Fw8bene Form

What is the Fw8bene?

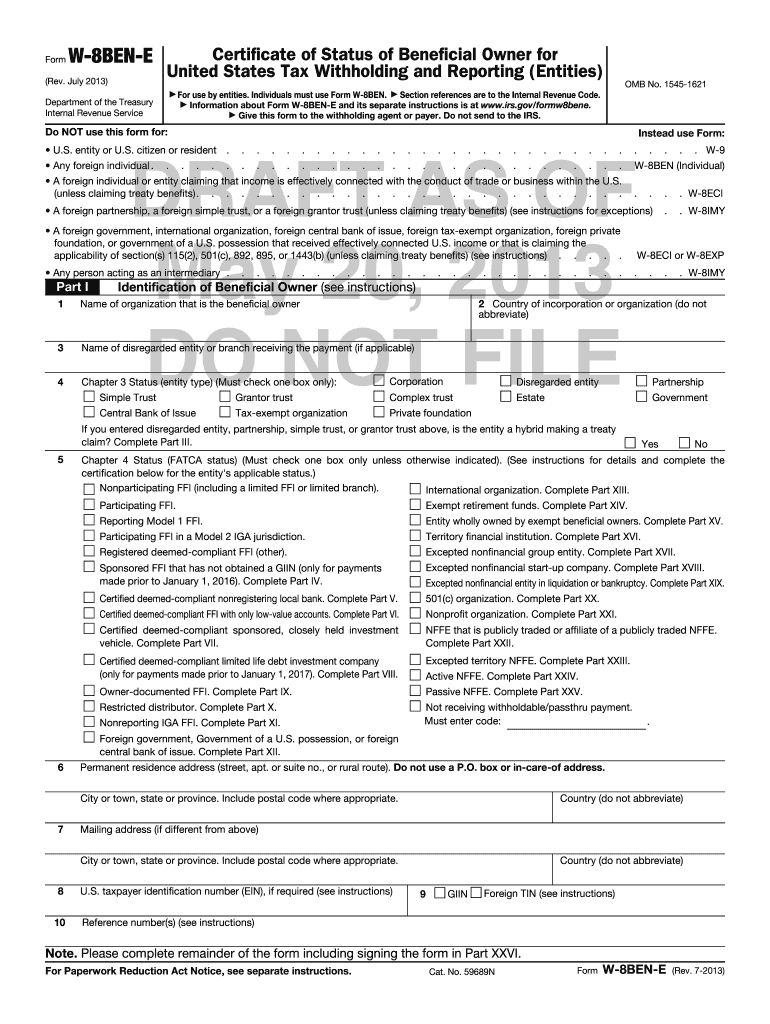

The Fw8bene form is a document used by foreign individuals and entities to certify their foreign status for tax purposes in the United States. It allows them to claim a reduced rate of withholding tax on certain types of income, such as dividends, interest, and royalties, under an applicable tax treaty. By submitting the Fw8bene form, foreign taxpayers can avoid higher withholding rates and ensure compliance with U.S. tax regulations.

How to use the Fw8bene

Using the Fw8bene form involves several straightforward steps. First, individuals or entities must gather the necessary information, including their name, address, and taxpayer identification number. Next, they should complete the form accurately, ensuring that all sections are filled out according to IRS guidelines. Once completed, the form must be submitted to the withholding agent or financial institution requesting it. This submission can often be done electronically, streamlining the process.

Steps to complete the Fw8bene

Completing the Fw8bene form requires careful attention to detail. Here are the essential steps:

- Provide personal information, including your name and address.

- Indicate your foreign tax identification number, if applicable.

- Specify the type of income for which you are claiming reduced withholding.

- Certify your foreign status by signing and dating the form.

After ensuring all information is accurate, submit the form to the relevant withholding agent or financial institution.

Legal use of the Fw8bene

The Fw8bene form is legally binding when completed correctly and submitted to the appropriate parties. It complies with U.S. tax laws, allowing foreign individuals and entities to benefit from reduced withholding rates under tax treaties. To ensure legal validity, it is crucial to provide accurate information and maintain proper documentation in case of audits or inquiries by the IRS.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the use of the Fw8bene form. These guidelines outline eligibility criteria, the types of income eligible for reduced withholding, and the necessary documentation to support claims. It is essential for filers to review these guidelines carefully to ensure compliance and avoid potential penalties.

Required Documents

When completing the Fw8bene form, certain documents may be required to support the information provided. These can include:

- Proof of foreign status, such as a passport or national identification card.

- Tax identification numbers from the foreign country.

- Documentation of income types being reported.

Having these documents ready can facilitate the completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete fw8bene

Complete Fw8bene effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Fw8bene on any device using airSlate SignNow apps for Android or iOS and streamline any document-centric process today.

The easiest method to alter and eSign Fw8bene without exertion

- Locate Fw8bene and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Fw8bene and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fw8bene

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fw8bene form and why is it important?

The fw8bene form is a tax form used by foreign individuals and entities to signNow their foreign status and claim a reduced rate or exemption from withholding tax in the United States. It is essential for international businesses and foreign investors to avoid overpaying on taxes and to ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with the fw8bene form?

airSlate SignNow simplifies the process of completing and eSigning the fw8bene form. Our platform enables you to fill out the form digitally, ensuring accuracy and efficiency, while providing a secure environment for storing and sharing sensitive documents.

-

Is there a cost associated with using the fw8bene form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include features for managing the fw8bene form and other essential documents. Our cost-effective solutions cater to businesses of all sizes, allowing you to select a plan that fits your specific needs and budget.

-

What features does airSlate SignNow offer for handling the fw8bene form?

airSlate SignNow comes with features like customizable templates, in-app collaboration, secure eSigning, and document tracking, all specifically designed to streamline the process of completing the fw8bene form. These tools enhance productivity and ensure that you can manage forms effortlessly.

-

Can the fw8bene form be integrated with other tools using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with various third-party applications, making it easy to incorporate the fw8bene form into your existing workflows. This ensures that you can easily transfer data between tools, enhancing your overall efficiency.

-

What are the advantages of using airSlate SignNow for the fw8bene form?

Using airSlate SignNow for the fw8bene form offers multiple advantages, including reduced processing time, increased accuracy, and an improved user experience. Additionally, our platform keeps your documents organized and secure, which is especially important for sensitive information.

-

Is there customer support available for assistance with the fw8bene form?

Absolutely! AirSlate SignNow provides customer support to help you navigate any questions or issues related to the fw8bene form. Our knowledgeable team is available via chat, email, or phone to ensure that you have the assistance you need.

Get more for Fw8bene

- Forbes marketing plan template form

- Sheet records form

- Klein oak transcript request form

- Fundations scope and sequence level 1 form

- Tpt20 form

- Certificate of terminal illness form

- Forms for tax withholding

- 96002e republic of the philippines department of public works and highways office of the local building officials districtcity form

Find out other Fw8bene

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple