Abl 29 Form

What is the Abl 29 Form

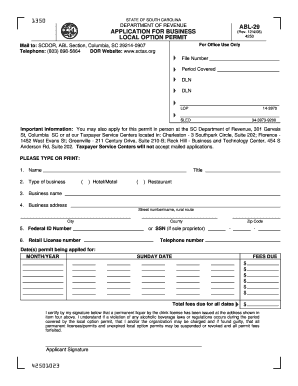

The Abl 29 Form is a specific document used primarily in the context of tax reporting and compliance in the United States. It serves as a declaration for various financial activities and is essential for individuals and businesses to ensure accurate tax filings. Understanding the purpose of this form is crucial for maintaining compliance with IRS regulations and avoiding potential penalties.

How to use the Abl 29 Form

Using the Abl 29 Form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents that pertain to the reporting period. Next, fill out the form by entering your personal or business information, including income details and deductions. It is important to review the completed form for accuracy before submission. Finally, submit the form according to the specified methods, which may include online submission or mailing it to the appropriate IRS address.

Steps to complete the Abl 29 Form

Completing the Abl 29 Form requires attention to detail and a systematic approach. Here are the key steps:

- Gather necessary financial documents, including income statements and receipts.

- Fill in your personal or business information accurately.

- Detail all income sources and applicable deductions.

- Review the form for any errors or omissions.

- Submit the form via the designated method, ensuring you keep a copy for your records.

Legal use of the Abl 29 Form

The legal use of the Abl 29 Form is governed by IRS regulations, which stipulate that the form must be completed truthfully and submitted within the designated timeframes. Failing to comply with these regulations can lead to penalties, including fines or additional scrutiny from the IRS. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can result in legal consequences.

Key elements of the Abl 29 Form

Key elements of the Abl 29 Form include personal identification information, income details, and deductions. Each section must be filled out accurately to reflect the financial situation of the individual or business. Additionally, the form may require signatures or electronic verification to validate the information provided, ensuring that it meets legal standards for submission.

Filing Deadlines / Important Dates

Filing deadlines for the Abl 29 Form are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 for most taxpayers. However, specific circumstances may alter this date, such as extensions or special filing requirements for businesses. Staying informed about these deadlines is essential to avoid penalties.

Who Issues the Form

The Abl 29 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. It is important to obtain the most current version of the form directly from the IRS to ensure compliance with the latest regulations and requirements.

Quick guide on how to complete abl 29 form

Effortlessly complete Abl 29 Form on any device

Online document management is gaining traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can easily access the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Handle Abl 29 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest method to edit and electronically sign Abl 29 Form without hassle

- Obtain Abl 29 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign function, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Abl 29 Form to ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the abl 29 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Abl 29 Form and why is it important?

The Abl 29 Form is a crucial document used in various business processes for compliance and record-keeping. It enables organizations to gather necessary information efficiently and securely. By utilizing airSlate SignNow to manage the Abl 29 Form, businesses can streamline their documentation flow and ensure that all required signatures are collected promptly.

-

How can airSlate SignNow simplify the management of the Abl 29 Form?

airSlate SignNow simplifies the management of the Abl 29 Form by allowing users to create, send, and eSign documents quickly through an intuitive interface. The platform offers templates and automation features that can enhance efficiency and reduce the time spent on paperwork. Additionally, all actions taken with the Abl 29 Form are securely stored and easily accessible.

-

Is there a cost associated with using the Abl 29 Form on airSlate SignNow?

Yes, using the Abl 29 Form on airSlate SignNow involves a subscription fee, but it is a cost-effective solution when compared to traditional methods of document management. Various pricing plans are available to meet different business needs, ensuring you can find an option that fits your budget while gaining access to essential features related to the Abl 29 Form.

-

What features does airSlate SignNow offer for the Abl 29 Form?

airSlate SignNow provides several features for the Abl 29 Form, including customizable templates, eSignature capabilities, and real-time tracking of document status. These features help ensure that signatures are collected efficiently and that the form is processed on time. Additionally, users can integrate the Abl 29 Form into existing workflows for seamless operation.

-

Can I integrate the Abl 29 Form with other software tools?

Absolutely! airSlate SignNow supports integrations with various software tools, allowing you to incorporate the Abl 29 Form into your existing systems. This includes CRM platforms, cloud storage solutions, and productivity tools, making it easier to manage your documentation workflow. By integrating, you can enhance efficiency and reduce redundancy when handling the Abl 29 Form.

-

What are the benefits of using airSlate SignNow for the Abl 29 Form?

Using airSlate SignNow for the Abl 29 Form offers numerous benefits, including improved accuracy, faster processing times, and enhanced security. The platform reduces the risk of errors that can occur with manual handling and guarantees that all signatures are validated. Furthermore, it ensures compliance with regulations, which is vital when dealing with forms like the Abl 29 Form.

-

How does airSlate SignNow ensure the security of the Abl 29 Form?

airSlate SignNow takes security very seriously, implementing several measures to protect the Abl 29 Form during transit and storage. This includes data encryption, secure access controls, and audit trails that track all interactions with the document. These features help ensure that sensitive information contained within the Abl 29 Form remains confidential and protected from unauthorized access.

Get more for Abl 29 Form

Find out other Abl 29 Form

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement