See Section 197A1, 197A1A and Rule 29C Form

Understanding the 15G Form and Its Legal Basis

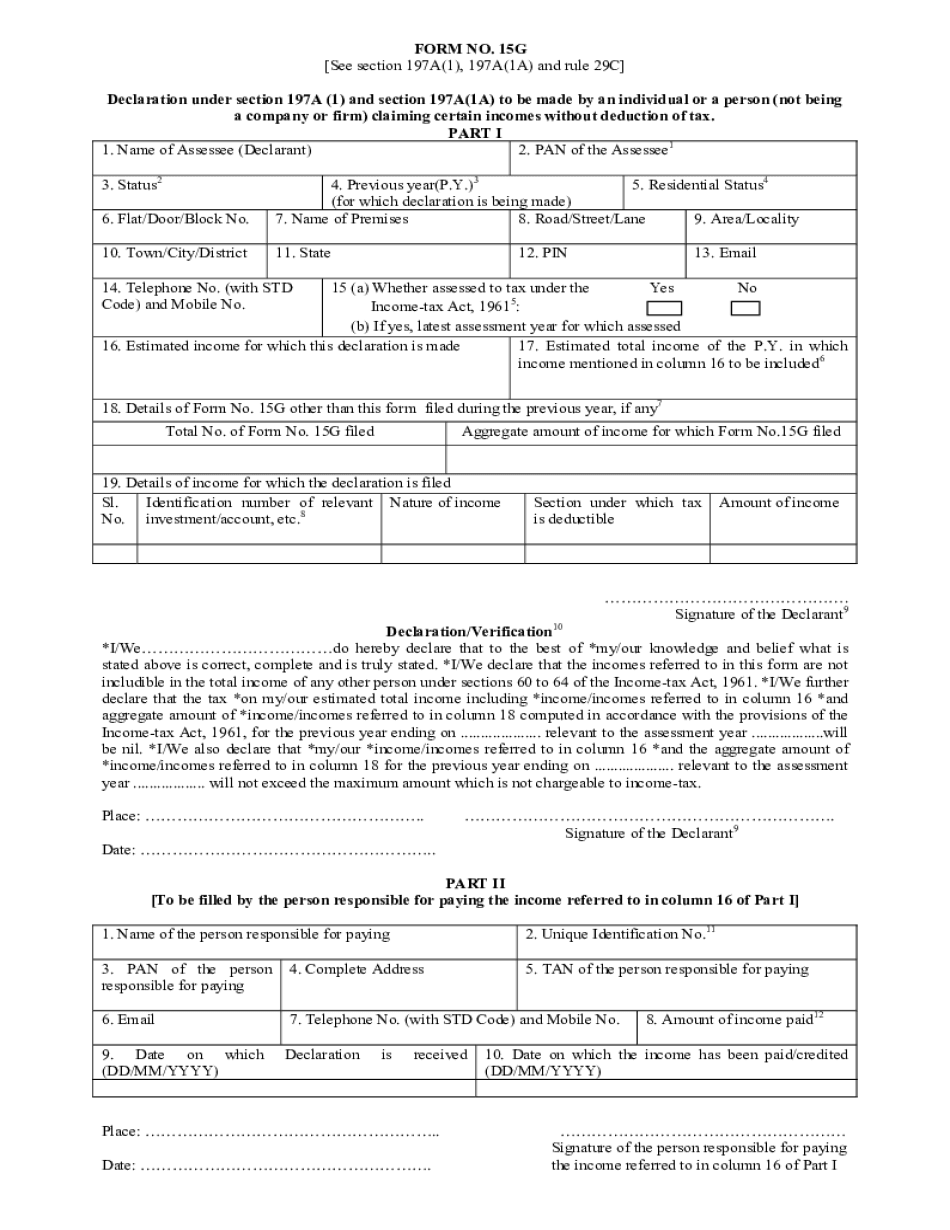

The 15G form is a critical document for individuals in India, primarily used to ensure that no tax is deducted at source on interest income. This form is governed by Section 197A(1) of the Income Tax Act, which allows taxpayers to declare that their total income is below the taxable limit. By submitting this form, individuals can avoid unnecessary tax deductions on their income, especially when it comes to interest earned on fixed deposits or savings accounts. Understanding the legal framework surrounding the 15G form is essential for compliance and effective tax planning.

Steps to Complete the 15G Form

Filling out the 15G form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Begin by entering your personal details, including your name, address, and PAN (Permanent Account Number).

- Provide the relevant financial institution's name and the account number where the interest income is generated.

- Indicate the financial year for which you are submitting the form.

- Declare the total income earned during the financial year, ensuring it does not exceed the taxable limit.

- Sign and date the form, confirming that the information provided is accurate.

Eligibility Criteria for Submitting the 15G Form

To submit the 15G form, certain eligibility criteria must be met. Primarily, individuals must ensure that their total taxable income is below the basic exemption limit set by the Income Tax Department. For the financial year 2, this limit is typically set at $12,400 for individuals under 65 years of age. Additionally, the form can only be submitted by residents of India, and it is applicable for interest income earned from savings accounts, fixed deposits, and other similar financial instruments.

Required Documents for 15G Form Submission

When submitting the 15G form, it is essential to have the following documents ready:

- Proof of identity, such as a government-issued ID or PAN card.

- Bank statements or passbooks showing the interest income earned.

- Any other relevant financial documents that support your income declaration.

Filing Deadlines for the 15G Form

Timely submission of the 15G form is crucial to avoid tax deductions at source. The form should be submitted to the financial institution before the end of the financial year, typically by March 31st. It is advisable to submit the form at the beginning of the financial year to ensure that tax deductions do not occur on interest income throughout the year.

Digital vs. Paper Version of the 15G Form

The 15G form can be completed both digitally and in paper format. The digital version allows for easier submission, often through online banking portals or financial institution websites. This method is efficient and provides instant confirmation. Conversely, the paper version requires manual submission at the bank or financial institution, which may take longer to process. Regardless of the method chosen, ensuring accuracy in the information provided is paramount.

Quick guide on how to complete see section 197a1 197a1a and rule 29c

Prepare See Section 197A1, 197A1A And Rule 29C effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly and without delays. Manage See Section 197A1, 197A1A And Rule 29C on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign See Section 197A1, 197A1A And Rule 29C without stress

- Find See Section 197A1, 197A1A And Rule 29C and click on Get Form to commence.

- Leverage the tools we provide to fill out your document.

- Emphasize key sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of form delivery: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages your document processing needs with just a few clicks from any device you choose. Modify and eSign See Section 197A1, 197A1A And Rule 29C and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the see section 197a1 197a1a and rule 29c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 15G form PDF and why is it important?

The 15G form PDF is a declaration document used by individuals to ensure that no tax is deducted from their interest income. It is particularly important for taxpayers who earn below the taxable limit and want to manage their finances effectively without unnecessary deductions.

-

How can I access the 15G form PDF using airSlate SignNow?

You can easily access and fill out the 15G form PDF directly on the airSlate SignNow platform. Our user-friendly interface allows you to upload, customize, and electronically sign the document all in one place, streamlining your document management process.

-

Is there a cost associated with using airSlate SignNow for the 15G form PDF?

airSlate SignNow offers a cost-effective solution for managing documents like the 15G form PDF. We provide various pricing plans that cater to businesses of all sizes, ensuring that you can find a solution that fits your budget while enjoying our comprehensive features.

-

What features does airSlate SignNow offer for the 15G form PDF?

With airSlate SignNow, you can create, sign, and send the 15G form PDF seamlessly. Key features include document templates, real-time tracking, secure cloud storage, and the ability to integrate with popular applications, making document management hassle-free.

-

Can I integrate airSlate SignNow with other applications for using the 15G form PDF?

Yes, airSlate SignNow supports a wide array of integrations with popular applications and services. This allows you to streamline your workflow when working with the 15G form PDF and enhance collaboration across your team.

-

How does airSlate SignNow ensure the security of my 15G form PDF?

We prioritize the security of your documents, including the 15G form PDF. airSlate SignNow employs advanced encryption, secure cloud storage, and user authentication measures to ensure that your sensitive information remains safe and confidential.

-

What are the benefits of using airSlate SignNow for the 15G form PDF?

By using airSlate SignNow for the 15G form PDF, you gain access to a streamlined signing process, enhanced document security, and efficient management of all your paperwork. This ensures that you save time and reduce errors, enabling a more productive workflow.

Get more for See Section 197A1, 197A1A And Rule 29C

Find out other See Section 197A1, 197A1A And Rule 29C

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile