Fidelity Roe Form 2011

What is the Fidelity Roe Form

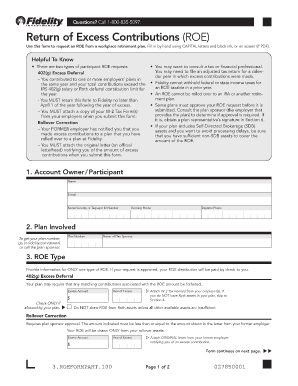

The Fidelity Roe Form, also known as the fidelity return of excess contribution 401k, is a crucial document for individuals who have contributed more to their 401k retirement accounts than the IRS allows. This form is designed to report and rectify excess contributions, ensuring compliance with tax regulations. It helps account holders reclaim any overages to avoid potential penalties associated with excess contributions.

Steps to Complete the Fidelity Roe Form

Completing the Fidelity Roe Form involves several key steps:

- Gather necessary information, such as your personal details and account information.

- Identify the amount of excess contributions made during the tax year.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

How to Obtain the Fidelity Roe Form

The Fidelity Roe Form can be obtained directly from Fidelity's official website or by contacting their customer service. It is typically available in a downloadable format, allowing users to fill it out electronically or print it for manual completion. Ensure you have the most current version of the form to comply with IRS guidelines.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Fidelity Roe Form. Generally, the form must be submitted by the tax filing deadline for the year in which the excess contribution was made. If you miss this deadline, you may face penalties or additional taxes. Always check the IRS guidelines for the most accurate and up-to-date information regarding deadlines.

Legal Use of the Fidelity Roe Form

The Fidelity Roe Form is legally binding when completed and submitted according to IRS regulations. It serves as a formal declaration of excess contributions and is essential for maintaining compliance with tax laws. Utilizing a reliable eSignature platform can enhance the legal standing of your submission, ensuring that it meets all necessary requirements.

Key Elements of the Fidelity Roe Form

Understanding the key elements of the Fidelity Roe Form is vital for accurate completion. Key components typically include:

- Your personal information, including name and Social Security number.

- Details of your 401k account, including account number and plan name.

- The total amount of contributions made during the tax year.

- The specific amount deemed as excess contributions.

- Signature and date to validate the form.

Quick guide on how to complete fidelity roe form

Prepare Fidelity Roe Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Fidelity Roe Form across any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Fidelity Roe Form without hassle

- Locate Fidelity Roe Form and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors necessitating new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fidelity Roe Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity roe form

Create this form in 5 minutes!

How to create an eSignature for the fidelity roe form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fidelity return of excess contribution 401k?

A fidelity return of excess contribution 401k refers to the process of correcting contributions that exceed the allowable limits set by the IRS for 401k accounts. This can happen if an employee contributes more than the maximum limit, necessitating a return of the excess funds to avoid severe tax implications.

-

How does the airSlate SignNow platform support the management of excess 401k contributions?

The airSlate SignNow platform enables users to easily generate and manage the necessary documentation for a fidelity return of excess contribution 401k. With our solutions, businesses can streamline the eSigning process, ensuring all compliance requirements are met efficiently and accurately.

-

What are the costs associated with processing a fidelity return of excess contribution 401k through airSlate SignNow?

The costs for processing a fidelity return of excess contribution 401k using airSlate SignNow vary depending on the plan selected. Our pricing is designed to be cost-effective, offering various tiers that accommodate different business sizes, ensuring that the return process remains affordable while maintaining compliance.

-

Are there specific features in airSlate SignNow that facilitate 401k contribution management?

Yes, airSlate SignNow offers features tailored for 401k contribution management, including customizable templates for creating compliance documents related to fidelity return of excess contribution 401k. The intuitive interface allows users to easily manage, sign, and store these documents securely.

-

What benefits does airSlate SignNow provide for handling 401k excess contributions?

Using airSlate SignNow for handling fidelity return of excess contribution 401k provides the benefits of increased efficiency, reduced paperwork, and improved compliance tracking. Our electronic signature solution ensures that all necessary parties can view and sign documents quickly, minimizing delays.

-

Can airSlate SignNow integrate with existing payroll systems to manage 401k contributions?

Absolutely, airSlate SignNow can integrate seamlessly with various payroll systems to assist in managing fidelity return of excess contribution 401k. This integration helps automate data transfer, ensuring accurate information is used when evaluating contributions and avoiding excess situations.

-

Is there customer support available for questions related to 401k contribution management in airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support for all questions regarding the fidelity return of excess contribution 401k. Our team is available to assist with queries about the software, processing returns, and ensuring compliance with IRS regulations.

Get more for Fidelity Roe Form

- Cf 1158 form

- 13 week wage statement florida form

- Info sheet sample macau form

- Identify and calculate the area and perimeter for each quadrilateral worksheet answer key form

- Form 943 xadjusted employers annual federal tax

- Form 8974 rev december quarterly small business payroll tax credit for increasing research activities

- Schedule oi form 1040 nr sp other information spanish version 771104607

- Form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version 771104799

Find out other Fidelity Roe Form

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free