Maximum Cash Accountability Form

What is the maximum cash accountability form?

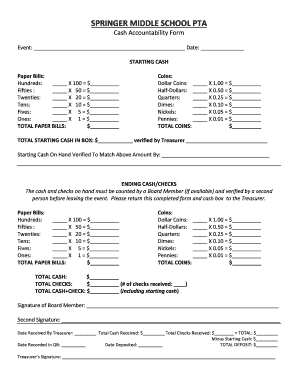

The maximum cash accountability form is a crucial document used by organizations to track and manage cash transactions. This form ensures that all cash inflows and outflows are accounted for, providing transparency and accountability in financial operations. It is particularly important for businesses that handle significant amounts of cash, as it helps prevent discrepancies and fraud.

How to use the maximum cash accountability form

Using the maximum cash accountability form involves several key steps. First, gather all necessary information related to cash transactions, including dates, amounts, and purposes. Next, accurately fill out the form, ensuring that all entries are clear and precise. After completing the form, review it for accuracy before submitting it to the appropriate department or individual responsible for financial oversight. This process helps maintain accurate financial records and supports compliance with regulatory requirements.

Steps to complete the maximum cash accountability form

Completing the maximum cash accountability form requires attention to detail. Follow these steps for effective completion:

- Collect all relevant cash transaction information.

- Fill in the date of each transaction.

- Record the amount of cash received or spent.

- Specify the purpose of each transaction for clarity.

- Double-check all entries to ensure accuracy.

- Sign and date the form to validate its authenticity.

Legal use of the maximum cash accountability form

The maximum cash accountability form is legally binding when completed correctly. It serves as an official record of cash transactions, which can be referenced in audits or legal proceedings. To ensure its legal validity, organizations must adhere to relevant regulations and maintain accurate records. Compliance with financial reporting standards is essential to uphold the integrity of the form.

Key elements of the maximum cash accountability form

Several key elements must be included in the maximum cash accountability form to ensure its effectiveness:

- Date: The date of each cash transaction.

- Transaction Amount: The total cash involved in each transaction.

- Purpose: A brief description of why the cash was received or spent.

- Signatures: Required signatures to validate the form.

- Audit Trail: Documentation supporting each transaction for accountability.

Examples of using the maximum cash accountability form

The maximum cash accountability form can be utilized in various scenarios, such as:

- Tracking cash sales in retail environments.

- Documenting cash expenditures for events or projects.

- Managing petty cash funds within an organization.

- Recording cash donations for non-profit organizations.

Quick guide on how to complete maximum cash accountability form

Complete Maximum Cash Accountability Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Maximum Cash Accountability Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused operation today.

The easiest way to edit and eSign Maximum Cash Accountability Form without any hassle

- Find Maximum Cash Accountability Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Maximum Cash Accountability Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maximum cash accountability form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cash accountability, and why is it important for businesses?

Cash accountability refers to the processes and measures that ensure all cash transactions are properly recorded and monitored. For businesses, achieving cash accountability is crucial to maintaining financial integrity, preventing fraud, and ensuring accurate financial reporting.

-

How does airSlate SignNow support cash accountability?

airSlate SignNow enhances cash accountability by providing a secure platform for eSigning and managing documents related to financial transactions. With our solution, businesses can ensure that all cash transactions are documented accurately and compliantly, contributing to improved cash management practices.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to suit various business needs and budgets. Our competitive pricing ensures that businesses can implement effective cash accountability measures without overspending while benefiting from our cutting-edge eSignature technology.

-

What features does airSlate SignNow offer that aid in cash accountability?

Key features of airSlate SignNow that support cash accountability include document templates, automated workflows, and real-time tracking of document status. These tools streamline the process of cash transactions, making it easier for businesses to maintain transparency and accountability.

-

Can airSlate SignNow integrate with other financial software for improved cash accountability?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software platforms. This integration enhances cash accountability by allowing businesses to synchronize document management with their existing financial systems for more efficient cash flow management.

-

How does eSigning with airSlate SignNow improve cash accountability?

ESigning with airSlate SignNow improves cash accountability by providing secure, verifiable, and tamper-proof electronic signatures on financial documents. This not only speeds up the signing process but also ensures that there is a clear record of consent for cash transactions, reducing the risk of disputes.

-

What benefits can I expect from using airSlate SignNow for cash accountability?

By using airSlate SignNow for cash accountability, you can expect increased efficiency, enhanced security, and streamlined workflows. These benefits lead to better financial oversight and a more reliable approach to managing cash transactions, giving you peace of mind.

Get more for Maximum Cash Accountability Form

Find out other Maximum Cash Accountability Form

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document