Archbold Income Tax 2020

What is the Archbold Income Tax

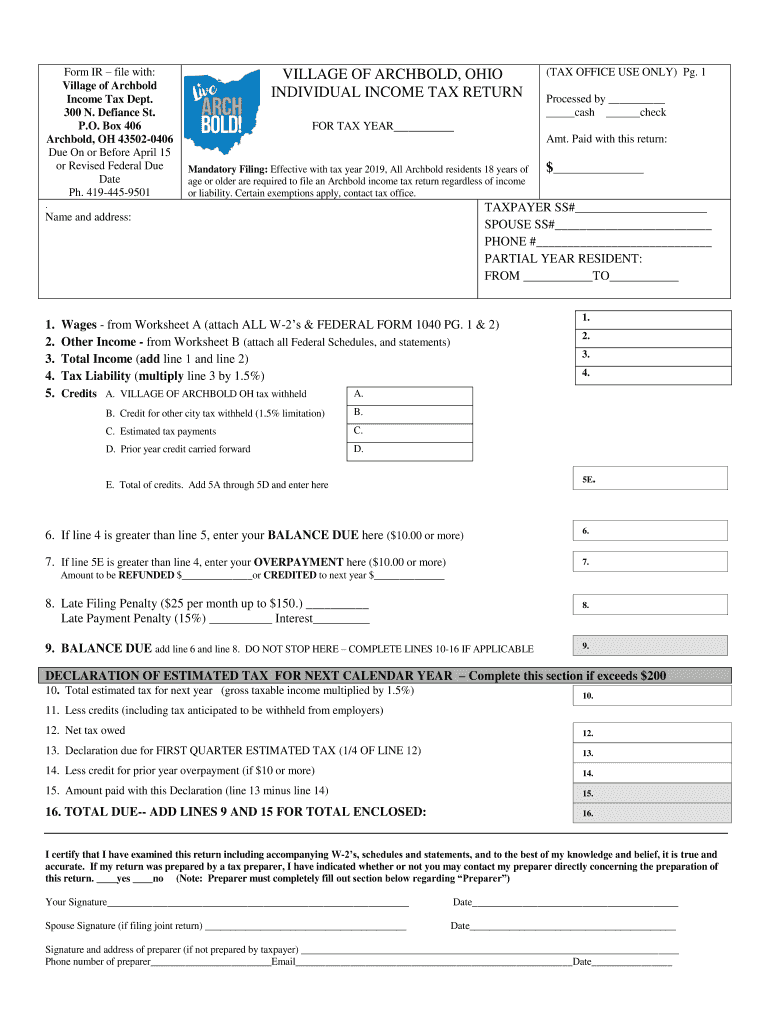

The Archbold Income Tax is a municipal tax levied on individuals and businesses residing or operating within the village of Archbold, Ohio. This tax is primarily based on earned income, including wages, salaries, and other forms of compensation. The purpose of this tax is to fund local services and infrastructure, ensuring that the community can maintain essential public services. Understanding the specifics of the Archbold Income Tax is crucial for residents and business owners to ensure compliance and avoid penalties.

How to obtain the Archbold Income Tax

To obtain the Archbold Income Tax form, residents can visit the official village website or the local tax office. The form is typically available for download in a PDF format, allowing taxpayers to print and complete it at their convenience. Additionally, the tax office may provide physical copies of the form for those who prefer to fill it out in person. It is important to ensure that you have the most current version of the form, as updates may occur annually.

Steps to complete the Archbold Income Tax

Completing the Archbold Income Tax form involves several key steps:

- Gather necessary documentation, such as W-2 forms and other income statements.

- Fill out the form accurately, ensuring that all income sources are reported.

- Calculate the total tax owed based on the provided tax rate.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online, by mail, or in person.

Following these steps carefully can help ensure that the filing process goes smoothly and that taxpayers meet their obligations.

Legal use of the Archbold Income Tax

The Archbold Income Tax must be filed in accordance with local laws and regulations. This means that taxpayers are required to report their income accurately and pay the appropriate amount of tax owed. Failure to comply with these requirements can result in penalties, including fines and interest on unpaid taxes. It is essential for taxpayers to understand their rights and responsibilities under local tax laws to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Archbold Income Tax typically coincide with the federal income tax deadlines. Generally, taxpayers must submit their forms by April fifteenth of each year. However, it is advisable to check with the village tax office for any specific deadlines or extensions that may apply. Staying informed about these important dates can help taxpayers avoid late fees and ensure timely compliance.

Required Documents

When completing the Archbold Income Tax form, taxpayers should prepare the following documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation of deductions or credits that may apply.

Having these documents ready can streamline the filing process and help ensure that all income is reported accurately.

Quick guide on how to complete archbold income tax

Accomplish Archbold Income Tax with ease on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly without delays. Manage Archbold Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Archbold Income Tax effortlessly

- Locate Archbold Income Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunts, or mistakes that necessitate the printing of new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign Archbold Income Tax and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct archbold income tax

Create this form in 5 minutes!

How to create an eSignature for the archbold income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the village of Archbold income tax rate?

The village of Archbold income tax rate is set at 1.5%, which is applicable to residents and businesses operating within the village. This tax is used to fund essential local services and infrastructure. It's important for business owners to stay informed about these rates to ensure compliance.

-

How can airSlate SignNow help with village of Archbold income tax documentation?

airSlate SignNow simplifies the process of handling village of Archbold income tax documentation by allowing users to eSign and send documents securely. This streamlines the filing process and ensures that all documents are executed in a timely manner. Our platform can help businesses maintain their tax records efficiently.

-

Are there any fees associated with filing the village of Archbold income tax?

While there are no specific e-filing fees for the village of Archbold income tax, businesses may incur costs related to preparing their tax returns. Utilizing airSlate SignNow can minimize these costs by reducing paperwork and improving workflow efficiency. It's a cost-effective solution for managing tax obligations.

-

What features does airSlate SignNow offer for managing taxes?

airSlate SignNow includes features like document templates, eSignature capabilities, and secure cloud storage, all of which are useful for managing village of Archbold income tax documents. These tools enable businesses to prepare and sign tax forms easily, ensuring accuracy and compliance. The user-friendly interface enhances the overall experience.

-

Can airSlate SignNow integrate with accounting software for village of Archbold income tax purposes?

Yes, airSlate SignNow integrates with various accounting software solutions, allowing businesses to manage their village of Archbold income tax filings seamlessly. This integration helps in automating financial workflows and ensuring that all tax documents are organized. It's a great way to maintain a clear financial overview.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with village of Archbold income tax?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses, making it an ideal tool for anyone dealing with village of Archbold income tax documents. Whether you are a freelancer or a corporation, our platform provides the features you need to manage your tax filings effectively.

-

What are the benefits of using airSlate SignNow for village of Archbold income tax submissions?

Using airSlate SignNow for village of Archbold income tax submissions means faster processing and enhanced accuracy. The eSignature feature reduces the time spent on obtaining signatures, and secure storage keeps your documents safe. Overall, it helps streamline your tax management process.

Get more for Archbold Income Tax

Find out other Archbold Income Tax

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT