Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund 2023

What is the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

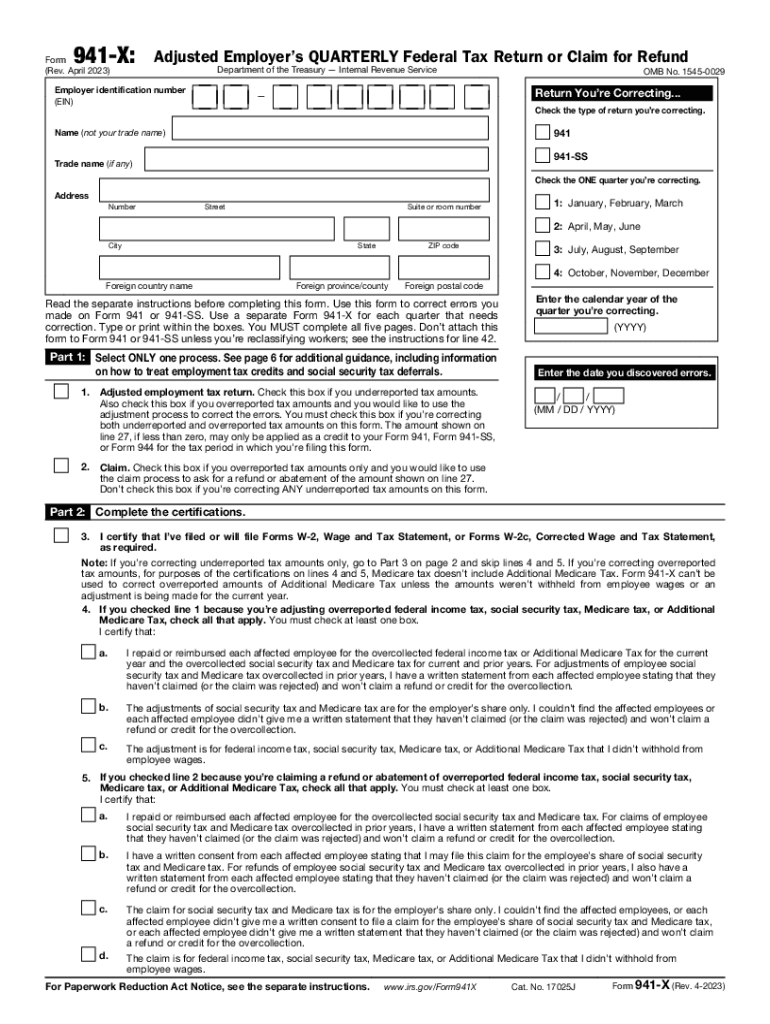

The Form 941 X is a crucial document used by employers to correct errors on previously filed Form 941, which reports payroll taxes. This form allows businesses to amend their quarterly federal tax returns or claim refunds for overreported taxes. It is essential for employers who need to adjust their reported wages, tips, or tax liabilities due to mistakes or changes in circumstances. Understanding the purpose and function of Form 941 X is vital for maintaining compliance with IRS regulations.

Steps to Complete the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

Completing Form 941 X involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including the original Form 941 and any supporting documents related to the corrections.

- Fill out the identifying information at the top of the form, including the employer's name, address, and Employer Identification Number (EIN).

- Indicate the quarter and year for which you are making corrections.

- Complete the sections that require adjustments, detailing the original amounts and the corrected figures.

- Provide explanations for each correction in the designated area.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 941 X are critical to avoid penalties. Employers must submit this form within three years from the date the original Form 941 was filed or within two years from the date the tax was paid, whichever is later. It is important to keep track of these dates to ensure compliance and to facilitate any potential refunds.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting Form 941 X. The form can be mailed to the appropriate IRS service center based on the employer's location. While electronic submission is not available for Form 941 X, it is advisable to send the form via certified mail to ensure it is received. Employers should keep copies of the submitted form and any correspondence with the IRS for their records.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 941 X. These guidelines include instructions on how to report adjustments accurately, the importance of providing detailed explanations for each correction, and the necessity of maintaining accurate records. Employers should refer to the latest IRS publications and instructions to ensure compliance with current regulations.

Legal Use of the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

Form 941 X is legally binding when completed accurately and submitted in a timely manner. It serves as the official record of corrections made to previously filed payroll tax returns. Employers must ensure that all information provided is truthful and complete to avoid penalties or legal issues. Understanding the legal implications of filing Form 941 X is essential for maintaining compliance with federal tax laws.

Quick guide on how to complete form 941 x rev april adjusted employers quarterly federal tax return or claim for refund

Complete Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without complications. Handle Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund with ease

- Find Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize crucial sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as an ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, be it via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors necessitating new printed copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund to ensure seamless communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x rev april adjusted employers quarterly federal tax return or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the form 941 x rev april adjusted employers quarterly federal tax return or claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 941X and why would I need to submit it?

Form 941X is used to correct errors made on previously filed Form 941, the Employer's Quarterly Federal Tax Return. When you need to amend payroll taxes, understanding where to mail 941X is crucial for efficient processing and compliance with IRS regulations.

-

Where do I mail the completed 941X form?

The mailing address for Form 941X varies based on your location and whether you are including a payment. It is important to refer to the IRS instructions or consult with your tax professional to determine where to mail 941X for your specific situation.

-

What are the features of airSlate SignNow for processing Form 941X?

airSlate SignNow provides easy document management, eSigning capabilities, and secure storage. With our platform, you can efficiently prepare and send Form 941X while ensuring compliance, especially when determining where to mail 941X after completion.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Our subscription packages ensure you have the necessary tools to manage documents like Form 941X effectively, providing clarity on where to mail 941X without breaking the bank.

-

How can airSlate SignNow benefit my business in filing tax forms?

By using airSlate SignNow, you gain a powerful solution for document management, making tasks like filing Form 941X much simpler. It helps streamline your workflow and provides confirmation of eSigned documents, ensuring you have everything you need to know about where to mail 941X.

-

Can I integrate airSlate SignNow with my accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions. This integration simplifies the process of preparing and submitting forms like 941X and makes it easier to find out where to mail 941X once completed.

-

Is electronic submission of 941X allowed, or do I have to mail it?

Currently, Form 941X must be mailed to the IRS; electronic submission is not allowed. Knowing where to mail 941X is essential to ensure that your forms signNow the correct IRS office for processing in a timely manner.

Get more for Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- Health declaration form deped editable

- Justicecourtsjohannesburg magistrates court civil sectionhome form

- Adult full assessment form

- Bd professional samples form

- Van t hof rijnland huur opzeggen form

- Nis sangre grande form

- Daily inspections city of wildomar form

- Inedible kitchen grease transporter registration application personal use form

Find out other Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document