6251 Form

What is the 6251

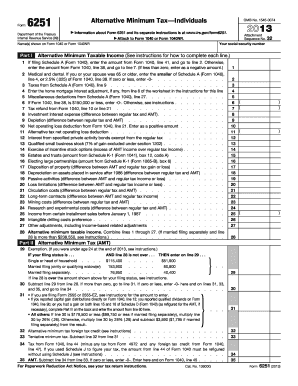

The 2013 Form 6251 is a tax form used by individuals to calculate and report their Alternative Minimum Tax (AMT) liability. The AMT is designed to ensure that high-income earners pay a minimum amount of tax, even if they have significant deductions or credits that would otherwise reduce their tax liability. The form helps taxpayers determine if they owe AMT and the amount due, which may differ from their regular tax calculation.

How to use the 6251

To use the 2013 Form 6251, taxpayers must first complete their standard income tax return. Once the regular tax is calculated, the next step is to determine if the AMT applies. This involves filling out the form by entering various income and deduction amounts, as specified in the instructions. The form guides users through the calculation process, ultimately revealing whether they owe additional tax due to the AMT.

Steps to complete the 6251

Completing the 2013 Form 6251 involves several key steps:

- Gather necessary documentation, including income statements, deductions, and credits.

- Complete your regular tax return to establish your baseline tax liability.

- Fill out the top section of Form 6251, which includes your income and adjustments.

- Calculate your AMT income by adding back certain deductions that are not allowed under AMT rules.

- Determine your AMT exemption amount based on your filing status.

- Calculate your tentative AMT and compare it to your regular tax liability.

- Submit the completed form with your tax return.

Legal use of the 6251

The 2013 Form 6251 is legally binding when filled out correctly and submitted to the Internal Revenue Service (IRS) as part of your tax return. It is essential to ensure that all information is accurate and complete. Failure to properly report AMT can lead to penalties and interest on unpaid taxes. Therefore, using a reliable platform for eSigning and submitting the form can enhance compliance and security.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when submitting the 2013 Form 6251. Typically, individual tax returns, including Form 6251, are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of these dates to avoid late filing penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the 2013 Form 6251. These guidelines include detailed instructions on how to calculate AMT, what income and deductions to include, and how to report the information accurately. Taxpayers should refer to the IRS instructions for Form 6251 to ensure compliance with current tax laws and regulations.

Examples of using the 6251

There are various scenarios in which a taxpayer might need to use the 2013 Form 6251. For instance, a high-income individual with substantial itemized deductions may find that their regular tax liability is significantly reduced, triggering the need for AMT calculations. Similarly, a taxpayer who exercises stock options may also need to complete this form to determine their AMT liability. Each situation will differ based on individual financial circumstances.

Quick guide on how to complete 6251

Prepare 6251 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 6251 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign 6251 without hassle

- Obtain 6251 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and eSign 6251 and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6251

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2013 form 6251?

The 2013 form 6251 is used to determine whether you owe any alternative minimum tax (AMT). This form is particularly relevant for individuals with high incomes and specific deductible items. Understanding how to fill out the 2013 form 6251 can help you ensure compliance with tax regulations.

-

How can I fill out the 2013 form 6251 using airSlate SignNow?

With airSlate SignNow, you can easily complete the 2013 form 6251 online. Our platform offers a user-friendly interface that streamlines the process of filling out tax forms. Plus, you can eSign the document securely and share it with your accountant or tax advisor seamlessly.

-

Is there a cost associated with using airSlate SignNow for the 2013 form 6251?

AirSlate SignNow offers a cost-effective solution for managing your documents, including the 2013 form 6251. Pricing varies based on your chosen plan, providing options that cater to both occasional users and businesses. Check our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow provide for document management, especially for the 2013 form 6251?

AirSlate SignNow provides several features to enhance your document management, including customizable templates, secure eSigning, and real-time collaboration. For the 2013 form 6251, our platform allows easy editing and tracking of changes, making it ideal for any tax-related documentation.

-

Can I integrate airSlate SignNow with accounting software for managing the 2013 form 6251?

Yes, airSlate SignNow integrates with various accounting software solutions to streamline your workflow. This integration allows you to manage the 2013 form 6251 alongside your other financial documents, ensuring a more organized approach to tax preparation. Check our integrations page for a list of compatible software.

-

What are the benefits of using airSlate SignNow for tax forms like the 2013 form 6251?

Using airSlate SignNow for tax forms, including the 2013 form 6251, offers numerous benefits such as increased efficiency, document security, and reduced turnaround time. Our platform empowers users to manage workflows effortlessly, ensuring that documents are submitted on time and with accuracy.

-

How does airSlate SignNow ensure the security of my 2013 form 6251?

AirSlate SignNow prioritizes the security of your documents, employing industry-standard encryption and authentication measures. When managing sensitive forms like the 2013 form 6251, your data remains protected from unauthorized access. Our commitment to security means you can eSign and share documents with confidence.

Get more for 6251

- Demographic sheet form

- Ri 088a form

- Fam fcs 021 rev 0113 replaces 76c646p fam 048 form

- Group membership change form kirkwood

- Wh 1606a the south carolina department of revenue form

- Notice of special appearance pdf 33938869 form

- Kyle keller po box 13037 sfa station nacogdoches tx form

- City of alice fire department smoke alarm request form ci alice tx

Find out other 6251

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy