Substitute Form 1099 S PDF

What is the Substitute Form 1099 S Pdf

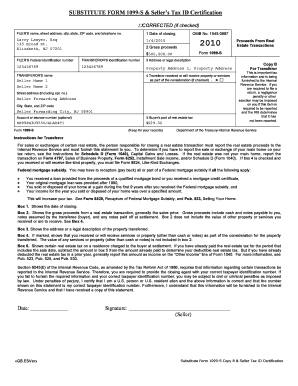

The Substitute Form 1099 S is a tax document used in the United States to report proceeds from real estate transactions. It serves as an alternative to the official IRS Form 1099 S, which is typically issued by the closing agent or real estate broker. This form is essential for individuals and businesses involved in real estate sales, as it helps ensure compliance with tax reporting requirements. The Substitute Form 1099 S captures crucial information, including the seller's details, transaction date, and sale amount, making it a vital component for accurate tax filing.

Steps to complete the Substitute Form 1099 S Pdf

Completing the Substitute Form 1099 S involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as the seller's name, address, and taxpayer identification number (TIN). Next, input the transaction details, including the date of sale and gross proceeds. It is important to double-check all entries for accuracy, as errors can lead to complications with the IRS. After filling out the form, review it carefully before submitting. Ensure that all required signatures are included, as this validates the document.

Legal use of the Substitute Form 1099 S Pdf

The legal use of the Substitute Form 1099 S is governed by IRS regulations, which mandate accurate reporting of real estate transactions. This form must be filed by the seller or the closing agent, depending on the transaction's specifics. It is essential to adhere to IRS guidelines to avoid penalties. The form serves as a legal record of the transaction and can be used in case of audits or disputes. Understanding the legal implications of this form is crucial for both buyers and sellers in real estate transactions.

Filing Deadlines / Important Dates

Filing deadlines for the Substitute Form 1099 S are critical to ensure compliance with IRS regulations. Generally, the form must be submitted to the IRS by the end of February if filed on paper, or by March 31 if filed electronically. Additionally, copies of the form must be provided to the recipients by January 31. It is important to mark these dates on your calendar to avoid late filing penalties. Keeping track of these deadlines helps maintain good standing with tax authorities and ensures accurate reporting of real estate transactions.

Who Issues the Form

The Substitute Form 1099 S is typically issued by the closing agent, real estate broker, or seller involved in the transaction. These parties are responsible for ensuring that the form is accurately completed and submitted to the IRS. In some cases, the seller may need to provide the necessary information to the closing agent for accurate reporting. Understanding who is responsible for issuing the form is important for all parties involved in real estate transactions to ensure compliance with tax regulations.

Key elements of the Substitute Form 1099 S Pdf

Key elements of the Substitute Form 1099 S include essential information that must be accurately reported. This includes the seller's name, address, and TIN, as well as the buyer's information. The form also requires details about the property sold, including the transaction date and gross proceeds. Additionally, any applicable adjustments or deductions should be noted. Ensuring that all key elements are correctly filled out is vital for compliance and to avoid potential issues with the IRS.

Quick guide on how to complete substitute form 1099 s pdf

Easily Prepare Substitute Form 1099 S Pdf on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Substitute Form 1099 S Pdf on any device with the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to Modify and eSign Substitute Form 1099 S Pdf Effortlessly

- Find Substitute Form 1099 S Pdf and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Mark essential sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form navigation, or errors that require reprinting new document versions. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign Substitute Form 1099 S Pdf and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the substitute form 1099 s pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a substitute 1099s form?

A substitute 1099s form is an alternative document that can be used in place of the official IRS 1099 form. It must contain the same information and comply with IRS regulations. Businesses can utilize the substitute 1099s form for various reporting requirements, ensuring that their financial records are accurate and up to date.

-

How can airSlate SignNow help with substitute 1099s forms?

airSlate SignNow enables businesses to create, send, and eSign their substitute 1099s forms quickly and securely. With our user-friendly interface, you can streamline your document management process, saving time and reducing the risk of errors. This ensures that your substitute 1099s forms are delivered effectively and meet compliance standards.

-

What are the pricing options for using airSlate SignNow for substitute 1099s forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features specifically designed for managing substitute 1099s forms among other document types. You can choose a plan that matches your volume of transactions while benefiting from our cost-effective solution.

-

Can I integrate airSlate SignNow with other applications to manage substitute 1099s forms?

Yes, airSlate SignNow supports integration with numerous applications to enhance your workflow for substitute 1099s forms. Integrate with popular tools like CRMs, accounting software, and cloud storage services to streamline your document processes. This integration allows for seamless management of your substitute 1099s forms without disrupting your existing operations.

-

What features does airSlate SignNow offer for preparing substitute 1099s forms?

airSlate SignNow offers robust features for preparing substitute 1099s forms, such as customizable templates, automatic data population, and real-time tracking of document status. This ensures that you can fill out and send your forms quickly while staying updated on their progress. Tools like signature workflows and reminders also make the process efficient.

-

Is airSlate SignNow compliant with IRS regulations for substitute 1099s forms?

Absolutely! airSlate SignNow is designed to adhere to IRS regulations regarding substitute 1099s forms. Our platform ensures that the forms you generate meet all necessary compliance requirements, allowing you to focus on your business without worrying about regulatory issues.

-

What are the benefits of using airSlate SignNow for substitute 1099s forms?

Using airSlate SignNow for substitute 1099s forms offers various benefits, including improved efficiency, reduced paperwork, and enhanced security. You can easily eSign forms, which eliminates the need for printing and scanning. This not only saves time but also contributes to an eco-friendly approach to document management.

Get more for Substitute Form 1099 S Pdf

Find out other Substitute Form 1099 S Pdf

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer