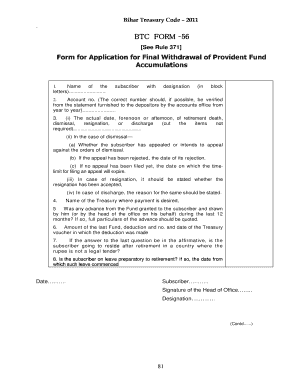

Btc Form 56

What is the Btc Form 56

The Btc Form 56 is a crucial document used primarily for tax purposes in the United States. It serves as a notification of the existence of a trust, estate, or other entity that is required to file tax returns. This form is essential for informing the IRS about the entity's tax obligations and ensuring compliance with federal tax laws. By accurately completing and submitting the Btc Form 56, individuals and businesses can maintain proper tax records and avoid potential penalties.

Steps to complete the Btc Form 56

Filling out the Btc Form 56 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the name and address of the entity, the taxpayer identification number, and the details of the responsible party. Once you have all the required information, follow these steps:

- Download the Btc Form 56 from a reliable source.

- Fill in the entity's name and address accurately.

- Provide the taxpayer identification number.

- Include the name and address of the responsible party.

- Review the form for any errors or omissions.

- Sign and date the form where indicated.

Completing these steps carefully will help ensure that the form is processed without issues.

Legal use of the Btc Form 56

The Btc Form 56 is legally binding when completed and submitted according to IRS regulations. It is essential for maintaining compliance with federal tax laws. The form notifies the IRS of the existence of a trust or estate, which is crucial for tax reporting purposes. Proper use of this form can help avoid legal complications and ensure that the entity meets its tax obligations. Additionally, it is important to keep a copy of the completed form for your records.

How to obtain the Btc Form 56

The Btc Form 56 can be obtained easily through various channels. It is available for download from the official IRS website or other reliable tax-related resources. Ensure that you are accessing the most current version of the form to avoid any compliance issues. Additionally, you may also find the form at tax preparation offices or through certified tax professionals who can provide guidance on its completion.

Form Submission Methods

Submitting the Btc Form 56 can be done through various methods, depending on your preference and the requirements set by the IRS. The primary submission methods include:

- Online submission via the IRS e-file system, which is recommended for faster processing.

- Mailing the completed form to the appropriate IRS address, ensuring you use the correct postage.

- In-person submission at designated IRS offices, which may be beneficial for those needing immediate assistance.

Choosing the right submission method can help ensure timely processing of your form.

Key elements of the Btc Form 56

Understanding the key elements of the Btc Form 56 is vital for accurate completion. The form typically includes the following sections:

- Entity Information: This section requires the name, address, and taxpayer identification number of the entity.

- Responsible Party: You must provide the name and address of the individual responsible for managing the entity's tax obligations.

- Signature: The form must be signed and dated by the responsible party or authorized individual.

Each of these elements plays a crucial role in ensuring that the form is legally valid and properly processed by the IRS.

Quick guide on how to complete btc form 56

Complete Btc Form 56 effortlessly on any device

Online document management has gained immense traction among businesses and individuals. It offers a seamless eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Btc Form 56 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Btc Form 56 with ease

- Locate Btc Form 56 and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and eSign Btc Form 56 to guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the btc form 56

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is btc056 in relation to airSlate SignNow?

The term btc056 refers to a unique identifier for a specific airflow signing solution offered by airSlate SignNow. It encompasses a range of features designed to enhance document management and electronic signing processes. By implementing btc056, users can streamline their workflow and improve efficiency.

-

How much does airSlate SignNow with btc056 feature cost?

Pricing for airSlate SignNow utilizing the btc056 feature varies based on the plan you choose. Different tiers offer flexibility to match the needs of both individuals and businesses. Check our pricing page for detailed information on the packages that include btc056.

-

What features are included with btc056?

The btc056 feature includes essential tools for sending, receiving, and signing documents electronically. Additionally, it offers customizable templates, real-time tracking, and secure cloud storage. These features work together to provide a seamless eSigning experience.

-

What are the benefits of using airSlate SignNow with btc056?

Using airSlate SignNow with btc056 delivers enhanced efficiency and productivity for your business. It simplifies document workflows, reduces turnaround times, and minimizes the reliance on physical paperwork. Embracing btc056 means empowering your organization for better collaboration.

-

Can I integrate airSlate SignNow with existing software using btc056?

Yes, airSlate SignNow supports integrations with various applications, seamlessly incorporating the btc056 feature into your existing ecosystem. This allows you to sync data, automate workflows, and improve overall productivity. Explore our integration options to find compatible apps.

-

Is it safe to use airSlate SignNow with the btc056 feature?

Absolutely! airSlate SignNow with btc056 prioritizes user security through advanced encryption and compliance with legal standards. This ensures your documents and data remain protected while you use our eSigning solution. Security is a core pillar of our service.

-

How can I get support for the btc056 feature in airSlate SignNow?

Support for the btc056 feature is readily available through our client assistance channels. Users can access a comprehensive knowledge base, contact our support team, or utilize live chat for immediate help. We are dedicated to ensuring your experience with btc056 is smooth and effective.

Get more for Btc Form 56

Find out other Btc Form 56

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure