Royal Farms W2 Form

What is the Royal Farms W-2?

The Royal Farms W-2 form is a tax document that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for former employees to accurately file their federal and state income taxes. It includes details such as the employee's total earnings, Social Security wages, Medicare wages, and various tax withholdings. Understanding the components of the W-2 is crucial for ensuring compliance with tax regulations.

How to obtain the Royal Farms W-2

Former employees can obtain their Royal Farms W-2 by contacting the human resources department. Typically, the W-2 forms are mailed to employees by the end of January each year. If a former employee does not receive their W-2 by mid-February, they should reach out to the Royal Farms HR department via phone or email to request a duplicate. It is important to provide accurate personal information to facilitate the retrieval process.

Steps to complete the Royal Farms W-2

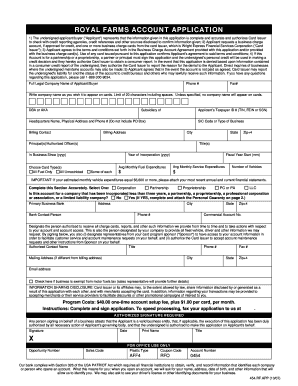

Completing the Royal Farms W-2 involves several straightforward steps. First, gather all necessary documents, including your previous year’s income statements and any other relevant tax documents. Next, accurately fill in your personal information, including your name, address, and Social Security number. Ensure that all income and tax withholding amounts are correctly entered as listed on your W-2. Finally, review the completed form for accuracy before submitting it to the IRS or your state tax authority.

Legal use of the Royal Farms W-2

The Royal Farms W-2 has legal significance as it serves as an official record of earnings and tax withholdings. To ensure its legal validity, it must be filled out accurately and submitted to the appropriate tax authorities by the designated deadlines. The form must be signed and dated if required, and it is advisable to keep a copy for personal records. Misuse of the W-2 or failure to file it correctly can lead to penalties or audits.

Filing Deadlines / Important Dates

It is crucial for former employees to be aware of filing deadlines associated with the Royal Farms W-2. The IRS typically requires that W-2 forms be submitted by April 15 of the following year. Employers must send out W-2 forms to employees by January 31. Being mindful of these dates helps prevent late filing penalties and ensures compliance with tax regulations.

Who Issues the Form

The Royal Farms W-2 is issued by the Royal Farms human resources department. This department is responsible for compiling the necessary payroll information and generating the W-2 forms for all employees, including former employees. If there are any discrepancies or issues with the W-2, it is advisable to contact the HR department directly for clarification or corrections.

Quick guide on how to complete royal farms w2

Complete Royal Farms W2 effortlessly on any gadget

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Royal Farms W2 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Royal Farms W2 effortlessly

- Obtain Royal Farms W2 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Royal Farms W2 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the royal farms w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining my royal farms W2 as a former employee?

As a royal farms W2 former employee, you can request your W2 form through the payroll department or online employee portal. Ensure that your contact information is up to date to receive your documents promptly. It's advisable to check back regularly if you face any delays.

-

Are there any fees associated with accessing my royal farms W2 as a former employee?

Typically, there are no fees for obtaining your royal farms W2 as a former employee. However, if you need additional services such as expedited mailing or reprints, there may be small charges. Always confirm with your payroll department for specific details.

-

Can I get my royal farms W2 electronically?

Yes, as a royal farms W2 former employee, you can opt to receive your W2 electronically through the company’s online portal. This method is secure, fast, and environmentally friendly, making it a convenient choice for many former employees.

-

What should I do if my royal farms W2 is incorrect?

If you discover discrepancies in your royal farms W2, contact the payroll department immediately. They will review your claim and issue a corrected W2 if necessary. It's crucial to resolve any inaccuracies for accurate tax filing.

-

What are the advantages of obtaining my royal farms W2 through airSlate SignNow?

Using airSlate SignNow to obtain your royal farms W2 simplifies the document request process. With its user-friendly eSigning features, you can quickly sign and submit necessary forms online, ensuring you receive your W2 without hassle.

-

Is it possible to access previous years' royal farms W2s as a former employee?

Yes, former employees can often access their previous years' royal farms W2s, depending on company policy. This information can usually be requested through the payroll department or an online portal where past documents are stored.

-

Can I use airSlate SignNow for other employment documents after accessing my royal farms W2?

Absolutely! AirSlate SignNow is not only effective for retrieving your royal farms W2 but also ideal for signing other employment-related documents. Its robust features streamline all your documentation needs, making it a versatile tool for former employees.

Get more for Royal Farms W2

Find out other Royal Farms W2

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile