Forms for Tax Withholding

What is the Forms For Tax Withholding

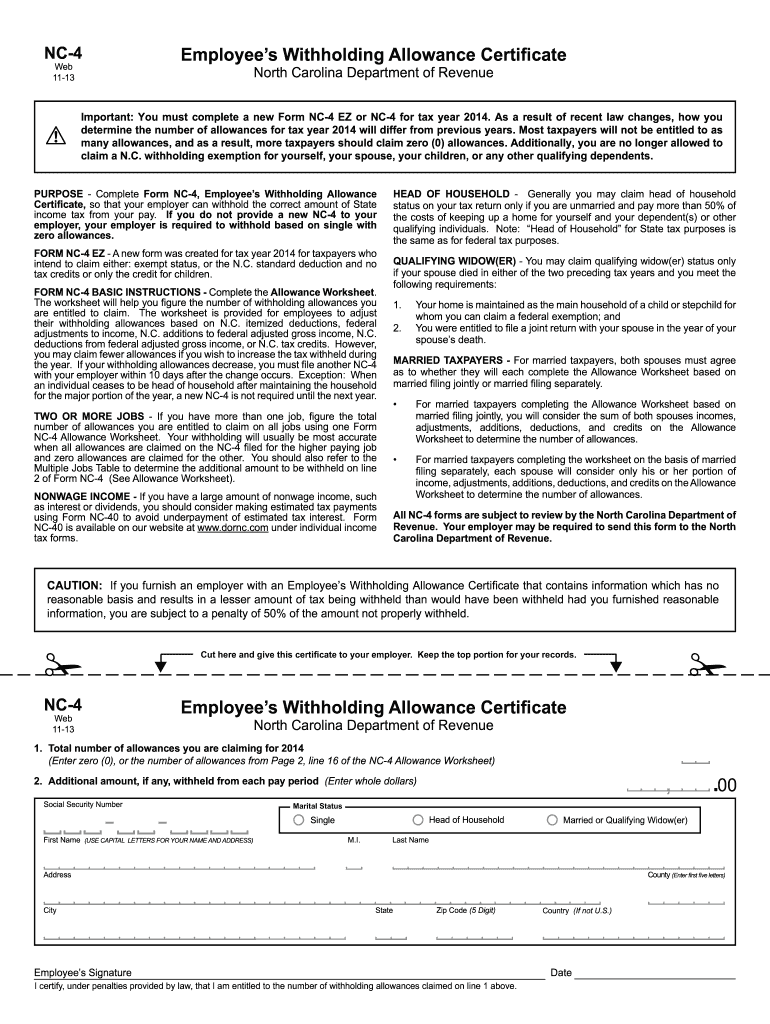

The Forms For Tax Withholding are essential documents used by employers and employees to determine the amount of federal income tax to withhold from an employee's paycheck. These forms help ensure that the correct amount of tax is deducted, which can prevent underpayment or overpayment of taxes. The most commonly used form for this purpose is the W-4, which employees fill out to indicate their tax situation, including filing status and any additional withholding allowances. Understanding these forms is crucial for maintaining compliance with tax regulations.

Steps to complete the Forms For Tax Withholding

Completing the Forms For Tax Withholding involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your Social Security number, filing status, and any deductions or credits you plan to claim.

- Obtain the appropriate form, such as the W-4 for employees.

- Fill out the form carefully, making sure to follow the instructions provided. Indicate your filing status and any additional withholding allowances.

- Review the completed form for accuracy to avoid errors that could affect your tax withholding.

- Submit the form to your employer, ensuring they have the most up-to-date information for tax withholding purposes.

Legal use of the Forms For Tax Withholding

The legal use of the Forms For Tax Withholding is governed by federal tax laws, which require employers to withhold a certain amount of income tax from employee wages. These forms must be filled out accurately to reflect an employee's tax situation. Failure to comply with withholding requirements can result in penalties for both the employer and employee. It is important to keep the forms updated, especially after significant life changes, such as marriage or having a child, which may affect tax obligations.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting the Forms For Tax Withholding. These guidelines include instructions on how to fill out the forms, the importance of accuracy, and the need for timely submission. The IRS also offers resources to help taxpayers understand their withholding obligations and make necessary adjustments. Staying informed about IRS guidelines can help ensure compliance and avoid potential issues during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the Forms For Tax Withholding are crucial for both employers and employees. Typically, employees should submit their W-4 forms to their employer at the start of employment or whenever their tax situation changes. Employers must then ensure that withholding is adjusted accordingly. Additionally, it is important to be aware of annual tax deadlines, such as the date by which employers must provide employees with their W-2 forms, which summarize annual earnings and withholding amounts.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Forms For Tax Withholding can be done through various methods. Employees can typically submit their completed W-4 forms directly to their employer via email or through an online payroll system, depending on the employer's policies. In some cases, employees may also choose to print and mail the form. It is essential to follow the submission method preferred by the employer to ensure timely processing and compliance with tax withholding requirements.

Quick guide on how to complete forms for tax withholding

Complete Forms For Tax Withholding effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Forms For Tax Withholding on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Forms For Tax Withholding with ease

- Find Forms For Tax Withholding and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Forms For Tax Withholding and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms for tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Forms For Tax Withholding and why are they important?

Forms For Tax Withholding are essential documents used by employers to determine the appropriate amount of federal income tax to withhold from employee paychecks. They ensure compliance with tax regulations and help employees manage their tax liabilities effectively. Properly completed Forms For Tax Withholding can prevent tax penalties and adjust withholding amounts based on an employee's financial situation.

-

How can airSlate SignNow simplify the process of managing Forms For Tax Withholding?

airSlate SignNow provides a user-friendly platform that enables businesses to create, send, and eSign Forms For Tax Withholding quickly and efficiently. With its intuitive interface, users can easily customize forms and track their submission status, thereby streamlining the entire workflow. This reduces administrative burden and helps ensure timely submission of important documents.

-

Are there any integrations available for managing Forms For Tax Withholding?

Yes, airSlate SignNow offers seamless integrations with various accounting and payroll software systems, enabling businesses to manage Forms For Tax Withholding more effectively. These integrations facilitate data transfer and synchronization, ensuring that tax withholding calculations remain accurate and up-to-date. This connectivity enhances overall efficiency in handling payroll processes.

-

What features does airSlate SignNow provide for Forms For Tax Withholding?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities to manage Forms For Tax Withholding. The platform also offers real-time tracking and reminders for pending documents, ensuring that no form is overlooked. Additionally, enhanced security measures protect sensitive employee information throughout the signing process.

-

How does airSlate SignNow ensure the security of Forms For Tax Withholding?

Security is a priority at airSlate SignNow, with advanced encryption methods employed to protect Forms For Tax Withholding and other sensitive documents. The platform adheres to industry standards and regulations, ensuring that all transactions and data are secure. Additionally, user access controls allow businesses to manage who can view and edit documents.

-

Can airSlate SignNow help reduce costs associated with Forms For Tax Withholding?

By utilizing airSlate SignNow for managing Forms For Tax Withholding, businesses can signNowly reduce administrative costs related to paper handling and manual processes. The digital workflow minimizes the need for physical storage and helps eliminate delays associated with traditional signing methods. Overall, this translates to cost savings and increased productivity.

-

What pricing options are available for airSlate SignNow in relation to Forms For Tax Withholding?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes that require management of Forms For Tax Withholding. Each plan provides a set of features tailored to meet different needs, ranging from basic document signing to advanced automation tools. This flexibility allows companies to choose a plan that best aligns with their budget and requirements.

Get more for Forms For Tax Withholding

- Id rec agency disclosure brochure 2020 2021 fill and form

- Hereinafter called seller and hereinafter form

- Wwwsignnowcomfill and sign pdf form79640make sure you are aware of possible nancial consequences

- Temporary hearing aid dispenser license initial application form

- 2020 form wa doh 646 164 fill online printable fillable

- Wwwpdffillercom334408022 ncp 1 lppdf massmasshealth non custodial parent form fill online printable

- New york state bar exam application allexampapercom form

- Non motor vehicle case form

Find out other Forms For Tax Withholding

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors