Oktap Agriculture Exemption Form

What is the Oktap Agriculture Exemption

The Oktap Agriculture Exemption is a program designed to provide tax relief for qualifying agricultural activities in Oklahoma. This exemption allows eligible farmers and ranchers to reduce or eliminate certain taxes on their agricultural operations. The program is aimed at supporting the agricultural industry by making it more financially viable for those engaged in farming and ranching.

Eligibility Criteria

To qualify for the Oktap Agriculture Exemption, applicants must meet specific criteria. Generally, this includes having a minimum acreage dedicated to agricultural production. The exact minimum acreage required can vary based on the type of farming or ranching operation. Additionally, applicants must demonstrate that their activities are primarily agricultural in nature, which may include crop production, livestock raising, or other related activities.

Steps to Complete the Oktap Agriculture Exemption

Completing the Oktap Agriculture Exemption involves several key steps:

- Gather necessary documentation, including proof of agricultural operations and minimum acreage.

- Fill out the Oktap application form accurately, ensuring all required information is provided.

- Submit the completed application online or by mail, following the guidelines provided by the Oklahoma Tax Commission.

- Await confirmation of your application status and any further instructions from the tax authority.

Required Documents

When applying for the Oktap Agriculture Exemption, specific documents are necessary to support your application. These may include:

- Proof of ownership or lease of the agricultural land.

- Records of agricultural production or livestock numbers.

- Any previous tax exemption certificates, if applicable.

Legal Use of the Oktap Agriculture Exemption

The Oktap Agriculture Exemption must be used in accordance with state laws and regulations. Misuse or fraudulent claims can lead to penalties, including fines or revocation of the exemption. It is essential for applicants to understand the legal implications of the exemption and ensure compliance with all requirements set forth by the Oklahoma Tax Commission.

Who Issues the Form

The Oktap Agriculture Exemption form is issued by the Oklahoma Tax Commission. This state agency is responsible for overseeing tax-related matters, including the administration of agricultural exemptions. Applicants can access the form and additional guidance directly from the Oklahoma Tax Commission’s official resources.

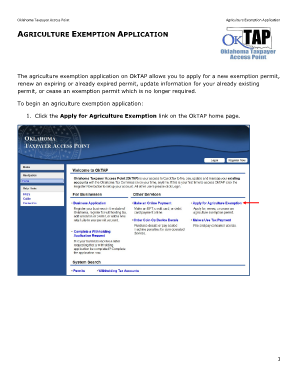

Quick guide on how to complete oktap agriculture exemption

Complete Oktap Agriculture Exemption easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Oktap Agriculture Exemption on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Oktap Agriculture Exemption effortlessly

- Find Oktap Agriculture Exemption and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight essential sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to share your form, by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious searches for forms, or errors that require printing new copies of documents. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Alter and eSign Oktap Agriculture Exemption and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oktap agriculture exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the minimum acreage for farm tax qualifications in Oklahoma?

In Oklahoma, the minimum acreage for farm tax qualifications is generally 10 acres, but this can vary based on specific agricultural practices. It's important to check local regulations for any additional stipulations that may apply to your situation.

-

How can I verify if my farm qualifies for tax benefits in Oklahoma?

To verify if your farm qualifies for tax benefits, you should consult the Oklahoma State Agriculture Department. They provide resources and guidelines regarding the minimum acreage for farm tax in Oklahoma and other eligibility criteria that may be applicable.

-

What features does airSlate SignNow offer for farmers needing to manage documents?

airSlate SignNow offers a range of features perfect for farmers, including document eSigning, templates specifically for tax documents, and collaboration tools. These features help streamline the paperwork associated with the minimum acreage for farm tax in Oklahoma and simplify compliance.

-

Is there a cost associated with using airSlate SignNow for farm-related documents?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. The cost is competitive and reflects the valuable features that assist farmers in managing their documents efficiently, especially concerning the minimum acreage for farm tax in Oklahoma.

-

How does airSlate SignNow integrate with other tools for farm management?

airSlate SignNow integrates seamlessly with various popular tools used in farm management, such as accounting software and CRM systems. This allows farmers to manage documents related to the minimum acreage for farm tax in Oklahoma alongside their other operational needs.

-

What are the benefits of eSigning documents for farm tax purposes?

eSigning documents for farm tax purposes saves time and reduces the hassle of printing and scanning. With airSlate SignNow, farmers can quickly sign documents related to the minimum acreage for farm tax in Oklahoma from anywhere, enhancing efficiency and accuracy.

-

Can I track the status of documents sent for eSigning?

Yes, airSlate SignNow provides tracking capabilities for documents sent for eSigning. This feature is particularly useful for farmers managing their paperwork related to the minimum acreage for farm tax in Oklahoma, as it ensures all necessary signatures are collected in a timely manner.

Get more for Oktap Agriculture Exemption

- Help card houston pdf form

- Caregiver monthly time sheet for month of form

- Abmeldung online form

- Missouri dept of social services bcct form

- Form 101 state of north dakota taxhow

- Mi 1040 schedule 1 form

- We are excited to have you in the arsenal family and look forward to the form

- Pa forms 3150 pm bwew0502

Find out other Oktap Agriculture Exemption

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself