Arizona Form 140 Instructions and Information 2024-2026

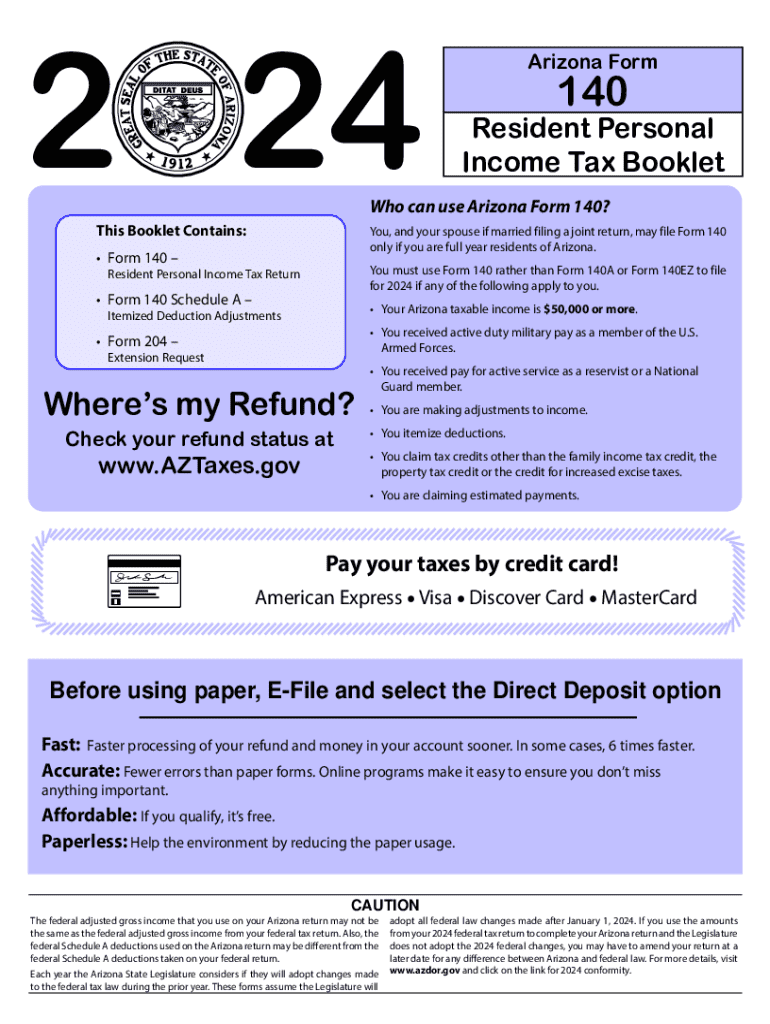

What is the Arizona Form 140?

The Arizona Form 140 is a state income tax return form used by residents of Arizona to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Arizona and are required to file a tax return. The form includes various sections for reporting different types of income, deductions, and credits, ensuring that taxpayers comply with Arizona tax laws. Understanding the purpose and requirements of the Arizona Form 140 is crucial for accurate tax filing.

Steps to Complete the Arizona Form 140

Completing the Arizona Form 140 involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, such as your name, address, and Social Security number. After that, report your total income, including wages, interest, and dividends. Deduct any eligible expenses or credits, and calculate your tax liability based on the provided tax tables. Finally, review the form for errors before submitting it to the Arizona Department of Revenue.

Filing Deadlines for the Arizona Form 140

Taxpayers must adhere to specific deadlines when filing the Arizona Form 140. Generally, the deadline for filing is April 15 of each year, coinciding with the federal tax deadline. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers seeking an extension can file for one, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents for the Arizona Form 140

To complete the Arizona Form 140, taxpayers need to gather several important documents. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or medical expenses

- Proof of tax credits, if applicable

- Any prior year tax returns for reference

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Legal Use of the Arizona Form 140

The Arizona Form 140 must be used in accordance with state tax laws. It is designed for individual taxpayers who are residents of Arizona. Filing this form accurately is essential to avoid legal repercussions, such as fines or audits. Additionally, taxpayers should ensure that they are using the correct version of the form for the tax year they are filing, as rules and regulations may change annually.

Form Submission Methods for the Arizona Form 140

Taxpayers have several options for submitting the Arizona Form 140. The form can be filed electronically through approved e-filing software, which is often the fastest method. Alternatively, taxpayers may choose to print the completed form and mail it to the Arizona Department of Revenue. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so choosing the right one can help ensure timely filing.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 140 instructions and information

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140 instructions and information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the az 140 instructions for using airSlate SignNow?

The az 140 instructions for airSlate SignNow provide a comprehensive guide on how to effectively utilize the platform for eSigning and document management. These instructions cover everything from setting up your account to sending documents for signature. Following these guidelines ensures a smooth experience and maximizes the benefits of our solution.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses of all sizes. The az 140 instructions detail the different pricing tiers and what features are included in each. This allows you to select the best option that fits your budget and needs.

-

What features are included in the az 140 instructions?

The az 140 instructions highlight key features such as document templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document workflow and improve efficiency. By following the az 140 instructions, you can leverage these tools to streamline your eSigning process.

-

How can airSlate SignNow benefit my business?

airSlate SignNow offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. The az 140 instructions explain how to implement these benefits effectively. By adopting our solution, your business can save time and resources while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various applications, enhancing its functionality. The az 140 instructions provide guidance on how to connect with popular tools like Google Drive, Salesforce, and more. This integration capability allows for a seamless workflow across your business applications.

-

Is there a mobile app for airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage your documents on the go. The az 140 instructions include details on how to download and use the app effectively. This feature ensures that you can send and sign documents anytime, anywhere.

-

What security measures does airSlate SignNow implement?

Security is a top priority for airSlate SignNow, and we implement several measures to protect your documents. The az 140 instructions outline our encryption protocols and compliance with industry standards. By following these guidelines, you can ensure that your sensitive information remains secure.

Get more for Arizona Form 140 Instructions And Information

Find out other Arizona Form 140 Instructions And Information

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online