Tax Alaska 2019

What is the Tax Alaska

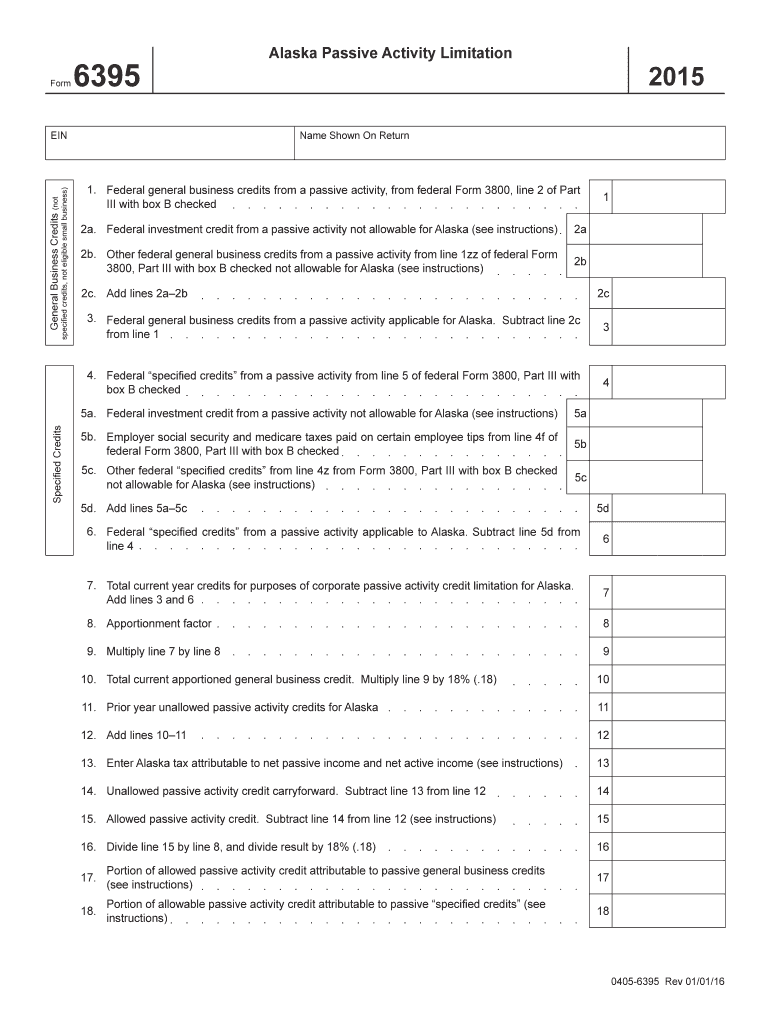

The Tax Alaska form is a specific document used for tax-related purposes within the state of Alaska. It serves as a means for individuals and businesses to report their income, deductions, and tax liabilities to the state government. Understanding this form is essential for compliance with state tax laws and ensuring accurate reporting of financial information.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Follow these guidelines for a smooth process:

- Gather necessary financial documents, including income statements and deduction records.

- Carefully read the instructions provided with the form to understand all requirements.

- Fill out the form accurately, ensuring all figures are correct and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail.

Legal use of the Tax Alaska

The Tax Alaska form is legally binding when completed and submitted according to state regulations. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. It is crucial to ensure that all information is accurate and truthful to avoid penalties and legal issues.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is essential for timely submission of the Tax Alaska form. Generally, the deadline for filing is April fifteenth of each year, but it may vary depending on specific circumstances or extensions. It is advisable to check the official state tax website for any updates or changes to these important dates.

Required Documents

To complete the Tax Alaska form, certain documents are necessary. These typically include:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the state tax website, which is often the fastest method.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices for those who prefer face-to-face assistance.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This agency is responsible for the administration of state tax laws and provides the necessary forms and guidelines for taxpayers. It is important to refer to the official department resources for the most current version of the form and any updates regarding tax regulations.

Quick guide on how to complete tax alaska 6967231

Complete Tax Alaska effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tax Alaska on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and electronically sign Tax Alaska without any hassle

- Locate Tax Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the equivalent legal validity of a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Tax Alaska and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967231

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967231

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What are the pricing options for airSlate SignNow in relation to Tax Alaska?

airSlate SignNow offers several pricing tiers to cater to businesses of all sizes managing Tax Alaska documents. Each plan provides essential features like unlimited eSignatures and document storage, ensuring you get the best value for your investment. Additionally, our flexible subscription options allow businesses to choose a plan that fits their budget and required functionalities.

-

How does airSlate SignNow facilitate the management of Tax Alaska documents?

airSlate SignNow streamlines the process of managing Tax Alaska documents through an intuitive platform that enables easy document creation, editing, and signing. Our user-friendly interface ensures that you can quickly navigate the essential tasks without hassle. With built-in templates and smart features, you can enhance productivity while ensuring compliance with tax regulations in Alaska.

-

What features does airSlate SignNow provide for handling Tax Alaska paperwork?

airSlate SignNow comes equipped with robust features designed specifically for handling Tax Alaska paperwork. Key features include customizable templates, automated workflows, and secure cloud storage, helping businesses maintain organization and efficiency. Additionally, advanced tracking capabilities allow you to monitor the status of your documents in real-time.

-

Is airSlate SignNow suitable for remote teams managing Tax Alaska tasks?

Absolutely! airSlate SignNow is designed to support remote teams working on Tax Alaska tasks by enabling seamless collaboration and secure document sharing. Our platform allows team members to access and sign documents from anywhere, facilitating efficient communication. This flexibility is ideal for businesses that work across different locations and need a reliable solution for document management.

-

Can I integrate airSlate SignNow with other software for Tax Alaska purposes?

Yes, airSlate SignNow supports integration with various software applications, enhancing your ability to manage Tax Alaska tasks efficiently. You can easily connect with accounting software, CRMs, and other tools to streamline your workflows. This integration capability ensures that your team can transition smoothly between platforms, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for Tax Alaska documentation?

Using airSlate SignNow for Tax Alaska documentation offers numerous benefits, including time savings, enhanced organization, and improved compliance. Businesses can reduce paperwork delays through instant eSignatures and automated reminders. Additionally, implementing a digital solution like airSlate SignNow not only increases security but also contributes to a more environmentally friendly approach by reducing paper usage.

-

How secure is airSlate SignNow when handling Tax Alaska documents?

Security is a top priority for airSlate SignNow when managing Tax Alaska documents. Our platform utilizes industry-standard encryption protocols to protect your sensitive information. Furthermore, we comply with regulatory standards, ensuring that your data remains safe and secure throughout the signing process.

Get more for Tax Alaska

- Contact us florida department of highway safety andcontact us florida department of highway safety andcontact us florida form

- Florida department of highway safety and motor vehicles form

- Mobile home installer license application form

- Irpifta address change form 85041

- Driver license records request florida courts form

- Form hsmv82033 title surety bond for a motor vehicle florida

- Forms in govdownloadapplication for certificate of title for a vehicle

- Arizona rental lease agreement templatespdfword form

Find out other Tax Alaska

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile