Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return or Claim for Refund 2024

Understanding Form 944X: Adjusted Employer's Annual Federal Tax Return or Claim for Refund

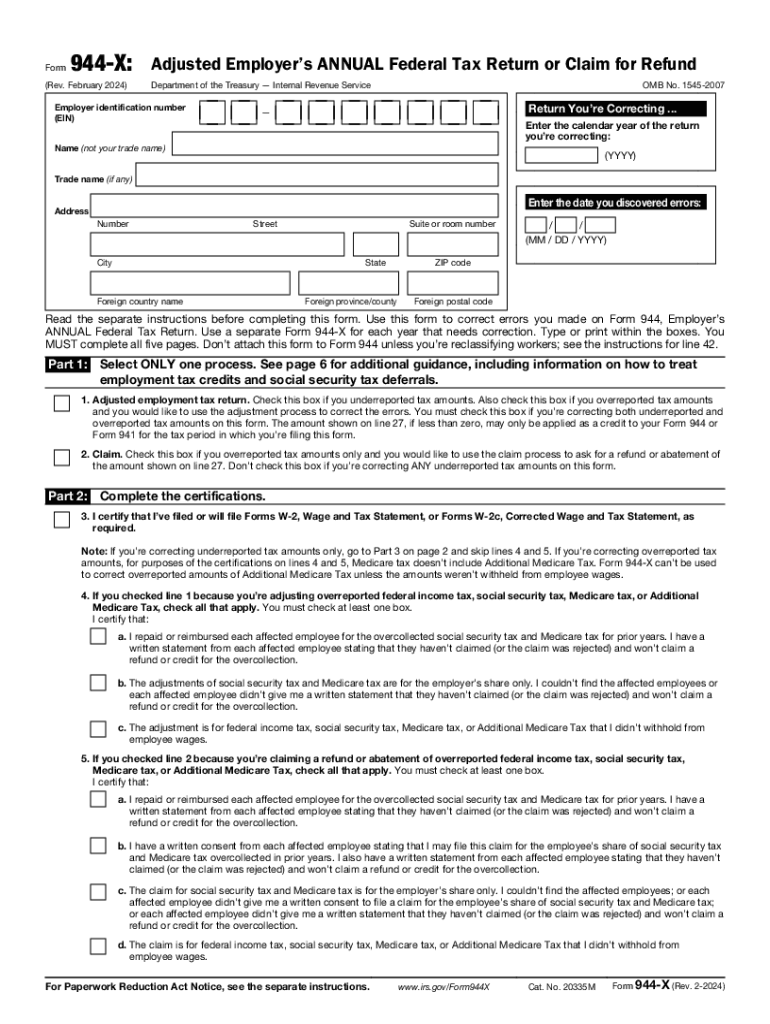

The Form 944X is a crucial document for employers who need to correct errors made on their previously submitted Form 944, which reports annual federal payroll taxes. This form allows businesses to adjust their tax liabilities, either increasing or decreasing them, based on corrections to wages, tax withheld, or other relevant factors. It is essential for ensuring compliance with IRS regulations and for accurately reporting federal tax obligations.

Steps to Complete Form 944X

Completing Form 944X involves a systematic approach to ensure accuracy. Here are the steps:

- Gather necessary documentation, including the original Form 944 and any supporting records that detail the errors.

- Clearly indicate the tax year for which you are making adjustments.

- Complete the sections that require changes, specifying the original amounts and the corrected amounts.

- Provide a detailed explanation of why the adjustments are necessary, which helps the IRS understand the context of the changes.

- Review the completed form for accuracy before submission, ensuring all calculations are correct.

Obtaining Form 944X

Employers can obtain Form 944X from the IRS website or by contacting the IRS directly. The form is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, businesses may find the form through tax preparation software that includes IRS forms, simplifying the process of obtaining and completing the necessary documentation.

Filing Deadlines for Form 944X

It is important to be aware of the filing deadlines for Form 944X to avoid penalties. Generally, Form 944X must be filed within three years from the due date of the original Form 944. This timeline allows employers to make necessary corrections without incurring additional fees or interest. Keeping track of these deadlines is essential for maintaining compliance with federal tax obligations.

Legal Use of Form 944X

Form 944X is legally sanctioned for use by employers who need to amend their annual federal payroll tax returns. It is important to use this form correctly to avoid legal issues with the IRS. Employers must ensure that they are eligible to file this form and that they are making legitimate corrections to their tax filings. Misuse of the form can lead to penalties and audits, emphasizing the need for careful completion and submission.

Key Elements of Form 944X

Understanding the key elements of Form 944X is vital for accurate completion. The form includes sections for identifying the employer, detailing the tax year, and specifying the corrections being made. Employers must provide both the original and corrected amounts for wages, tips, and other compensation, as well as any adjustments to the tax withheld. Clear and precise information is crucial for the IRS to process the corrections efficiently.

Quick guide on how to complete form 944 x rev february adjusted employers annual federal tax return or claim for refund 731664766

Accomplish Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to alter and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund without any hassle

- Locate Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Modify and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944 x rev february adjusted employers annual federal tax return or claim for refund 731664766

Create this form in 5 minutes!

How to create an eSignature for the form 944 x rev february adjusted employers annual federal tax return or claim for refund 731664766

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 944x feature in airSlate SignNow?

The 944x feature in airSlate SignNow allows users to streamline their document signing process with enhanced security and efficiency. This feature is designed to cater to businesses of all sizes, ensuring that your documents are signed quickly and securely. With 944x, you can manage multiple signers and track document status in real-time.

-

How does pricing work for the 944x solution?

airSlate SignNow offers flexible pricing plans for the 944x solution, making it accessible for businesses of all budgets. You can choose from monthly or annual subscriptions, with options that scale according to your needs. This ensures that you only pay for the features you use while benefiting from the robust capabilities of 944x.

-

What are the key benefits of using the 944x feature?

The 944x feature provides numerous benefits, including improved document turnaround times and enhanced security measures. By utilizing 944x, businesses can reduce operational costs and increase productivity through automated workflows. Additionally, it offers a user-friendly interface that simplifies the signing process for all parties involved.

-

Can I integrate 944x with other software tools?

Yes, airSlate SignNow's 944x feature seamlessly integrates with various software tools, including CRM systems and cloud storage services. This integration allows for a more cohesive workflow, enabling users to manage documents and signatures without switching between platforms. The flexibility of 944x ensures that it fits well within your existing tech stack.

-

Is the 944x feature suitable for small businesses?

Absolutely! The 944x feature is designed to cater to businesses of all sizes, including small businesses. It provides an affordable and efficient solution for managing document signing, allowing small businesses to compete effectively in their markets. With 944x, small businesses can enhance their operational efficiency without breaking the bank.

-

What types of documents can I sign using 944x?

With the 944x feature, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for different industries, from real estate to healthcare. The ability to handle multiple document types ensures that your signing needs are comprehensively met.

-

How secure is the 944x signing process?

The 944x signing process is highly secure, employing advanced encryption and authentication methods to protect your documents. airSlate SignNow adheres to industry standards to ensure that your sensitive information remains confidential. With 944x, you can have peace of mind knowing that your documents are safeguarded throughout the signing process.

Get more for Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- Paternity law and procedure handbook indiana form

- Bill of sale in connection with sale of business by individual or corporate seller indiana form

- Office lease agreement indiana form

- Indiana marital agreement form

- Commercial sublease indiana form

- Residential lease renewal agreement indiana form

- Notice to lessor exercising option to purchase indiana form

- Assignment of lease and rent from borrower to lender indiana form

Find out other Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online