Request to Update Property Data for Tax Class NYC Gov Nyc 2014

What is the Request To Update Property Data For Tax Class NYC gov Nyc

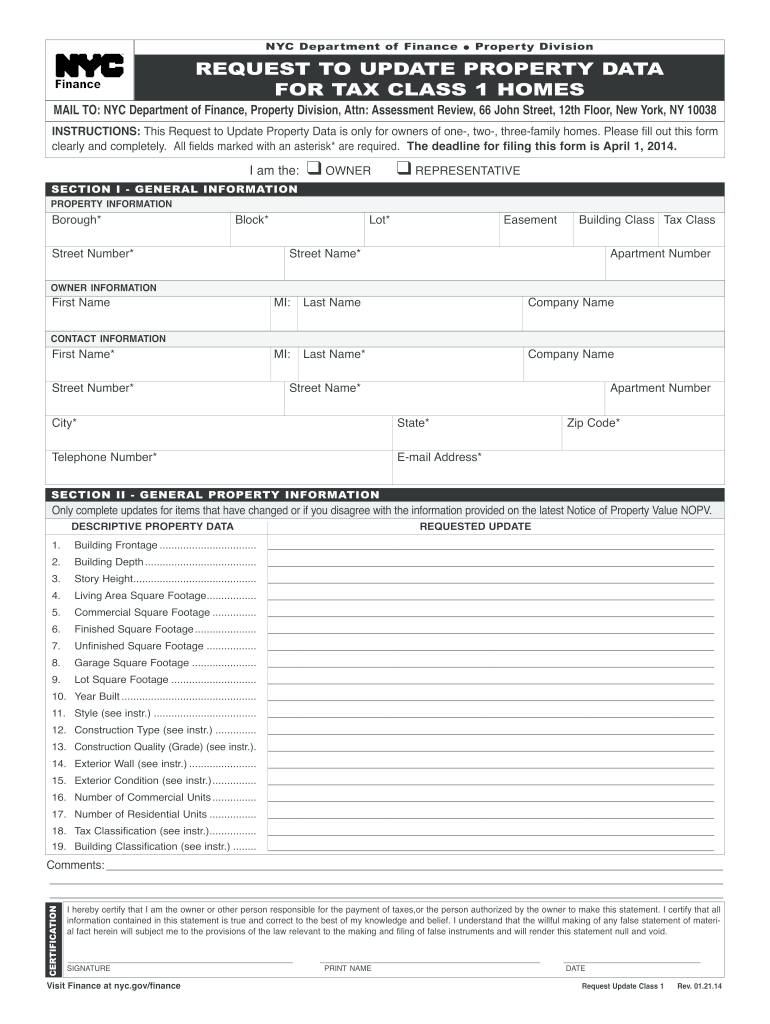

The Request To Update Property Data For Tax Class NYC gov Nyc is an official document used by property owners in New York City to request changes to their property tax classification. This form is essential for ensuring that property assessments are accurate and reflect any changes in property use or ownership. By submitting this request, property owners can potentially lower their tax burden or ensure compliance with local regulations.

How to use the Request To Update Property Data For Tax Class NYC gov Nyc

Using the Request To Update Property Data For Tax Class NYC gov Nyc involves several steps. First, property owners must gather relevant information about their property, including the current tax classification and any changes that need to be made. Next, they should complete the form accurately, ensuring all required fields are filled. Once completed, the form can be submitted electronically or by mail, depending on the preferences outlined by the NYC Department of Finance.

Steps to complete the Request To Update Property Data For Tax Class NYC gov Nyc

Completing the Request To Update Property Data For Tax Class NYC gov Nyc involves a straightforward process:

- Gather necessary documentation, including proof of ownership and any relevant property details.

- Access the form through the NYC Department of Finance website or other official channels.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, following the submission guidelines provided.

Required Documents

When submitting the Request To Update Property Data For Tax Class NYC gov Nyc, certain documents may be required to support the request. These typically include:

- Proof of property ownership, such as a deed or title.

- Previous tax bills to show current classifications.

- Documentation of any changes to property use or structure.

Form Submission Methods (Online / Mail / In-Person)

Property owners have several options for submitting the Request To Update Property Data For Tax Class NYC gov Nyc. The methods include:

- Online: Submit the form through the NYC Department of Finance's online portal for a quicker processing time.

- Mail: Send the completed form and any supporting documents to the designated address provided on the form.

- In-Person: Visit a local Department of Finance office to submit the form directly, if preferred.

Legal use of the Request To Update Property Data For Tax Class NYC gov Nyc

The Request To Update Property Data For Tax Class NYC gov Nyc is legally recognized and must be completed in accordance with local laws and regulations. Proper use of this form ensures that property owners remain compliant with tax obligations and can take advantage of any applicable tax benefits. Failure to use the form correctly may result in penalties or continued misclassification of the property.

Quick guide on how to complete request to update property data for tax class nycgov nyc

Your assistance manual on how to prepare your Request To Update Property Data For Tax Class NYC gov Nyc

If you’re curious about how to generate and submit your Request To Update Property Data For Tax Class NYC gov Nyc, here are some straightforward guidelines on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to amend details when necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Request To Update Property Data For Tax Class NYC gov Nyc in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Explore our catalog to obtain any IRS tax form; browse through variants and schedules.

- Click Get form to access your Request To Update Property Data For Tax Class NYC gov Nyc in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your file and correct any discrepancies.

- Save modifications, print your copy, submit it to your intended recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please remember that submitting on paper can lead to additional errors and delays in refunds. Certainly, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct request to update property data for tax class nycgov nyc

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I have a class lesson assessment form that I need to have filled out for 75 lessons. The form will be exactly the same except for the course number. How would you do this?

Another way would be to use the option of getting pre-filled answers with the course numbers entered. A custom URL is created and the form would collect the answers for all of the courses in the same spreadsheet. Not sure if that creates another problem for you, but you could sort OR filter the sheet once all the forms had been submitted. This is what the URL would look like for a Text Box https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+75 The nice thing about this is you can just change the part of the URL that Contains "COURSE+NUMBER+75" to a different number...SO for course number 1 it would be https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+1This is what the URL would look like for a Text Box radio button, same concept. https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+1 OR https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+6The Google Doc would look like this Quora pre-filled form I'm not sure if this helps at all or makes too complicated and prone to mistakes.

Create this form in 5 minutes!

How to create an eSignature for the request to update property data for tax class nycgov nyc

How to create an eSignature for the Request To Update Property Data For Tax Class Nycgov Nyc online

How to create an eSignature for your Request To Update Property Data For Tax Class Nycgov Nyc in Google Chrome

How to make an electronic signature for signing the Request To Update Property Data For Tax Class Nycgov Nyc in Gmail

How to make an eSignature for the Request To Update Property Data For Tax Class Nycgov Nyc right from your mobile device

How to make an electronic signature for the Request To Update Property Data For Tax Class Nycgov Nyc on iOS

How to make an eSignature for the Request To Update Property Data For Tax Class Nycgov Nyc on Android OS

People also ask

-

What is the process to Request To Update Property Data For Tax Class NYC gov Nyc using airSlate SignNow?

To Request To Update Property Data For Tax Class NYC gov Nyc, simply log into your airSlate SignNow account and create a new document. You can easily add the necessary fields and signatures required for submission. Once completed, share the document with the relevant authorities for processing.

-

How much does it cost to use airSlate SignNow for property data updates?

airSlate SignNow offers flexible pricing plans to cater to various business needs. By signing up, you'll have access to features that simplify the process to Request To Update Property Data For Tax Class NYC gov Nyc, making it a cost-effective choice for businesses of all sizes.

-

What features does airSlate SignNow offer for document signing related to property data updates?

airSlate SignNow provides a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These tools streamline the process to Request To Update Property Data For Tax Class NYC gov Nyc, ensuring that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for property data management?

Yes, airSlate SignNow seamlessly integrates with various applications like CRM systems and cloud storage services. This connectivity enhances your ability to Request To Update Property Data For Tax Class NYC gov Nyc by allowing for easy data sharing and document management.

-

What are the benefits of using airSlate SignNow for tax-related document management?

Using airSlate SignNow ensures a simplified and efficient workflow for managing tax-related documents. By leveraging our platform, you can easily Request To Update Property Data For Tax Class NYC gov Nyc, reduce processing time, and enhance compliance with local regulations.

-

Is airSlate SignNow secure for handling sensitive property data?

Absolutely! airSlate SignNow employs top-level security measures, including encryption and secure access controls, to protect your sensitive information. When you Request To Update Property Data For Tax Class NYC gov Nyc through our platform, you can trust that your data is safe and confidential.

-

How does airSlate SignNow support compliance with NYC property tax regulations?

airSlate SignNow is designed to help users comply with NYC property tax regulations by providing templates and workflows tailored to specific requirements. This makes it easier for you to Request To Update Property Data For Tax Class NYC gov Nyc in accordance with local laws and guidelines.

Get more for Request To Update Property Data For Tax Class NYC gov Nyc

Find out other Request To Update Property Data For Tax Class NYC gov Nyc

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document