Income Form PDF

What is the Income Form PDF?

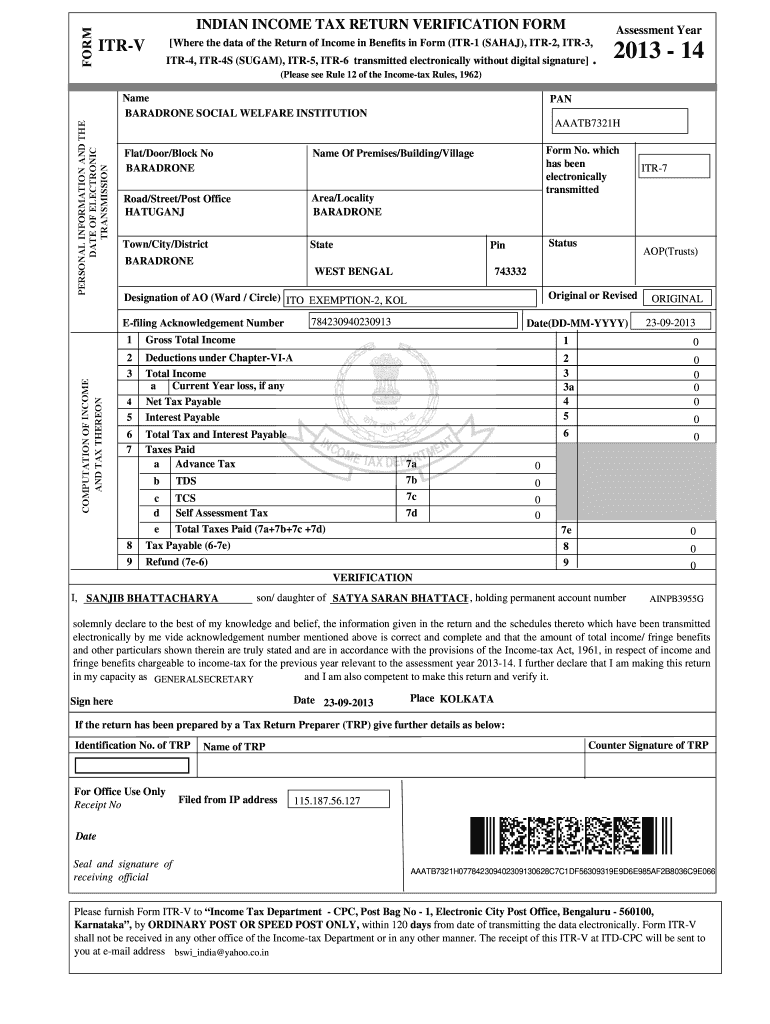

The Income Form PDF is a standardized document used for reporting income to the Internal Revenue Service (IRS) in the United States. This form is essential for individuals and businesses to declare their earnings and calculate their tax obligations. It includes various sections for detailing different types of income, deductions, and credits that may apply. Understanding this form is crucial for accurate income tax return verification, ensuring compliance with federal tax laws.

Steps to Complete the Income Form PDF

Completing the Income Form PDF involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2s, 1099s, and any other records of income. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Carefully list all sources of income, ensuring that you include any applicable deductions or credits. Once completed, review the form for errors before submitting it to the IRS.

Legal Use of the Income Form PDF

The Income Form PDF is legally binding when completed accurately and submitted in accordance with IRS guidelines. It is important to ensure that all information provided is truthful and complete to avoid penalties or legal issues. Utilizing a reliable eSignature platform, like signNow, can enhance the legal standing of the document by ensuring that signatures are verified and securely stored. Compliance with regulations such as the ESIGN Act further solidifies the form's legality when executed electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Income Form PDF are crucial for taxpayers to keep in mind. Typically, individual tax returns are due by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Income Form PDF accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements and medical expenses

Having these documents ready will streamline the process and help ensure that your income tax return verification is accurate.

Form Submission Methods

The Income Form PDF can be submitted to the IRS through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission via e-filing platforms

- Mailing a printed copy of the form to the appropriate IRS address

- In-person submission at designated IRS offices

Each method has its own set of guidelines and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete income form pdf

Complete Income Form Pdf effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Income Form Pdf on any gadget using airSlate SignNow apps for Android or iOS and streamline your document-centric tasks today.

How to modify and electronically sign Income Form Pdf without any hassle

- Find Income Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Income Form Pdf and guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is income tax return verification?

Income tax return verification is the process of confirming the accuracy and authenticity of submitted income tax returns. Ensuring proper verification is crucial for avoiding potential legal issues and ensuring compliance with tax regulations.

-

How does airSlate SignNow support income tax return verification?

airSlate SignNow provides a seamless platform for digitally signing and sending documents, including income tax returns. This ensures that all necessary signatures and verifications are securely captured, streamlining the income tax return verification process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Each plan is designed to provide comprehensive features that support income tax return verification and other document management solutions at an affordable cost.

-

Can I integrate airSlate SignNow with other software for income tax return verification?

Yes, airSlate SignNow easily integrates with popular accounting and tax software, allowing for a smooth workflow in managing income tax return verification. These integrations enhance efficiency, making document handling and verification much simpler.

-

What benefits does airSlate SignNow offer for income tax return verification?

By using airSlate SignNow for income tax return verification, businesses can ensure faster processing times, improved accuracy, and enhanced security. The platform's user-friendly interface makes it accessible for all users, enabling hassle-free documentation.

-

Is it secure to use airSlate SignNow for income tax return verification?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure storage, to protect sensitive information during income tax return verification. Compliance with industry standards further ensures the safe handling of tax documents.

-

How quickly can I complete income tax return verification using airSlate SignNow?

With airSlate SignNow's efficient workflows, you can signNowly speed up the income tax return verification process. Many users report completing their verifications in minutes rather than days, thanks to the platform's automation features.

Get more for Income Form Pdf

Find out other Income Form Pdf

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online