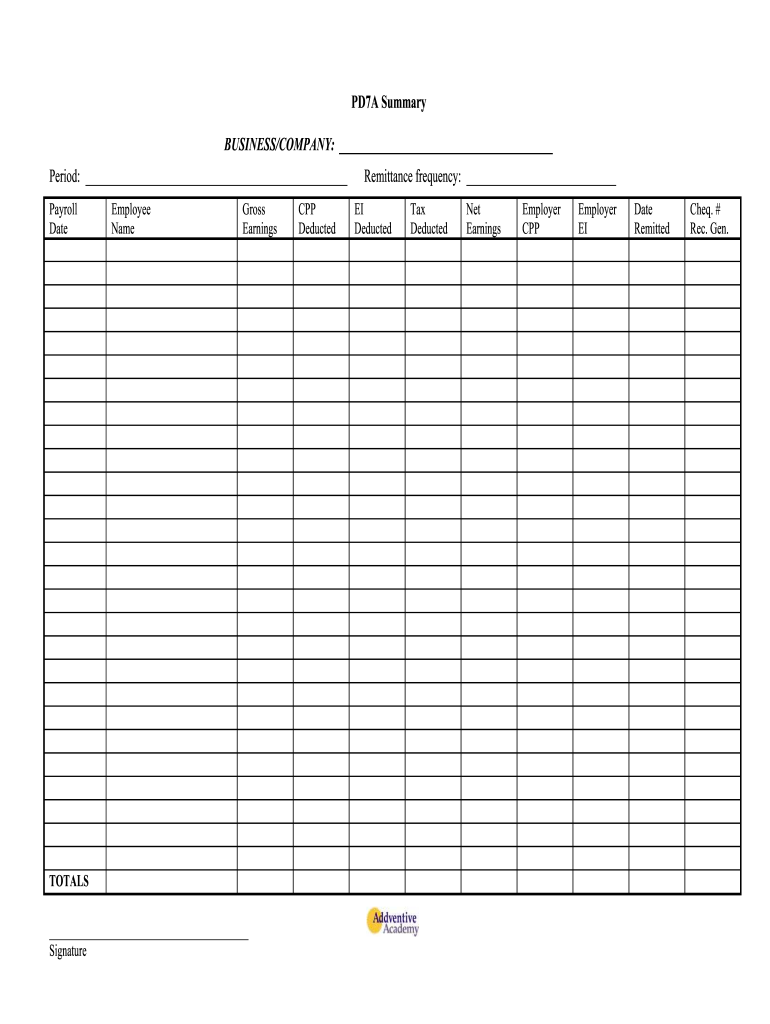

Blank Spreadsheet Form

What is the PD7A Payroll Remittance?

The PD7A payroll remittance is a crucial form used by employers in Canada to report and remit payroll deductions to the Canada Revenue Agency (CRA). This form is essential for ensuring compliance with tax regulations, as it outlines the amounts deducted from employee wages for income tax, Canada Pension Plan (CPP), and Employment Insurance (EI). Understanding the PD7A payroll remittance is vital for businesses to maintain accurate payroll records and avoid potential penalties.

Steps to Complete the PD7A Payroll Remittance

Completing the PD7A payroll remittance involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll information, including total wages paid, deductions for income tax, CPP, and EI. Next, calculate the total amounts owed for each category. Once you have this information, fill out the PD7A form accurately, ensuring that all figures are correct. Finally, submit the completed form to the CRA by the designated deadline, which varies based on your remittance frequency.

Filing Deadlines / Important Dates

Timely submission of the PD7A payroll remittance is critical to avoid penalties. Employers must be aware of their remittance frequency, which can be monthly, quarterly, or annually. The deadlines for submitting the PD7A form generally fall on the 15th of the month following the end of the reporting period. For example, if you are filing for January, the form is due by February 15. It's important to stay informed about these deadlines to ensure compliance and avoid late fees.

Legal Use of the PD7A Payroll Remittance

The PD7A payroll remittance must be completed and submitted in accordance with the Canada Revenue Agency's regulations. This form serves as a legal document that confirms the employer's compliance with payroll deduction laws. Failure to submit the PD7A accurately or on time can result in penalties, including interest on unpaid amounts and potential audits. Employers should ensure that they understand their legal obligations regarding payroll remittances to maintain compliance.

Required Documents

To complete the PD7A payroll remittance, employers need to gather specific documents to ensure accuracy. These include payroll records, employee tax forms, and any previous remittance slips. Having these documents on hand will facilitate the calculation of deductions and ensure that the information reported on the PD7A is correct. Keeping organized records will also help in case of audits or inquiries from the CRA.

Form Submission Methods

The PD7A payroll remittance can be submitted through various methods, providing flexibility for employers. Options include online submission through the CRA's My Business Account, mailing a paper form, or delivering it in person to a local CRA office. Each method has its own processing times, so employers should choose the option that best suits their needs while ensuring compliance with submission deadlines.

Quick guide on how to complete blank spreadsheet templates form

Effortlessly Prepare Blank Spreadsheet on Any Device

The management of documents online has increasingly gained traction among businesses and individuals. It serves as a superb eco-friendly substitute to traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle Blank Spreadsheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Blank Spreadsheet with Ease

- Locate Blank Spreadsheet and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to confirm your changes.

- Choose your preferred method to send your form: via email, text message (SMS), or a shareable link, or download it to your PC.

Eliminate concerns over lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Edit and electronically sign Blank Spreadsheet to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the recipe correctly? (Instagram likes to spreadsheet)

I'm assuming you are asking how to fill out an "If This Then That" recipe. Your question doesn't state this but you use the word "Recipe" and I can't think of any other time that word would be used. That said: Here is a link to a recipe that will work: LINKBottom line: If > Instagram > LikeThen > Google Sheets > RowName your spreadsheet. Formatted Row: {{Username}} ||| {{Caption}} ||| {{Url}} ||| {{SourceUrl}} ||| {{CreatedAt}}Drive Folder Path: IFTTT/InstagramThat should be it.

-

If you are filling out job applications, should you set a limit to how many you fill out daily-weekly? Why/why not?

Many people will tell you that looking for a job is a full time job. They’ll tell you it’s a numbers game. Put yourself out there as much as possible and something will eventually work out. They may have a point, but I think they’re also missing some important things that you need to consider.I would know. I’ve applied for hundreds, maybe thousands of jobs since I graduated college. Most of them I never heard back from. For a while, I had a whole system set up. A spreadsheet to track the applications and their results. Automated searches and reminder emails from the major job sites. Resumes publically available for any potential employers to see. I had a goal to apply for as many jobs a day as I could. I’m beginning to realize how all of this was exactly the wrong approach.I’ve had several jobs over this time. I said jobs. Not good jobs, not high paying jobs, not rewarding jobs. Just something to give me a bit of money to allow me to exist in this country for another two week pay period. I’ve gone through spells where I sat, feeling stuck and unfulfilled, in a miserable cubicle making less money every year. Occasionally I’d get angry and bang out a bunch of job applications, hoping someone would throw me a lifeline.They never did. You have to create your own lifeline. You have to save yourself.After a recent layoff, with unemployment benefits, I’ve had a bit of time to think and reflect on my approach and what I’ve done wrong. Here are a few lessons that may apply to your situation also.Quality, not quantity: I mentioned my job application system. I had it all. A template resume with blanks to fill in specific keywords from the job description. Cover letters set up the same way, insert name of this job here. Who has time to write a new letter each time? These HR people are not stupid. Well, some of them probably are. But they do this a lot. They can tell a template form letter every time. Sometimes you make the mistake of forgetting to change the name of the company or job in your letter. I admit to this mistake, multiple times. I’ve also sat down and carefully crafted a well thought out, excellent application package. Usually for that rare job you come across and say “Wow, this is what I want!” It really really sucks when you put in all this effort and don’t get any response. It takes a lot of time to do these kind of applications also. How do we deal with this?Apply for fewer jobs. Be selective. Desperation is a stinky cologne. If you are totally unqualified and send off a generic application, don’t be surprised if you don’t hear back. You’ve wasted your time. You’d be better off not applying at all. If you don’t meet the requirements posted for a job but feel you are the right choice anyways, give them a good explanation of why you’re the right choice. If you just graduated, don’t apply for the CEO job. Similarly, if you see a description for a job that you’re qualified for but know you would hate, save yourself the time and aggravation. It’s very hard to motivate yourself to do all that work knowing that the best possible outcome is to be stuck doing something you hate.Send good applications: Read the job description. Make lists of what they’re looking for, what skills you have, and your specific experience. Find the intersection of these three lists and highlight these points in your application.Consider temp agencies: These people get paid when you get paid. They want to find you something. They’re also typically overwhelmed with people looking for jobs, but most of the jobs I’ve had, unsatisfying as they were, were found for me by temp agencies. A lot of these jobs have the potential to go “permanent” (no job is actually a permanent job, but this is the term that is used for direct employment).Do something other than apply for jobs: This especially applies to periods of unemployment. If you just sit around eating tacos and playing Halo, I wouldn’t hire you either. Do something to improve your skills. Learn a language. Try freelancing. Look into starting your own business if you have an idea. If you don’t, think of ideas. Maybe you’ll think of something you want to try. Have something to put on your resume or LinkedIn profile, or even just to tell an interviewer, other than “Yeah, I’m unemployed...”Relax: The 1950’s are over. The labor market is very different in this country, even compared to just a few years ago. People who couldn’t find a “good job” used to be thought of as lazy, stupid, or unmotivated. “Get a job, you dirty hippy!” As you have already figured out for yourself, it isn’t that simple anymore. They guy making 6 figures who says he’d work at Taco Bell if he was unemployed is lying to you, or he’s an idiot. In any case, ignore him. Reflect: It is very normal for people to go through periods of unemployment and underemployment in today’s economy. There just isn’t the same demand for a bunch of bodies sitting at desks as there once was. Think and reflect on this. Is the career you’re pursuing even going to exist in a few years? Would your energy be better spent getting into something else with more potential? Sometimes it feels like you’re just banging your head against the same cement wall expecting different results. Go find a thinner wall, maybe one of those Japanese ones made of paper and bamboo. You know that old cliche about the definition of insanity...

-

How would I go about filling in a PDF form from an Excel spreadsheet?

Two ways of doing this with varying degrees of complexity:Easiest is to use something like http://pdfbatchfill.com.If you have Acrobat Pro DC, you can create a custom script. (1)// specify the filename of the data file

Create this form in 5 minutes!

How to create an eSignature for the blank spreadsheet templates form

How to make an eSignature for your Blank Spreadsheet Templates Form online

How to generate an electronic signature for the Blank Spreadsheet Templates Form in Chrome

How to make an eSignature for putting it on the Blank Spreadsheet Templates Form in Gmail

How to create an electronic signature for the Blank Spreadsheet Templates Form from your smartphone

How to make an eSignature for the Blank Spreadsheet Templates Form on iOS devices

How to create an electronic signature for the Blank Spreadsheet Templates Form on Android OS

People also ask

-

What is the pd7a payroll remittance form?

The pd7a payroll remittance form is a document used by employers in Canada to report payroll deductions to the Canada Revenue Agency. It outlines amounts deducted for income tax, Canada Pension Plan (CPP), and Employment Insurance (EI). Using the pd7a payroll remittance form ensures compliance with tax regulations and timely remittances.

-

How does airSlate SignNow help with the pd7a payroll remittance form?

airSlate SignNow simplifies the process of filling out and signing the pd7a payroll remittance form. The platform offers templates and integrations that save time and ensure accuracy. Additionally, eSigning provides a secure way to submit the form electronically.

-

Is there a cost associated with using airSlate SignNow for the pd7a payroll remittance form?

airSlate SignNow offers various pricing plans tailored to different business needs. Costs depend on the features you choose, but it remains an affordable solution for managing the pd7a payroll remittance form. There are also free trials available for new users to test the service.

-

What features does airSlate SignNow offer for managing documents like the pd7a payroll remittance form?

Key features include customizable templates, automated workflows, and secure eSigning capabilities. These tools make it easier to manage documents such as the pd7a payroll remittance form efficiently. The platform also supports collaboration, allowing multiple parties to work on the document simultaneously.

-

Can I integrate airSlate SignNow with other software to manage the pd7a payroll remittance form?

Yes, airSlate SignNow integrates with various third-party applications, including accounting software and CRM systems. These integrations allow for seamless data transfer, reducing the need for manual entry when completing the pd7a payroll remittance form. Streamlined processes help improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the pd7a payroll remittance form?

The primary benefits include increased efficiency, cost savings, and enhanced compliance. By utilizing airSlate SignNow, businesses can quickly and accurately complete the pd7a payroll remittance form, reducing administrative burdens. Additionally, the secure electronic submission reduces the risk of errors and delays.

-

How secure is airSlate SignNow when handling the pd7a payroll remittance form?

airSlate SignNow takes security seriously, implementing advanced encryption and data protection measures. User authentication and audit trails help maintain the integrity of documents like the pd7a payroll remittance form. Businesses can trust that their sensitive payroll information is secure.

Get more for Blank Spreadsheet

Find out other Blank Spreadsheet

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free