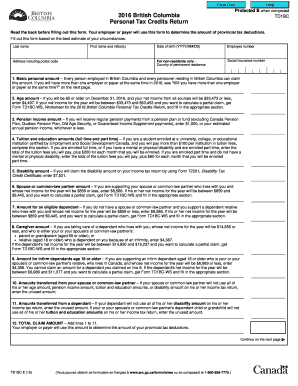

Td1bc Fillable Form

What is the IS220PRTDH1BC?

The IS220PRTDH1BC is a specific form used primarily for tax purposes in the United States. It serves as a fillable document that allows individuals and businesses to report certain financial information to the IRS. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and for accurate reporting of income and deductions.

How to Use the IS220PRTDH1BC

Using the IS220PRTDH1BC involves several steps to ensure that the form is filled out correctly. Users should first download the fillable version of the form from a reliable source. Once obtained, individuals can enter their information directly into the form fields. It is crucial to double-check all entries for accuracy before submission. Additionally, users can utilize digital signature options to sign the document electronically, which enhances the efficiency of the process.

Steps to Complete the IS220PRTDH1BC

Completing the IS220PRTDH1BC requires careful attention to detail. Here are the steps to follow:

- Download the IS220PRTDH1BC form in a fillable format.

- Open the form using a compatible PDF reader or editor.

- Fill in personal and financial information as required.

- Review all entries for accuracy and completeness.

- Sign the form electronically using a trusted eSignature solution.

- Save the completed form and prepare it for submission.

Legal Use of the IS220PRTDH1BC

The IS220PRTDH1BC is legally binding when filled out and signed correctly. To ensure its legal validity, it must comply with federal eSignature laws such as the ESIGN Act and UETA. These laws confirm that electronic signatures hold the same weight as traditional handwritten signatures, provided that the signer has consented to use electronic records. Utilizing a reputable eSignature platform can further enhance the legal standing of the completed form.

Key Elements of the IS220PRTDH1BC

Several key elements must be included in the IS220PRTDH1BC for it to be considered complete. These elements typically include:

- Taxpayer identification information, such as Social Security numbers or Employer Identification Numbers.

- Details regarding income sources and amounts.

- Applicable deductions and credits that the taxpayer is eligible for.

- Signature and date fields to validate the submission.

Form Submission Methods

The IS220PRTDH1BC can be submitted through various methods, accommodating different preferences and situations. Individuals may choose to submit the form electronically via a secure online platform, which is often the fastest option. Alternatively, the completed form can be printed and mailed to the appropriate IRS address. In-person submission may also be possible at designated IRS offices, depending on the taxpayer's needs.

Quick guide on how to complete td1bc fillable

Effortlessly Prepare Td1bc Fillable on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can easily obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents swiftly without any delays. Manage Td1bc Fillable on your preferred device through the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and eSign Td1bc Fillable with minimal effort

- Access Td1bc Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, be it email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Td1bc Fillable and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the td1bc fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is td1bc and how does it relate to airSlate SignNow?

td1bc is a key feature of airSlate SignNow that enhances document management and eSigning efficiency. It allows users to streamline their workflows by integrating electronic signatures within their business processes, ensuring quick and secure document transactions.

-

How does airSlate SignNow's pricing structure work for td1bc users?

The pricing for airSlate SignNow varies based on the features you choose, including td1bc capabilities. It offers different tiered plans to fit various budget needs, making it an affordable solution for businesses of all sizes looking to enhance their document management.

-

What are the main features of the td1bc tool within airSlate SignNow?

td1bc includes features such as customizable templates, secure eSignature collection, and real-time document tracking. These tools empower users to create, send, and manage documents efficiently, resulting in signNow time savings and improved productivity.

-

What benefits can businesses expect from using td1bc with airSlate SignNow?

By utilizing td1bc within airSlate SignNow, businesses can expect to reduce turnaround times for document signing, enhance compliance with security standards, and improve customer satisfaction. This user-friendly solution optimizes document workflows and saves valuable time.

-

Does airSlate SignNow support third-party integrations with td1bc?

Yes, airSlate SignNow supports a variety of third-party integrations that complement td1bc functionalities. This allows businesses to connect their existing software tools with airSlate SignNow, enabling seamless document workflows and enhancing overall efficiency.

-

Can I try airSlate SignNow with td1bc features before committing?

Absolutely! airSlate SignNow offers a free trial that includes access to td1bc features. This allows users to explore the platform and understand how it can optimize their document handling before making a financial commitment.

-

Is td1bc secure for handling sensitive documents?

Yes, td1bc within airSlate SignNow prioritizes the security of your documents. It uses advanced encryption, complies with industry regulations, and offers secure cloud storage, ensuring that sensitive information remains protected throughout the eSigning process.

Get more for Td1bc Fillable

Find out other Td1bc Fillable

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word