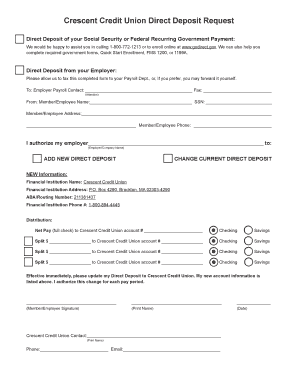

Crescent Credit Union Form

What is the Crescent Credit Union

The Crescent Credit Union is a financial cooperative that provides a range of banking services to its members. Unlike traditional banks, credit unions are owned and operated by their members, which allows them to offer lower fees and better interest rates. Members of Crescent Credit Union can access services such as savings accounts, loans, and credit cards, all tailored to meet their financial needs. The institution emphasizes community involvement and aims to support local initiatives while promoting financial literacy among its members.

How to use the Crescent Credit Union

Using the Crescent Credit Union involves becoming a member and accessing various services designed for personal and business financial management. Members can open accounts online or in person, apply for loans, and utilize digital banking features. The credit union offers user-friendly online platforms where members can manage their accounts, transfer funds, and apply for services. Additionally, members can contact Crescent Credit Union customer service for assistance with any inquiries or issues related to their accounts.

Steps to complete the Crescent Credit Union

Completing the Crescent Credit Union form typically involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including identification and financial details. Next, fill out the form carefully, ensuring all sections are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form either online through the credit union's secure portal or in person at a local branch. If required, keep a copy for your records.

Legal use of the Crescent Credit Union

The legal use of the Crescent Credit Union form requires adherence to specific regulations governing financial institutions. This includes compliance with federal and state laws that regulate credit unions, such as the National Credit Union Administration (NCUA) guidelines. Additionally, members must ensure that the information provided is accurate and truthful to avoid any legal repercussions. Utilizing secure digital tools for form submission can enhance the legal validity of the documents, ensuring they meet all necessary requirements.

Required Documents

When engaging with the Crescent Credit Union, several documents may be required for various services. Commonly needed documents include proof of identity, such as a government-issued ID, Social Security number, and proof of residence, like a utility bill. For loan applications, additional financial documents, such as income verification and credit history, may be necessary. It is essential to prepare these documents in advance to streamline the application process.

Form Submission Methods

Members can submit the Crescent Credit Union form through multiple methods, providing flexibility and convenience. The primary submission methods include:

- Online submission via the credit union's secure portal

- Mailing the completed form to the designated address

- In-person submission at a local branch

Each method is designed to ensure that members can choose the most convenient option for their needs while maintaining security and compliance.

Who Issues the Form

The Crescent Credit Union form is issued by the credit union itself, which operates under federal and state regulations. As a member-owned institution, the credit union is responsible for creating and managing the forms necessary for its services. This ensures that all forms are tailored to meet the specific needs of its members while adhering to legal standards set forth by governing bodies.

Quick guide on how to complete crescent credit union

Prepare Crescent Credit Union effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Crescent Credit Union on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Crescent Credit Union effortlessly

- Locate Crescent Credit Union and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Crescent Credit Union and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crescent credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Crescent Credit Union's eSigning solution?

Crescent Credit Union offers an eSigning solution powered by airSlate SignNow, which allows customers to send and sign documents effortlessly. This secure platform streamlines the signing process, making it easy for businesses to manage contracts and agreements efficiently.

-

How does Crescent Credit Union ensure document security?

Crescent Credit Union prioritizes document security by utilizing airSlate SignNow's industry-leading encryption and authentication measures. Each transaction is secured with robust protocols, providing peace of mind that sensitive information remains protected throughout the signing process.

-

What features does Crescent Credit Union offer through airSlate SignNow?

Crescent Credit Union leverages airSlate SignNow's comprehensive features, including customizable templates, real-time tracking, and mobile functionality. These features enhance user experience, allowing businesses to create, manage, and sign documents seamlessly from any device.

-

Is there a cost associated with using Crescent Credit Union's eSigning services?

Crescent Credit Union provides affordable eSigning services through airSlate SignNow, with various pricing plans tailored to meet different business needs. The cost-effective solution ensures that all businesses, regardless of size, can access professional document signing without breaking the bank.

-

Can I integrate Crescent Credit Union's eSigning with other software?

Yes, Crescent Credit Union's eSigning solution integrates effortlessly with numerous software applications. By utilizing airSlate SignNow's extensive integration capabilities, businesses can connect their favorite tools, streamlining workflows and enhancing productivity.

-

What are the benefits of using Crescent Credit Union's eSigning solution?

Crescent Credit Union's eSigning solution offers numerous benefits, including reduced turnaround times and increased efficiency in document management. By adopting airSlate SignNow, businesses can enhance their customer experience by providing quick and convenient signing options.

-

Is it easy to use Crescent Credit Union's eSigning platform?

Absolutely! Crescent Credit Union's eSigning platform, powered by airSlate SignNow, is designed for user-friendliness. With its intuitive interface, even those unfamiliar with technology can easily navigate the process of sending and signing documents.

Get more for Crescent Credit Union

- Dog board and train contract template form

- Travelsmith packing list form

- Cpp claim form pdf

- Unconditional waiver and release on progress payment form

- Form n 25 pass to counting agents state election commission sec kerala gov

- Health care facility complaint formillinois department of

- Application for sliding fee discount program form

- Order forms spotsylvania regional medical center

Find out other Crescent Credit Union

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document