Mlc Financial Hardship Form 2013

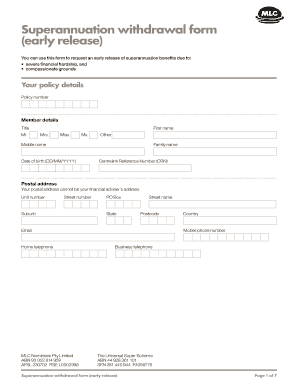

What is the Mlc Financial Hardship Form

The Mlc Financial Hardship Form is a document designed for individuals seeking early access to their superannuation funds due to financial difficulties. This form is particularly relevant for those who meet specific criteria, such as experiencing severe financial hardship or facing circumstances that warrant the early release of their superannuation. Understanding the purpose of this form is crucial for anyone considering a superannuation withdrawal on compassionate grounds.

Eligibility Criteria

To successfully complete the Mlc Financial Hardship Form, applicants must demonstrate that they meet certain eligibility criteria. Generally, these criteria include:

- Experiencing significant financial distress, such as being unable to meet basic living expenses.

- Facing medical emergencies or other compassionate grounds that necessitate immediate access to funds.

- Providing supporting documentation that verifies the financial hardship, such as bills or medical records.

Understanding these criteria is essential to ensure that your application is valid and stands a better chance of approval.

Steps to Complete the Mlc Financial Hardship Form

Completing the Mlc Financial Hardship Form involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather necessary documentation, including proof of financial hardship.

- Fill out the form with accurate personal and financial information.

- Attach any required supporting documents that validate your claim.

- Review the completed form for accuracy before submission.

- Submit the form through the appropriate channels, either online or via mail.

Following these steps can help streamline the process and improve the likelihood of a successful withdrawal request.

How to Obtain the Mlc Financial Hardship Form

The Mlc Financial Hardship Form can be obtained through several channels. Individuals can typically find the form on the official Mlc website or through their financial institution. Additionally, contacting Mlc customer service can provide guidance on how to access the form. It is essential to ensure that you are using the most current version of the form to avoid any delays in processing your application.

Legal Use of the Mlc Financial Hardship Form

Using the Mlc Financial Hardship Form legally involves adhering to the stipulations set forth by superannuation regulations. The form must be filled out truthfully, and all claims made within it should be substantiated with appropriate documentation. Misrepresentation or failure to provide accurate information can lead to penalties, including denial of the withdrawal request. Understanding the legal implications of this form is vital for ensuring compliance and protecting your rights.

Form Submission Methods

Submitting the Mlc Financial Hardship Form can be done through various methods. Applicants may choose to submit the form online through the Mlc portal, ensuring a quick and efficient process. Alternatively, the form can be mailed directly to Mlc or submitted in person at a designated location. Each submission method has its own requirements and processing times, so it is advisable to choose the one that best suits your circumstances.

Quick guide on how to complete mlc financial hardship form

Effortlessly Prepare Mlc Financial Hardship Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Mlc Financial Hardship Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Mlc Financial Hardship Form with Ease

- Locate Mlc Financial Hardship Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional hand-signed signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form—by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Mlc Financial Hardship Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mlc financial hardship form

Create this form in 5 minutes!

How to create an eSignature for the mlc financial hardship form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Australia superannuation withdrawal?

Australia superannuation withdrawal refers to the process by which individuals can access their superannuation funds under certain conditions. This may include retirement, financial hardship, or signNow life events. Understanding the regulations surrounding these withdrawals is crucial for maximizing your financial benefits.

-

Who is eligible for Australia superannuation withdrawal?

Eligibility for Australia superannuation withdrawal primarily includes individuals who have signNowed the minimum age or have experienced financial hardship. Additionally, special circumstances like terminal illness may qualify you for early withdrawal. Always check with your superannuation fund for specific requirements.

-

What documents are needed for Australia superannuation withdrawal?

To process an Australia superannuation withdrawal, you typically need to provide identification and relevant documentation that supports your claim, like medical certificates for hardship cases. It's essential to ensure all documents are accurate to avoid delays. Using solutions like airSlate SignNow can streamline this documentation process.

-

How can airSlate SignNow help with Australia superannuation withdrawal forms?

airSlate SignNow enhances the efficiency of completing and signing Australia superannuation withdrawal forms. With features for electronic signatures and document management, users can quickly fill out necessary paperwork and submit it securely. This saves time and ensures compliance with regulations.

-

Are there fees associated with Australia superannuation withdrawal processing?

Most superannuation funds have various fee structures related to Australia superannuation withdrawal processing. It's important to review your superfund's fee policy, as it varies by provider. Utilizing services like airSlate SignNow can help you minimize costs through efficient document handling.

-

What are the tax implications of Australia superannuation withdrawal?

Tax implications for Australia superannuation withdrawal depend on factors such as your age and the type of withdrawal. Generally, when withdrawing funds as a lump sum, tax rates may apply. It's advisable to consult with a financial advisor to understand all tax aspects.

-

Can I withdraw my Australia superannuation if I live overseas?

Yes, you can withdraw your Australia superannuation while living overseas, but specific rules and conditions apply. You may need to meet certain criteria, such as being a non-resident or returning to your country of citizenship. For detailed instructions, check with your super fund or tax advisor.

Get more for Mlc Financial Hardship Form

- Background waiver form

- Borang feedback pelanggan form

- Ny employment application form

- To open the sar sa spokane addendum live real estate form

- Hazmat shipping paper forms

- Ecas form uk edinburgh cognitive and behavioural als screen

- Pcci downloadable forms

- Mr alan craven deputy principals ms pippa brady ms anita form

Find out other Mlc Financial Hardship Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation