outstanding debts, including loans and credit card balances.

Legal use of the Form 433 F SP Rev 2 Collection Information Statement Spanish Version

The Form 433 F SP Rev 2 is a legal document that must be completed truthfully and accurately. Providing false information on this form can result in penalties or legal repercussions. Taxpayers are encouraged to seek assistance if they are unsure about how to complete the form or if they have questions regarding their financial situation. It is essential to understand that this form is used by the IRS to determine the taxpayer's ability to pay and to negotiate payment options.

Create this form in 5 minutes or less

Find and fill out the correct form 433 f sp rev 2 collection information statement spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 433 f sp rev 2 collection information statement spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

The Form 433 F SP Rev 2 Collection Information Statement Spanish Version is a document used by the IRS to collect financial information from individuals. This form helps the IRS assess a taxpayer's ability to pay their tax liabilities. By providing accurate information, taxpayers can negotiate payment plans or settle their debts more effectively.

-

How can airSlate SignNow help with the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

airSlate SignNow simplifies the process of completing and signing the Form 433 F SP Rev 2 Collection Information Statement Spanish Version. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can easily eSign the document, making it ready for submission to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing access to features that streamline the completion of the Form 433 F SP Rev 2 Collection Information Statement Spanish Version. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

airSlate SignNow provides a range of features for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience and ensure that your documents are handled securely and efficiently. You can also collaborate with others in real-time.

-

Can I integrate airSlate SignNow with other applications for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with the Form 433 F SP Rev 2 Collection Information Statement Spanish Version. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

Using airSlate SignNow for the Form 433 F SP Rev 2 Collection Information Statement Spanish Version provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents quickly, saving you time and effort. Additionally, your data is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for completing the Form 433 F SP Rev 2 Collection Information Statement Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for anyone to navigate and complete the Form 433 F SP Rev 2 Collection Information Statement Spanish Version without prior experience. Our platform also offers helpful resources and support to assist you throughout the process.

Get more for Form 433 F SP Rev 2 Collection Information Statement Spanish Version

- Aon care ghs form

- Seku form

- Car parking allotment letter format word

- Capability statement template for government contractors form

- West coast life insurance beneficiary change form

- Radio talk show script sample pdf form

- Form 4506 t ez sp rev 6 short form request for individual tax return transcript spanish version

- Irs gov tax forms 702455461

Find out other Form 433 F SP Rev 2 Collection Information Statement Spanish Version

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form