Tax Alaska 2020

What is the Tax Alaska

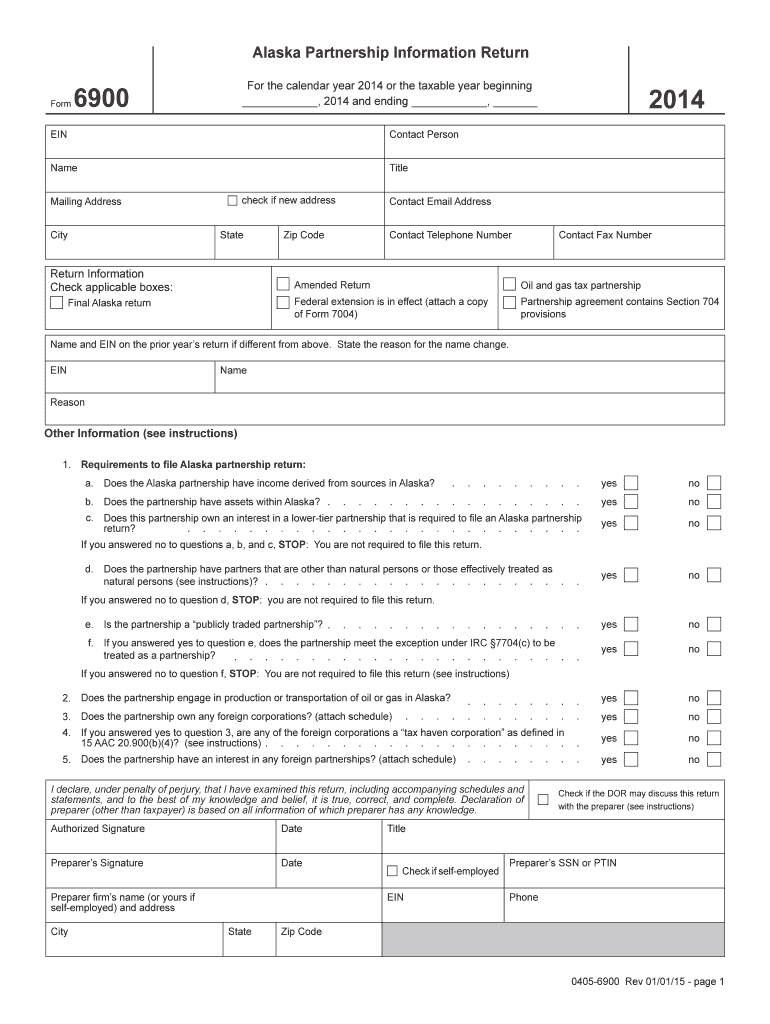

The Tax Alaska refers to the specific tax form used by residents and businesses in Alaska for reporting income and calculating tax obligations. This form is essential for ensuring compliance with state tax laws and regulations. It encompasses various tax categories, including personal income tax, corporate tax, and other applicable levies. Understanding the purpose and requirements of the Tax Alaska is crucial for accurate reporting and timely submissions.

Steps to complete the Tax Alaska

Completing the Tax Alaska involves a series of methodical steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary financial documents, including income statements, expense records, and previous tax returns.

- Access the Tax Alaska form through the official state tax website or other authorized platforms.

- Fill out the form with accurate information, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, adhering to the specified submission guidelines.

Legal use of the Tax Alaska

The Tax Alaska must be used in accordance with state laws and regulations governing tax reporting. This includes ensuring that all information provided is truthful and accurate. Legal use also entails adhering to deadlines for submission and maintaining records of submitted forms for future reference. Failure to comply with these legal requirements can lead to penalties or audits by state tax authorities.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for taxpayers using the Tax Alaska. Generally, the tax year aligns with the calendar year, and forms must be submitted by April fifteenth of the following year. Extensions may be available, but they require proper application and adherence to specific guidelines. It is advisable to mark these important dates on your calendar to avoid late submissions and potential penalties.

Required Documents

To complete the Tax Alaska accurately, several documents are necessary. These typically include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs.

- Previous year’s tax return for reference.

Having these documents ready can streamline the completion process and enhance accuracy.

Examples of using the Tax Alaska

There are various scenarios in which the Tax Alaska is utilized. For instance, individuals filing their annual income taxes will complete this form to report earnings and claim deductions. Businesses, on the other hand, may use the Tax Alaska to report corporate income and expenses, ensuring compliance with state tax laws. Each example highlights the importance of accurate reporting to avoid legal issues.

Quick guide on how to complete tax alaska 6967303

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has gained traction among companies and individuals alike. It presents an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without complications. Handle Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest method to edit and electronically sign Tax Alaska with ease

- Locate Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Alaska to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967303

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967303

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What features does airSlate SignNow offer for managing Tax Alaska documents?

airSlate SignNow provides a robust feature set tailored for managing Tax Alaska documentation, including eSigning, customizable templates, and automated workflows. These tools help streamline the process of preparing and filing tax-related documents, ensuring accuracy and compliance.

-

How does airSlate SignNow enhance the efficiency of handling Tax Alaska forms?

By utilizing airSlate SignNow for Tax Alaska forms, businesses can reduce the time spent on manual paperwork. The platform allows for easy document sharing, real-time collaboration, and quick eSigning, which increases productivity and ensures timely submission of tax documents.

-

Is airSlate SignNow cost-effective for small businesses managing Tax Alaska requirements?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses dealing with Tax Alaska requirements. The pricing plans are flexible and affordable, with options that suit various business needs while offering valuable features to handle tax documents efficiently.

-

Can I integrate airSlate SignNow with other tools for my Tax Alaska processes?

Absolutely! airSlate SignNow seamlessly integrates with popular business tools and platforms that you may already use for managing Tax Alaska processes. This ensures that your document workflows are cohesive and efficient, allowing for better data management and communication.

-

How secure is airSlate SignNow when handling sensitive Tax Alaska information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive Tax Alaska information. The platform employs advanced encryption, secure cloud storage, and compliance with industry standards to protect your documents and ensure your data remains confidential.

-

What kind of support does airSlate SignNow provide for Tax Alaska users?

airSlate SignNow offers comprehensive support for all users, including those focused on Tax Alaska documentation. Users can access a help center with articles, tutorials, and customer service representatives to assist with any challenges faced while using the platform.

-

Are there any mobile capabilities for managing Tax Alaska documents with airSlate SignNow?

Yes, airSlate SignNow provides mobile capabilities that allow users to manage Tax Alaska documents on-the-go. With the mobile app, you can eSign, send, and track documents from your smartphone or tablet, making it easy to stay on top of your tax obligations wherever you are.

Get more for Tax Alaska

- Mock recall exercise sample form

- Factoring trinomials worksheet answer key form

- Senior portrait questionnaire pdf form

- Tkes cheat sheet form

- Divorce forms for bulloch county

- Sti minisafe 4600 troubleshooting form

- Dam questionnaire gls 113 9 16 form

- Solicitud de declaratoria de nacionalidad mexicana por nacimiento dnn 2 form

Find out other Tax Alaska

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe