Form D 410

What is the Form D-410?

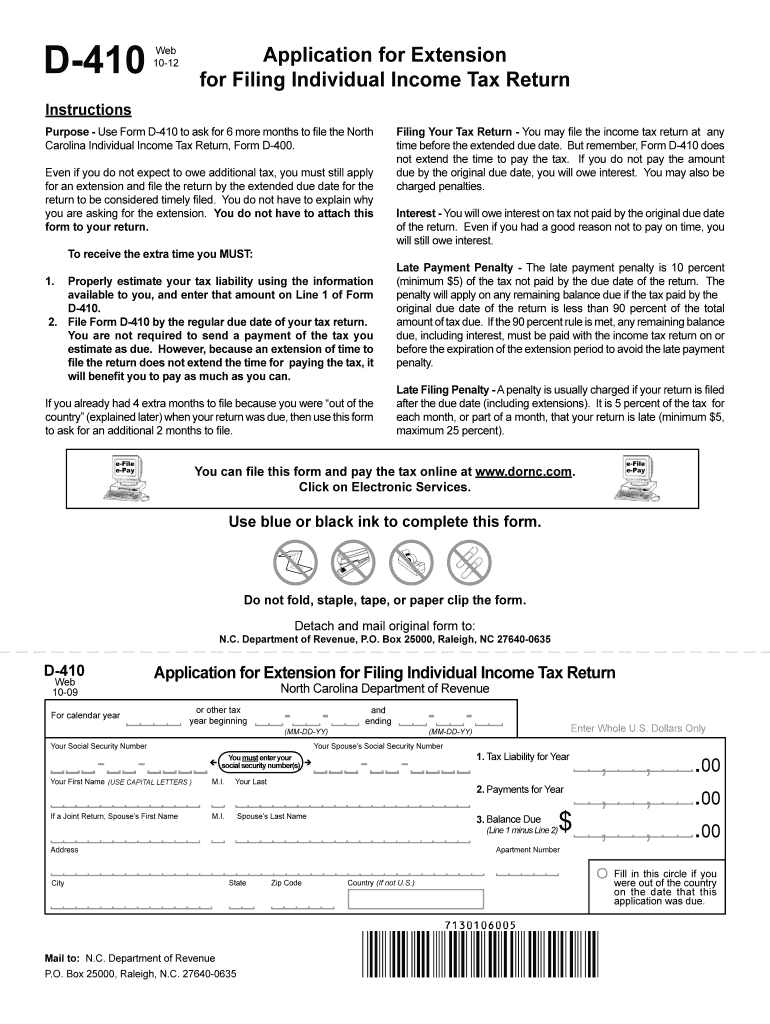

The Form D-410, also known as the North Carolina Tax Extension Form, is a document used by taxpayers in North Carolina to request an extension for filing their state income tax returns. This form allows individuals and businesses to extend their filing deadline, providing additional time to gather necessary documentation and complete their tax returns. Understanding the purpose and function of the D-410 is essential for ensuring compliance with state tax regulations.

How to Obtain the Form D-410

The Form D-410 can be easily obtained through the North Carolina Department of Revenue (NCDOR) website. Taxpayers can download the form directly in PDF format for convenience. Additionally, physical copies may be available at local NCDOR offices or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any issues with your tax extension request.

Steps to Complete the Form D-410

Completing the Form D-410 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Indicate the tax year for which you are requesting an extension.

- Provide an estimate of your total tax liability for the year.

- Calculate any payments made or credits that may apply.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, ensure it is submitted to the NCDOR by the designated deadline for extensions.

Legal Use of the Form D-410

The Form D-410 is legally recognized as a valid request for an extension of time to file state income tax returns in North Carolina. To ensure that the extension is granted, it is crucial to submit the form by the due date of the original return. The extension allows taxpayers to avoid penalties for late filing, provided that any taxes owed are paid on time. Familiarity with the legal implications of using the D-410 can help taxpayers navigate their obligations effectively.

Filing Deadlines / Important Dates

Taxpayers must be aware of the critical deadlines associated with the Form D-410. The form should be submitted by the original due date of the tax return, typically April 15 for individual returns. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is also essential to note that while the extension allows for more time to file, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

The Form D-410 can be submitted using various methods to accommodate different preferences:

- Online submission through the NCDOR's e-filing system, which provides a quick and efficient way to file.

- Mailing a printed copy of the completed form to the appropriate NCDOR address.

- In-person submission at local NCDOR offices, where taxpayers can receive assistance if needed.

Choosing the right submission method can help ensure that the form is processed promptly and accurately.

Quick guide on how to complete nc dept of revenue forms d410

Complete Form D 410 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form D 410 on any platform through airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form D 410 with ease

- Locate Form D 410 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form D 410 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

Is there any research on the topic of how people fill out forms?

There are a number of places online to look for peer-reviewed published HCI studies. Here are several good ones for usability of web forms: HCI Bibliography : Human-Computer Interaction Resources ACM Digital LibraryWebSM.org - Web Survey MethodologyA quick search resulted in these research studies measuring response rates of online forms. It seems like in addition to eye-tracking you can also use keystrokes to measure user behavior: Denscombe, Martyn. 2006. Web-Based Questionnaires and the Mode Effect. Soc. Sci. Comput. Rev. 24, 2 (May 2006), 246-254. DOI=10.1177/0894439305284522 Healey, B.: Drop Downs and Scrollmice: The Effect of Response Option Format and Input Mechanism Employed on Data Quality in Web Surveys. Social Science Computer Review 25(1), 111–128 (2007) Hogg, A., Masztal, J.J.: Drop-down, Radio Buttons, or Fill-in-the-blank? Effects of Attribute Rating Scale Type on Web Survey Responses. In: Proceedings ESOMAR 2001 (2001)Nikolaos Karousos, Christos Katsanos, Nikolaos Tselios, and Michalis Xenos. 2013. Effortless tool-based evaluation of web form filling tasks using keystroke level model and fitts law. In CHI '13 Extended Abstracts on Human Factors in Computing Systems (CHI EA '13). ACM, New York, NY, USA, 1851-1856. DOI=10.1145/2468356.2468688 Mirjam Seckler, Silvia Heinz, Javier A. Bargas-Avila, Klaus Opwis, and Alexandre N. Tuch. 2013. Empirical evaluation of 20 web form optimization guidelines. In CHI '13 Extended Abstracts on Human Factors in Computing Systems (CHI EA '13). ACM, New York, NY, USA, 1893-1898. DOI=10.1145/2468356.2468695 Vicente, P., & Reis, E. (2010). Using questionnaire design to fight nonresponse bias in web surveys. Social Science Computer Review, 28(2), 251-267.As for what the user actually does in regards to scan first or fill first, it depends on other factors beyond the design such as personal styles and cognitive styles. One approach to overcome the uncertainty of the answer to your question is by placing one question on a page at a time.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the nc dept of revenue forms d410

How to generate an electronic signature for your Nc Dept Of Revenue Forms D410 in the online mode

How to create an eSignature for your Nc Dept Of Revenue Forms D410 in Google Chrome

How to make an eSignature for signing the Nc Dept Of Revenue Forms D410 in Gmail

How to make an eSignature for the Nc Dept Of Revenue Forms D410 from your smartphone

How to generate an electronic signature for the Nc Dept Of Revenue Forms D410 on iOS

How to make an electronic signature for the Nc Dept Of Revenue Forms D410 on Android OS

People also ask

-

What is the D 410 form and why is it important?

The D 410 form is a crucial document used for official purposes, often pertaining to tax filings or business registrations. Understanding how to properly complete and submit the D 410 form can help ensure compliance and avoid unnecessary penalties.

-

How can airSlate SignNow assist with the D 410 form?

airSlate SignNow simplifies the process of preparing and submitting the D 410 form by allowing users to electronically sign and send documents securely. This streamlines the workflow, reduces the chances of errors, and saves time in document handling.

-

Is there a cost associated with using airSlate SignNow for the D 410 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those needing to manage the D 410 form. Pricing is designed to be cost-effective, ensuring you can afford to manage essential documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the D 410 form?

airSlate SignNow provides a range of features for the D 410 form, including templates, automated workflows, and tracking capabilities. These features enhance user experience and ensure that every stage of the document process is transparent and efficient.

-

Can I integrate airSlate SignNow with other applications when working with the D 410 form?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications, which can enhance your ability to manage the D 410 form and other documents. This integration allows for a more efficient workflow and better data management across platforms.

-

What are the benefits of using airSlate SignNow for the D 410 form?

Using airSlate SignNow for the D 410 form provides numerous benefits, including faster processing times, enhanced security for sensitive information, and increased accuracy in document handling. This helps your business remain organized and compliant with regulatory requirements.

-

Is support available for assistance with the D 410 form in airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support for users needing assistance with the D 410 form. Our team is available to answer any questions and help users navigate their workflows effectively.

Get more for Form D 410

Find out other Form D 410

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple