Aiico Flexible Endowment Plan Form

What is the Aiico Flexible Endowment Plan

The Aiico Flexible Endowment Plan is a financial product designed to provide policyholders with both savings and insurance benefits. It combines elements of an endowment policy with the flexibility to adjust contributions and coverage as personal circumstances change. This plan aims to help individuals save for specific goals, such as education or retirement, while also offering life insurance protection. The unique structure allows for a tailored approach to financial planning, making it suitable for a wide range of individuals.

How to use the Aiico Flexible Endowment Plan

Utilizing the Aiico Flexible Endowment Plan involves several steps to maximize its benefits. First, policyholders should assess their financial goals and determine the amount they wish to save. Next, they can choose the level of coverage that aligns with their needs. Regular contributions can be adjusted based on changing financial situations, allowing for ongoing flexibility. It is essential to review the plan periodically to ensure it continues to meet personal objectives and to make any necessary adjustments.

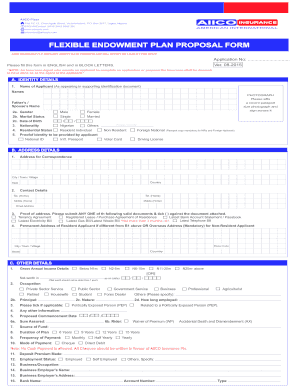

Steps to complete the Aiico Flexible Endowment Plan

Completing the Aiico Flexible Endowment Plan requires a systematic approach. Start by gathering necessary personal information, including identification and financial details. Next, fill out the application form accurately, ensuring all required fields are completed. Once the form is submitted, review the terms and conditions carefully. After approval, set up a payment schedule for contributions. Regularly monitor the plan's performance and make adjustments as needed to stay aligned with your financial goals.

Legal use of the Aiico Flexible Endowment Plan

The legal use of the Aiico Flexible Endowment Plan is governed by specific regulations that ensure compliance with financial and insurance laws. It is crucial that all documentation is completed accurately and that the policyholder understands their rights and obligations under the plan. The plan adheres to relevant legal frameworks, ensuring that it is recognized as a valid financial instrument. Policyholders should keep records of all transactions and communications related to the plan for future reference.

Key elements of the Aiico Flexible Endowment Plan

Several key elements define the Aiico Flexible Endowment Plan. These include the ability to adjust premium payments, the combination of savings and insurance benefits, and the potential for cash value accumulation over time. Additionally, the plan may offer various riders or additional options that enhance coverage, such as critical illness or disability benefits. Understanding these elements is essential for policyholders to fully leverage the plan's advantages.

Eligibility Criteria

Eligibility for the Aiico Flexible Endowment Plan typically requires individuals to meet specific criteria. Applicants usually need to be of a certain age, often between eighteen and sixty-five, and may be required to provide proof of income or financial stability. Additionally, applicants should have a clear understanding of their financial goals and the commitment to make regular contributions. Meeting these criteria ensures that individuals can effectively benefit from the plan's features.

Quick guide on how to complete aiico flexible endowment plan

Complete Aiico Flexible Endowment Plan effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and eSign your documents promptly without delays. Manage Aiico Flexible Endowment Plan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Aiico Flexible Endowment Plan with ease

- Locate Aiico Flexible Endowment Plan and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Aiico Flexible Endowment Plan and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aiico flexible endowment plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AIICO Flexible Endowment Plan?

The AIICO Flexible Endowment Plan is a savings and investment product designed to provide financial security for policyholders. It combines life insurance with a savings component to help secure ongoing financial needs. With flexible contributions, this plan allows you to save towards your financial goals while enjoying life cover.

-

How does the pricing of the AIICO Flexible Endowment Plan work?

Pricing for the AIICO Flexible Endowment Plan is dependent on the type of coverage chosen and the contribution amount. Premiums can be adjusted to fit your budget, making it a customizable option for different financial situations. It's best to consult with an AIICO advisor to get a precise quote based on your needs.

-

What are the key features of the AIICO Flexible Endowment Plan?

Key features of the AIICO Flexible Endowment Plan include flexible premium payments, a combination of savings and insurance benefits, and maturity benefits. Policyholders can also enjoy bonuses that may increase the final payout. This plan is designed for adaptability and can cater to various investment timelines.

-

What are the benefits of the AIICO Flexible Endowment Plan?

The main benefits of the AIICO Flexible Endowment Plan include financial protection for your loved ones, savings for future needs, and potential investment returns. This plan not only secures your family but also helps accumulate cash value over time. It's a reliable way to plan for major life events such as education or retirement.

-

Can I adjust my contributions to the AIICO Flexible Endowment Plan?

Yes, one of the strongest features of the AIICO Flexible Endowment Plan is its flexibility in contributions. Policyholders can change their premium deposits to suit their financial circumstances without losing coverage. This ensures that you can continue building your savings even during financial fluctuations.

-

How can I integrate the AIICO Flexible Endowment Plan with other financial products?

The AIICO Flexible Endowment Plan can be effectively integrated with other financial products, such as investment accounts or retirement plans. Doing so can provide a comprehensive financial strategy that caters to both immediate and long-term needs. Always consult with a financial advisor for personalized advice.

-

Is the AIICO Flexible Endowment Plan suitable for everyone?

The AIICO Flexible Endowment Plan is suitable for a wide range of individuals, especially those looking for a dual benefit of savings and life insurance. It can be tailored to fit various financial needs and goals, making it a versatile option for families, professionals, and retirees. Assessing your personal financial situation can help determine if it’s the right choice for you.

Get more for Aiico Flexible Endowment Plan

- Ireland work form

- Illinois st 105 form

- If you are reading this right now you are taking part in the wonder of literacy form

- A2179 il applctnfremplymntlng indd vprd form

- Babysittingchild care receipt distributable forms for quickbooks accounting software

- Mc 355 spanish form

- Provider inquiry claim form 470 3744

- Job completion report 77146577 form

Find out other Aiico Flexible Endowment Plan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors