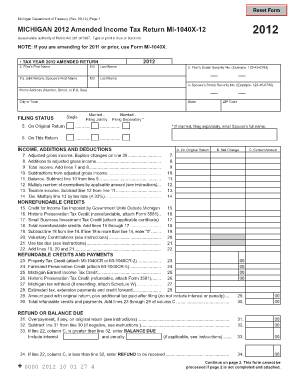

Michigan Tax Return Form

What is the Michigan Tax Return

The Michigan tax return is a document that residents of Michigan must file to report their income and calculate their state income tax obligations. This form is essential for individuals and businesses operating within the state. The Michigan income tax system is based on a flat tax rate applied to taxable income, which includes wages, salaries, and other forms of income. Understanding the Michigan tax return is crucial for compliance with state tax laws and for ensuring that taxpayers pay the correct amount of tax owed.

Steps to Complete the Michigan Tax Return

Completing the Michigan tax return involves several important steps. First, gather all necessary financial documents, such as W-2 forms, 1099 forms, and any relevant receipts for deductions. Next, determine your filing status, which can affect your tax rate and eligibility for certain credits. Then, calculate your total income and identify any deductions or credits you may qualify for. After completing the calculations, fill out the Michigan tax return form accurately, ensuring all information is correct. Finally, review the completed form for accuracy before submitting it to the Michigan Department of Treasury.

Required Documents

To successfully file the Michigan tax return, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical costs or educational expenses

- Previous year’s tax return for reference

Having these documents organized and accessible will streamline the filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

The deadline for filing the Michigan tax return generally aligns with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, as well as to keep track of any extensions that may apply. Filing on time is crucial to avoid penalties and interest on unpaid taxes.

Legal Use of the Michigan Tax Return

The Michigan tax return is legally binding and must be filed accurately to comply with state tax laws. Filing a false return can lead to severe penalties, including fines and interest on unpaid taxes. To ensure the legal validity of the return, taxpayers should use reliable methods for completing and submitting their forms. Utilizing secure digital platforms for e-filing can enhance the integrity of the submission process and provide a record of the filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Michigan have several options for submitting their tax returns. The most common methods include:

- Online filing through the Michigan Department of Treasury’s e-file system

- Mailing a paper return to the appropriate address based on the taxpayer's location

- In-person submission at designated state tax offices

Each method has its own advantages, with online filing often being the quickest and most efficient way to submit a return.

Quick guide on how to complete michigan tax return 100101086

Complete Michigan Tax Return effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-based procedures today.

The simplest way to modify and electronically sign Michigan Tax Return with ease

- Locate Michigan Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Michigan Tax Return to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan tax return 100101086

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of Michigan income tax on my business documents?

Michigan income tax can affect various aspects of your business, including how you handle contracts and agreements. Using airSlate SignNow allows you to electronically sign documents, making it easier to manage compliance with state tax laws while ensuring your transactions remain legally binding.

-

How does airSlate SignNow simplify managing Michigan income tax documentation?

airSlate SignNow streamlines the documentation process by allowing you to eSign necessary forms related to Michigan income tax. This not only speeds up the filing process but also minimizes errors, ensuring that your tax documents are accurately completed and submitted on time.

-

What features does airSlate SignNow offer for businesses dealing with Michigan income tax?

airSlate SignNow provides features such as customizable templates, secure eSignature solutions, and seamless document storage. These features help businesses manage Michigan income tax-related documents more efficiently, personalizing the user experience without sacrificing compliance.

-

Is airSlate SignNow cost-effective for handling Michigan income tax forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to handle Michigan income tax forms. By eliminating the need for paper and ink, our service helps reduce operational costs while ensuring your documents are signed and returned promptly.

-

Can airSlate SignNow integrate with accounting software for Michigan income tax purposes?

Absolutely! airSlate SignNow can integrate with popular accounting software, making the transition of data regarding Michigan income tax seamless. This integration saves you time and effort by automatically updating records as documents are processed.

-

What are the benefits of using airSlate SignNow for Michigan income tax-related contracts?

Using airSlate SignNow for Michigan income tax-related contracts offers enhanced security, compliance, and efficiency. Our platform ensures that your contracts are managed in a legally binding manner, safeguarding your business while simplifying the eSigning process.

-

How can I ensure my Michigan income tax forms are secure with airSlate SignNow?

airSlate SignNow prioritizes security by employing encryption and robust authentication measures. This ensures that your Michigan income tax forms are handled securely throughout the signing process, protecting sensitive information from unauthorized access.

Get more for Michigan Tax Return

- Mba project completion certificate format in word

- Meiosis coloring worksheet answer key form

- Anz identification by certified copy for individual form

- Vanguard organization resolution form

- Schedule lep form 1040 rev december request for change in language preference

- Instrucciones para elformulario w 3c pr instructions for form w 3c pr rev diciembre instrucciones para elformulario w 3c pr

- Form 1040 es nr form 1040 es nr u s estimated tax for nonresident alien individuals

- How to avoid tax scams and protect your finances form

Find out other Michigan Tax Return

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement