Update Property Description for Tax Class 1 Properties NYC Gov 2015

What is the Update Property Description For Tax Class 1 Properties NYC gov

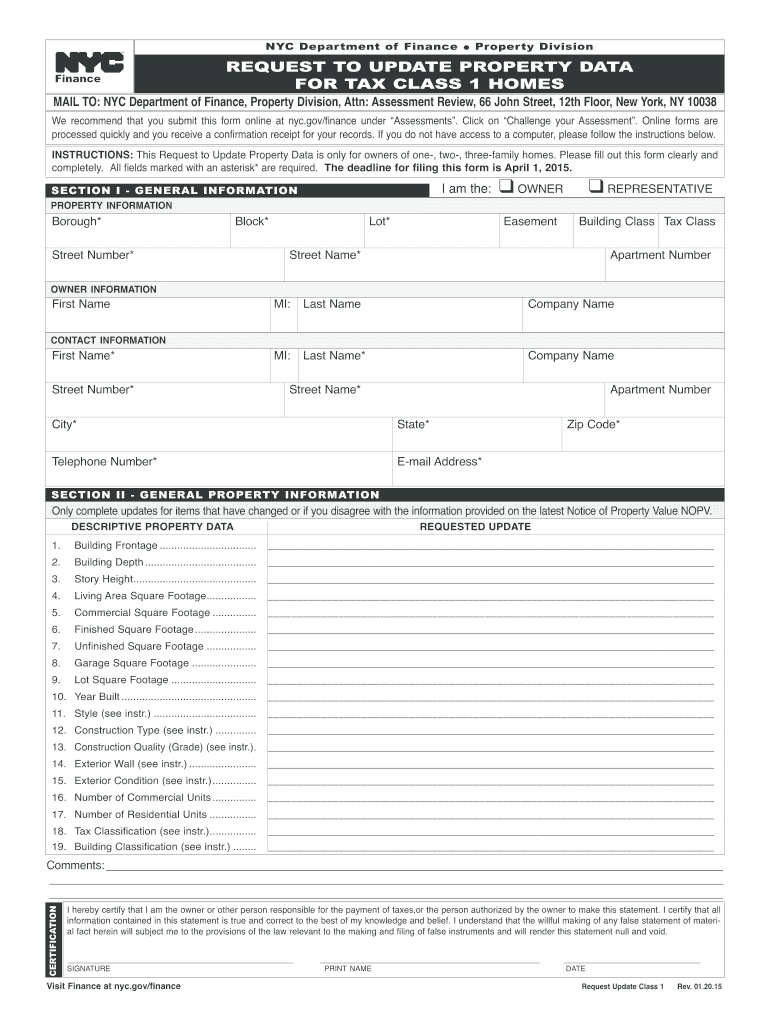

The Update Property Description for Tax Class 1 Properties NYC gov form is a crucial document for property owners in New York City. It allows individuals to update the official description of their properties classified under Tax Class 1, which typically includes residential properties with up to three units. This form ensures that property records are accurate and up-to-date, reflecting any changes in property characteristics, ownership, or usage. Keeping this information current is essential for proper tax assessment and compliance with local regulations.

Steps to complete the Update Property Description For Tax Class 1 Properties NYC gov

Completing the Update Property Description for Tax Class 1 Properties NYC gov form involves several key steps:

- Gather necessary information: Collect all relevant details about the property, including the current description, ownership information, and any changes that need to be made.

- Access the form: Obtain the form from the official NYC government website or designated office.

- Fill out the form: Carefully input the required information into the form, ensuring accuracy and completeness.

- Review the form: Double-check all entries to confirm that they are correct and reflect the intended updates.

- Submit the form: Follow the specified submission method, which may include online submission, mailing, or in-person delivery.

Legal use of the Update Property Description For Tax Class 1 Properties NYC gov

The legal use of the Update Property Description for Tax Class 1 Properties NYC gov form is essential for maintaining accurate property records. This form is recognized by local authorities and is necessary for compliance with New York City’s property tax regulations. By submitting this form, property owners confirm their responsibility to provide truthful and accurate information regarding their properties. Failure to do so may lead to penalties or issues with property tax assessments.

Form Submission Methods

Property owners have several options for submitting the Update Property Description for Tax Class 1 Properties NYC gov form. These methods include:

- Online submission: Many forms can be submitted electronically through the NYC government portal, providing a quick and efficient way to update property information.

- Mail: Property owners can print the completed form and send it via postal service to the appropriate NYC agency.

- In-person submission: Individuals may also choose to deliver the form directly to a designated office, allowing for immediate confirmation of receipt.

Required Documents

When completing the Update Property Description for Tax Class 1 Properties NYC gov form, certain documents may be required to support the information provided. These may include:

- Proof of ownership: Documentation such as a deed or title that verifies the property owner's identity.

- Previous property description: A copy of the existing property description to facilitate accurate updates.

- Additional supporting documents: Any other relevant documents that may assist in clarifying the changes being made.

Examples of using the Update Property Description For Tax Class 1 Properties NYC gov

There are various scenarios in which property owners might need to use the Update Property Description for Tax Class 1 Properties NYC gov form:

- Change in ownership: When a property is sold or transferred, the new owner must update the property description to reflect their ownership.

- Renovations or alterations: If significant changes are made to the property, such as adding units or changing its use, an update is necessary.

- Correction of errors: If there are inaccuracies in the current property description, submitting this form allows for corrections to be made.

Quick guide on how to complete update property description for tax class 1 properties nycgov

Your assistance manual on how to prepare your Update Property Description For Tax Class 1 Properties NYC gov

If you’re wondering how to fill out and submit your Update Property Description For Tax Class 1 Properties NYC gov, here are several brief instructions on how to simplify tax reporting.

Initially, you simply need to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document tool that enables you to alter, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to modify responses when necessary. Optimize your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to complete your Update Property Description For Tax Class 1 Properties NYC gov in just a few minutes:

- Create your account and start editing PDFs within minutes.

- Browse our directory to find any IRS tax form; sift through variations and schedules.

- Click Get form to access your Update Property Description For Tax Class 1 Properties NYC gov in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check boxes).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that filing on paper can lead to return errors and prolong reimbursements. Naturally, prior to electronically filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct update property description for tax class 1 properties nycgov

Create this form in 5 minutes!

How to create an eSignature for the update property description for tax class 1 properties nycgov

How to generate an eSignature for the Update Property Description For Tax Class 1 Properties Nycgov online

How to generate an electronic signature for the Update Property Description For Tax Class 1 Properties Nycgov in Chrome

How to create an electronic signature for putting it on the Update Property Description For Tax Class 1 Properties Nycgov in Gmail

How to make an eSignature for the Update Property Description For Tax Class 1 Properties Nycgov straight from your smartphone

How to create an eSignature for the Update Property Description For Tax Class 1 Properties Nycgov on iOS

How to create an electronic signature for the Update Property Description For Tax Class 1 Properties Nycgov on Android OS

People also ask

-

What steps do I need to take to Update Property Description For Tax Class 1 Properties NYC gov?

To Update Property Description For Tax Class 1 Properties NYC gov, you should first gather all necessary documentation regarding your property. Then, utilize the airSlate SignNow platform to complete and eSign the required forms efficiently. The submission can be done online, ensuring a hassle-free process.

-

How does airSlate SignNow simplify the process to Update Property Description For Tax Class 1 Properties NYC gov?

airSlate SignNow streamlines the process to Update Property Description For Tax Class 1 Properties NYC gov by allowing you to fill out and eSign forms digitally. This eliminates the need for physical document handling and expedites submission. You can also track the status of your updates in real-time.

-

Are there any costs associated with using airSlate SignNow to Update Property Description For Tax Class 1 Properties NYC gov?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there may be nominal fees associated with specific features or plan upgrades. However, the overall savings in time and effort often outweigh these costs when you need to Update Property Description For Tax Class 1 Properties NYC gov.

-

Can I access airSlate SignNow on mobile devices for updating property descriptions?

Absolutely! airSlate SignNow is designed to be mobile-friendly. You can easily access the platform from your smartphone or tablet to Update Property Description For Tax Class 1 Properties NYC gov while on the go, making it convenient for your busy lifestyle.

-

What integrations does airSlate SignNow offer that can help in updating property descriptions?

airSlate SignNow integrates seamlessly with various applications, such as cloud storage services and productivity tools. These integrations make it easier to gather documents necessary to Update Property Description For Tax Class 1 Properties NYC gov and keep all your data organized in one place.

-

Is there customer support available if I encounter issues while updating my property description?

Yes, airSlate SignNow provides comprehensive customer support to assist you whenever you face difficulties. You can signNow out via chat or email for guidance on how to effectively Update Property Description For Tax Class 1 Properties NYC gov and resolve any issues quickly.

-

Can airSlate SignNow guarantee the security of my information when updating property descriptions?

Definitely! airSlate SignNow prioritizes your security, utilizing advanced encryption to protect your data while you Update Property Description For Tax Class 1 Properties NYC gov. You can confidently manage your documents without worrying about bsignNowes or unauthorized access.

Get more for Update Property Description For Tax Class 1 Properties NYC gov

Find out other Update Property Description For Tax Class 1 Properties NYC gov

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form