Property Data Update Class 1 NYC Gov 2016

What is the Property Data Update Class 1 NYC gov

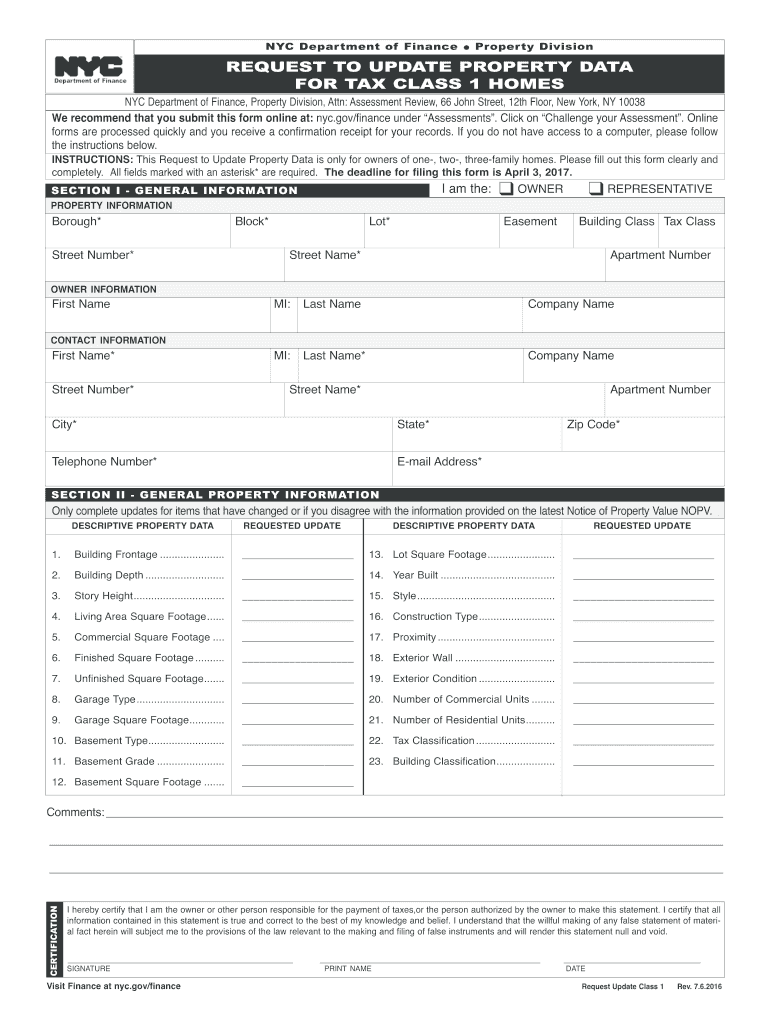

The Property Data Update Class 1 NYC gov form is a specific document designed for property owners in New York City to report changes or updates related to their property data. This form is crucial for ensuring that the information on record with the city government reflects the current status of the property, including ownership, physical characteristics, and other relevant details. By maintaining accurate property data, owners can avoid potential issues with tax assessments and compliance with local regulations.

How to use the Property Data Update Class 1 NYC gov

Using the Property Data Update Class 1 NYC gov form involves several straightforward steps. First, gather all necessary information regarding the property, such as the address, current ownership details, and any changes that need to be reported. Next, access the form through the official NYC government website or designated platforms. Fill out the form accurately, ensuring all fields are completed as required. Once completed, the form can be submitted electronically or printed for mailing, depending on your preference and the submission guidelines provided.

Steps to complete the Property Data Update Class 1 NYC gov

Completing the Property Data Update Class 1 NYC gov form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant property information, including the tax block and lot number.

- Access the form from the NYC government website.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, based on your chosen method.

Legal use of the Property Data Update Class 1 NYC gov

The Property Data Update Class 1 NYC gov form serves a legal purpose by allowing property owners to officially communicate changes to their property data to the city. This form must be completed in compliance with local laws and regulations governing property reporting. Failure to use the form correctly or to submit it in a timely manner can result in legal implications, including potential fines or discrepancies in property tax assessments.

Required Documents

When preparing to submit the Property Data Update Class 1 NYC gov form, it is essential to have certain documents on hand. These may include:

- Proof of ownership, such as a deed or title.

- Identification documents for the property owner.

- Any prior correspondence with the NYC government regarding the property.

- Supporting documents that verify the changes being reported.

Form Submission Methods (Online / Mail / In-Person)

The Property Data Update Class 1 NYC gov form can be submitted through various methods to accommodate different preferences. Property owners may choose to submit the form online via the NYC government website, which is often the fastest method. Alternatively, the completed form can be printed and mailed to the appropriate city department. For those who prefer a more personal approach, in-person submission at designated city offices is also an option. Each method has specific guidelines, so it is advisable to review the requirements before proceeding.

Quick guide on how to complete property data update class 1 nycgov 6965650

Your assistance manual on how to prepare your Property Data Update Class 1 NYC gov

If you're curious about how to create and submit your Property Data Update Class 1 NYC gov, here are a few straightforward guidelines to simplify tax declaration.

To get started, all you need to do is register your airSlate SignNow account to revolutionize your online paperwork management. airSlate SignNow offers a very intuitive and powerful document solution that allows you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and ease-of-use sharing.

Follow the directions below to complete your Property Data Update Class 1 NYC gov in just a few minutes:

- Establish your account and start managing PDFs in moments.

- Utilize our library to find any IRS tax form; navigate through versions and schedules.

- Click Get form to access your Property Data Update Class 1 NYC gov in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-recognized eSignature (if needed).

- Review your document and correct any discrepancies.

- Save updates, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and postpone refunds. Naturally, before e-filing your taxes, please verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct property data update class 1 nycgov 6965650

FAQs

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

I have a class lesson assessment form that I need to have filled out for 75 lessons. The form will be exactly the same except for the course number. How would you do this?

Another way would be to use the option of getting pre-filled answers with the course numbers entered. A custom URL is created and the form would collect the answers for all of the courses in the same spreadsheet. Not sure if that creates another problem for you, but you could sort OR filter the sheet once all the forms had been submitted. This is what the URL would look like for a Text Box https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+75 The nice thing about this is you can just change the part of the URL that Contains "COURSE+NUMBER+75" to a different number...SO for course number 1 it would be https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048=COURSE+NUMBER+1This is what the URL would look like for a Text Box radio button, same concept. https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+1 OR https://docs.google.com/forms/d/1Ia6-paRijdUOn8U2L2H0bF1yujktcqgDsdBJQy2yO30/viewform?entry.14965048&entry.1934317001=Option+6The Google Doc would look like this Quora pre-filled form I'm not sure if this helps at all or makes too complicated and prone to mistakes.

Create this form in 5 minutes!

How to create an eSignature for the property data update class 1 nycgov 6965650

How to make an electronic signature for the Property Data Update Class 1 Nycgov 6965650 in the online mode

How to make an electronic signature for the Property Data Update Class 1 Nycgov 6965650 in Chrome

How to create an electronic signature for putting it on the Property Data Update Class 1 Nycgov 6965650 in Gmail

How to create an eSignature for the Property Data Update Class 1 Nycgov 6965650 right from your mobile device

How to generate an eSignature for the Property Data Update Class 1 Nycgov 6965650 on iOS

How to generate an eSignature for the Property Data Update Class 1 Nycgov 6965650 on Android devices

People also ask

-

What is the Property Data Update Class 1 NYC gov?

The Property Data Update Class 1 NYC gov is a system that allows property owners to update their property data with the New York City government. This ensures that your property records are accurate and up-to-date, which is essential for compliance and legal purposes.

-

How does airSlate SignNow facilitate the Property Data Update Class 1 NYC gov process?

airSlate SignNow streamlines the Property Data Update Class 1 NYC gov process by providing an easy-to-use platform for eSigning and sending necessary documents. This simplifies the workflow, allowing you to focus on your property management rather than paperwork.

-

What are the benefits of using airSlate SignNow for Property Data Update Class 1 NYC gov?

Using airSlate SignNow for Property Data Update Class 1 NYC gov offers numerous benefits, including faster processing times, reduced paperwork, and enhanced document security. This cost-effective solution allows you to manage your property updates efficiently.

-

Is there a cost associated with using airSlate SignNow for the Property Data Update Class 1 NYC gov?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs for handling the Property Data Update Class 1 NYC gov. The plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements.

-

Can I integrate airSlate SignNow with other software for Property Data Update Class 1 NYC gov?

Absolutely! airSlate SignNow can be easily integrated with various applications and software that you may already be using for property management. This ensures a seamless flow of information and enhances your ability to manage the Property Data Update Class 1 NYC gov efficiently.

-

How secure is airSlate SignNow for handling Property Data Update Class 1 NYC gov documents?

Security is paramount when dealing with sensitive property data. airSlate SignNow employs advanced encryption and security measures to ensure that your documents related to the Property Data Update Class 1 NYC gov are protected from unauthorized access.

-

What types of documents can I manage for the Property Data Update Class 1 NYC gov using airSlate SignNow?

With airSlate SignNow, you can manage a variety of documents necessary for the Property Data Update Class 1 NYC gov, including application forms, compliance documents, and other legal paperwork. This versatility helps you handle all aspects of property management efficiently.

Get more for Property Data Update Class 1 NYC gov

- Dhcs 6168 form

- Authorization to release educational records form lone star

- Fitzharris dental insurance form

- Permit to carry application hubbard county co hubbard mn form

- Pest control food services 213 745 1435 trouble call form

- Enf 11 verifying departure cic gc form

- Blank dept chapter officers report a dav members portal davmembersportal form

- Head start application form

Find out other Property Data Update Class 1 NYC gov

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document