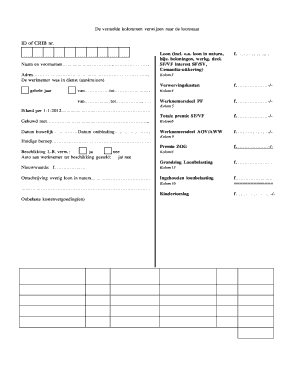

Loonbelastingkaart Form

What is the loonbelastingkaart?

The loonbelastingkaart is a tax form used primarily in the Netherlands to document income tax deductions for employees. This form serves as an official record of the tax withheld from wages and is essential for both employers and employees to ensure accurate tax reporting. While primarily utilized in the Netherlands, understanding its implications can be beneficial for individuals and businesses operating in a global context.

How to use the loonbelastingkaart

Using the loonbelastingkaart involves several steps to ensure compliance with tax regulations. First, employees should ensure that their personal information is accurately reflected on the form. This includes name, address, and tax identification number. Employers must then use this information to calculate the correct amount of tax to withhold from employee wages. It is crucial to keep this form updated, especially when there are changes in employment status or personal circumstances.

Steps to complete the loonbelastingkaart

Completing the loonbelastingkaart requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your tax identification number and current address.

- Fill out the form with accurate details regarding your employment status and income.

- Review the completed form for any errors or omissions.

- Submit the form to your employer for processing.

Legal use of the loonbelastingkaart

The loonbelastingkaart must be used in accordance with applicable tax laws to ensure its legality. Employers are responsible for withholding the correct amount of tax as indicated on the form. Failure to comply with tax regulations can result in penalties for both employers and employees. It is important to retain copies of the completed form for personal records and potential audits.

Who issues the loonbelastingkaart

The loonbelastingkaart is typically issued by the tax authorities in the Netherlands. Employers may also provide this form to their employees as part of the hiring process. It is essential for employees to ensure they receive this document, as it plays a significant role in tax compliance and reporting.

Filing deadlines / Important dates

Filing deadlines for the loonbelastingkaart are critical to avoid penalties. Generally, employers must submit this form at the beginning of each tax year or when an employee starts employment. It is advisable for employees to check with their employers regarding specific deadlines to ensure compliance with tax regulations.

Quick guide on how to complete loonbelastingkaart

Complete Loonbelastingkaart effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Loonbelastingkaart on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign Loonbelastingkaart without any hassle

- Find Loonbelastingkaart and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Loonbelastingkaart and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loonbelastingkaart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loonbelastingkaart and why is it important?

A loonbelastingkaart is a tax card issued to employees in the Netherlands, detailing their income tax information. It is important because it ensures that employers deduct the correct amount of tax from salaries, which helps in preventing underpayment or overpayment of taxes.

-

How can airSlate SignNow assist with managing loonbelastingkaarten?

With airSlate SignNow, you can easily send, sign, and manage documents related to loonbelastingkaarten electronically. This not only saves time but also reduces the risk of manual errors, ensuring that your tax documentation is accurate and up-to-date.

-

Is there a cost associated with using airSlate SignNow for loonbelastingkaart management?

Yes, airSlate SignNow offers a cost-effective solution for managing loonbelastingkaarten. Pricing is tiered based on the features you need, making it accessible for businesses of all sizes while also providing excellent value for the services offered.

-

What features does airSlate SignNow provide for loonbelastingkaart processing?

AirSlate SignNow provides features such as electronic signatures, document templates, and tracking capabilities specifically for loonbelastingkaart processing. These tools streamline the workflow, making it easier to manage employee tax documents efficiently.

-

Are there any integrations available for loonbelastingkaart workflows?

Yes, airSlate SignNow offers integrations with various HR and payroll systems, which simplifies the workflow for managing loonbelastingkaarten. This connectivity ensures that you can seamlessly incorporate tax management into your existing processes.

-

How secure is airSlate SignNow when handling loonbelastingkaarten?

AirSlate SignNow prioritizes security, employing advanced encryption protocols to protect sensitive data such as loonbelastingkaarten. Your documents are stored securely, ensuring that they are only accessible to authorized users.

-

Can I customize my loonbelastingkaart documents with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your loonbelastingkaart documents to meet your specific business needs. You can add your branding, adjust layouts, and create templates to streamline future document creation.

Get more for Loonbelastingkaart

Find out other Loonbelastingkaart

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple